- Where policy rates settle over the long run is more important for investors than how much the US Federal Reserve cuts rates meeting-to-meeting.

- We believe the neutral rate – the projected level of interest rates that would keep the economy from running too hot or too cold – will settle at around 3.5%, well above pre-pandemic levels.

- A higher neutral rate scenario favours a tilt towards bonds in investor portfolios.

The US Federal Reserve (Fed) cut short-term interest rates by 0.25% on 7 November, following a 0.50% cut at its previous meeting in September. The federal funds rate target range is now 4.50%-4.75%.

Although markets and investors tend to focus on the Fed’s near-term movements, a far more consequential question for investment portfolios is where the policy rate settles over the long run. Whether the US economy lands soft or hard as the Fed unwinds its inflation-fighting hiking cycle, we expect interest rates to settle well above their pre-pandemic levels. And that makes a strong case for bonds.

Soft and hard landings and the policy rate path

The central theme of our economic and market outlook for 2024 was that interest rates above their pre-pandemic levels were here to stay. The implication for the Fed was that the neutral rate—the projected level of interest rates that theoretically would keep an economy from running too hot or too cold—was higher than in the previous decade. We considered factors such as rising structural fiscal deficits and an aging population in concluding that the nominal neutral rate was around 3.5%.

The Fed has acknowledged a rising neutral rate, increasing its estimate three times this year to its current estimate of 2.9%. We expect the Fed to increase its estimate even further throughout 2025.

As the Fed reduces the federal funds rate over the coming months, it will ease its grip on an economy that’s no longer under the imminent threat of runaway inflation.

Finding the right balance in the pace of rate cuts is every central banker’s toughest task. Going too slowly increases the risk of a hard landing; going too quickly increases the risk of reigniting inflation. Naturally, the Fed has been laser-focused on forging a middle path, or a soft landing.

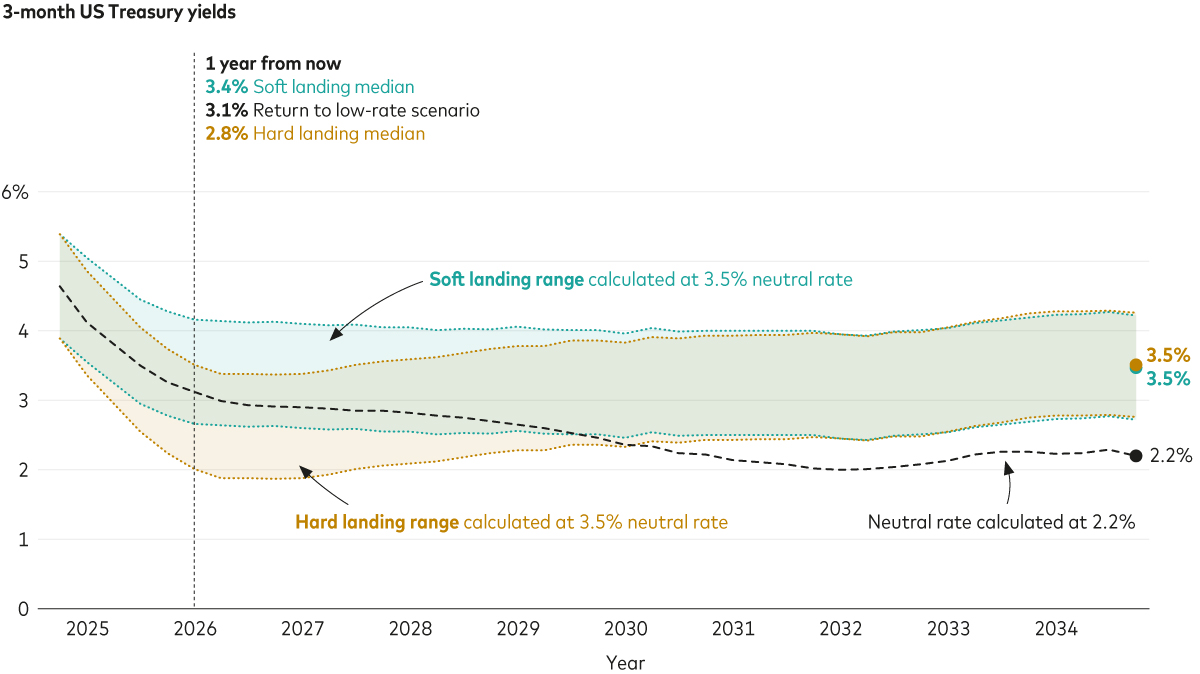

Our investment strategists leveraged the Vanguard Capital Markets Model® (VCMM) to project potential interest rate scenarios for 2025 with the goal of assessing what matters most for portfolios’ longer-term health. They analysed what alternative Fed rate paths would mean for US stock and bond returns under both soft landing and hard landing scenarios. In both cases, the analysis factored in our view of a higher nominal neutral rate of 3.5% and how that compares to a low-rate scenario, closer to pre-COVID levels, where the neutral rate is in the range of 2.0%–2.5%.

Our scenario-based 10-year forecasts for short-term interest rates

Notes: The figure shows the range of expected US policy rates from September 2024 through September 2034. Here, a soft landing implies that the economy is slowing but continues to expand over the next two years, and a hard landing implies that the economy tips into recession over the next two years. The forecasts are based on resampling the Vanguard Capital Markets Model® simulations by US 3-month Treasury yields and growth. The three scenarios are a subset of the 10,000 VCMM simulations as calculated on 30 September 2024. The bands shown for the soft and hard landing scenarios represent a deviation of 75 basis points from our estimate of the median US 3-month Treasury yield. The forecast figures that are shown for the soft and hard landing scenarios one year from now and at the end of 2034 are our median forecasts for the US 3-month Treasury yield.

Sources: Vanguard.

What a higher neutral rate could mean for long-term asset returns

As the Fed embarks on a rate-cutting cycle, it will become apparent to investors and markets that how low the Fed goes is more important than how much it cuts meeting-to-meeting.

Our projections for US stock and bond returns through 2034 don’t differ a lot on whether we see a soft or a hard landing in the near-term. Under both scenarios, we forecast the median average annualised return for US stocks to run a little under 4%, while US long-term Treasuries and credit are expected to come in materially over 4% and with less volatility1. The case for stocks would improve under a return to a low-rate environment. However, the higher-rate environment that we think is here to stay favours bonds.

A diversified, balanced portfolio of stocks and bonds serves long-term investors well in all potential future interest rate scenarios. However, for investors who have the requisite risk tolerance and feel comfortable, guided by appropriate financial advice, with the idea of dynamically altering their portfolio’s long-term positioning based on market conditions, those conditions currently favour bonds.

A word of caution for equity bulls

Investors bullish on stocks with today’s high valuations have to assume one of three things (or all of them): that the US economy will likely avoid recession in the near-term, that the benefit of artificial intelligence to future corporate profits will exceed already lofty expectations, or that the neutral rate will return to pre-COVID levels. We don’t expect a return to a low neutral rate. And whether we see a soft landing or a hard landing, our long-term US equity return expectations are subdued.

1 In our soft-landing scenario, the median annualised 10-year returns for US stocks are 3.90%, 4.33% for US long-term Treasuries, and 4.54% for US credit. In our hard-landing scenario, the median annualised 10-year returns are 3.70% for US stocks, 4.48% for US long-term Treasuries, and 4.39% for US credit. Calculations are in USD.

IMPORTANT: The projections or other information generated by the Vanguard Capital Markets Model® regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time. The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The Vanguard Capital Markets Model® is a proprietary financial simulation tool developed and maintained by Vanguard’s primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include US and international equity markets, several maturities of the US Treasury and corporate fixed income markets, international fixed income markets, US money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.

The primary value of the VCMM is in its application to analysing potential client portfolios. VCMM asset-class forecasts—comprising distributions of expected returns, volatilities, and correlations—are key to the evaluation of potential downside risks, various risk–return trade-offs, and the diversification benefits of various asset classes. Although central tendencies are generated in any return distribution, Vanguard stresses that focusing on the full range of potential outcomes for the assets considered, such as the data presented in this paper, is the most effective way to use VCMM output.

The VCMM seeks to represent the uncertainty in the forecast by generating a wide range of potential outcomes. It is important to recognise that the VCMM does not impose “normality” on the return distributions, but rather is influenced by the so-called fat tails and skewness in the empirical distribution of modeled asset-class returns. Within the range of outcomes, individual experiences can be quite different, underscoring the varied nature of potential future paths. Indeed, this is a key reason why we approach asset-return outlooks in a distributional framework.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Important information

This is a marketing communication.

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained in this document is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this document does not constitute legal, tax, or investment advice. You must not, therefore, rely on the content of this document when making any investment decisions.

The information contained in this document is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2024 Vanguard Group (Ireland) Limited. All rights reserved.

© 2024 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2024 Vanguard Asset Management, Limited. All rights reserved.