- Proposed changes to IHT calculations may significantly impact clients with a focus on legacy planning.

- While long-term investing is best achieved by staying the course, financial planning is agile and may require course-correciton.

- The Budget changes to IHT calculations are an important reason to re-engage with clients through solutions-oriented conversations.

The Autumn Budget included important changes to tax rates and reliefs that will impact most clients in some way, with those planning to leave a legacy likely to be most affected by changes to inheritance tax (IHT) rules.

We outlined all the key changes to tax rates and reliefs in our initial Budget reaction. In this article, we explore further what the changes to IHT might mean for clients focused on legacy planning; how you might help affected clients stay on course to meet their goals; and why the changes come at an important time for advisers in the context of the ‘great wealth transfer’.

Inheritance-tax changes

One of the most significant changes for investors revealed by the chancellor was the inclusion of pension assets in an individual’s estate for IHT calculations. Previously, pension assets were typically exempt from IHT. From April 2027, unused pension funds and death benefits payable from a person will be included in an individual’s estate for IHT calculations, which means they could be subject to a 40% tax.

Another key change that may impact some clients is the scaling back of business property relief.. Currently, investors can pass on certain business assets to their beneficiaries free from IHT when they die. This is known as ‘business relief’ and it includes shares listed on the Alternative Investment Market (AIM). To qualify for business relief, the shares must have been held for more than two years at the time of death. From April 2026, only 50% relief will be available against AIM shares, meaning an effective IHT rate of 20%. Other business relief-qualifying assets will be IHT-free up to £1 million, but assets over £1 million will subject to relief at 50% so an effective IHT rate of 20% will be levied.

The impact on legacy planning

The changes could be significant for clients focused on legacy planning.

Investors who have taken measures to acquire assets that are exempt from inheritance tax over time, such as investing in qualifying assets or preserving their pension so it can pass tax-efficiently to future generations, may now be facing a much larger inheritance tax liability than previously anticipated. Scaled back business relief from IHT will also affect business owners who had anticipated that their privately owned companies would not attract tax when passed to their beneficiaries.

Focusing on the inclusion of pension assets in IHT calculations, we offer an example case study of how the changes might impact a high-net-worth client with the goal of passing their wealth efficiently to the next generation. It should be noted that the full details of the legislation are yet to be published, so our example represents one possible interpretation of the changes. In other words, our example is for illustrative purposes only and the calculations should not be relied upon in client communications.

In our example, we consider a married couple with assets totalling £7.5 million who’ve taken measures under previous legislation towards their estate planning.

Here’s an overview of our example couple’s total assets:

| Main home* | £1.75m |

| ISA and general accounts | £1.5m |

| Pensions | £1.0m |

| AIM** portfolio (held for over two years) |

£0.25m |

| Business relief qualifying portfolio (held for over two years) |

£3.0m |

| Total assets | £7.5m |

Notes: Assets assumed to be held jointly or equally (the business-relief assets are assumed not to be one combined business). We have assumed no gifts have been made in the last 7 years. *The residence nil-rate band does not apply here due to the size of the estate. **Alternative Investment Market.

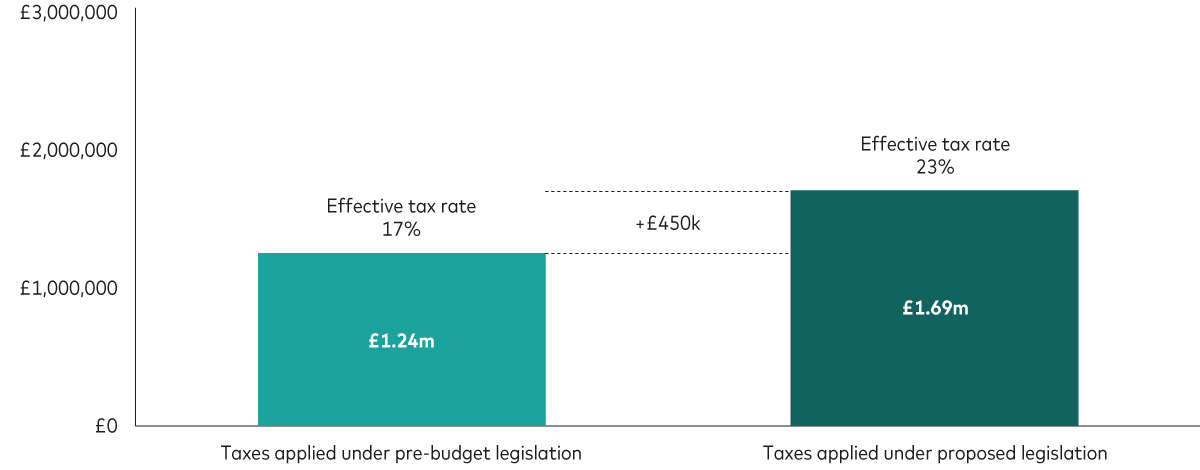

Based on their total portfolio, we analysed the impact of the Budget changes by comparing the clients’ effective IHT position on the second death under existing and incoming rules.

It’s important to note that we’ve made some specific assumptions in our calculations, including:

- unspent pensions become chargeable under IHT regime;

- relief on AIM portfolios reduced to 50%;

- relief on business relief assets changed to 50% on assets over £1m per person, assuming multiple businesses held separately; and

- under current legislation the pension can be passed to several grandchildren, all of whom pay at most 20% tax when they draw the funds over time.

Position on second death

Source: Vanguard. Notes: The figures shown are estimates and one interpretation of legislation to come. They should be taken only as indicative, as full legislation details are not yet published.

In this example, the inheritors prospectively receive £450k less under the incoming IHT laws relative to pre-Budget legislation. Any clients in a similar position may be worried and possibly angry about what the changes mean for their legacy.

It’s at moments like this that advisers can demonstrate the value of good financial advice. While the key to long-term investing is staying the course, estate planning demands an agile approach and the changes to IHT reliefs will mean course-correction for some clients.

Course-correction for estate planning

Through proactive, solutions-oriented engagements, you can help clients adapt their wealth transfer strategy to reduce the tax burden on their inheritors. Diversifying a client’s wealth transfer strategy is a sensible approach.

You may need to coach and encourage clients to spend their hard-earned wealth, helping them identify the right balance between enhancing their lifestyle and leaving a legacy. For the legacy that remains, there are typically three key ways to plan for inheritance tax: using gifting strategies, using IHT-efficient assets or using life assurance.

The Budget changes mean IHT-efficient assets will become less effective for some legacy planners in achieving their goals. The changes also underline the risks of anchoring too much to one particular approach. By rebalancing a client’s IHT approach, you can effectively help minimise the impact of the Budget changes relative to doing nothing.

Gifting may be the favoured approach for some individuals, which in most cases is going to be parents gifting to their children. This is often a conversation that merits including the recipient of any gifting strategy to facilitate a smoother transfer.

In other words, as an adviser you might want to start thinking about the different generations of the family as one collective, engaging with the next generation as part of this.

Navigating the great wealth transfer

Engagements with inheritors may take on greater significance considering recent research that suggests 87% of children would not consider retaining the services of their parents’ adviser following an inheritance1. Some of the leading reasons behind the reluctance of children to use their parents’ adviser include a lack of previous engagement; depletion of portfolio size; and a mismatch in brand, generation and gender.

The Budget changes to IHT reliefs is an important reason to have a fresh conversation with your clients about estate planning and part of the ask can be to bring the next generation into the conversation.

Deliver more value through thoughtful and proactive engagement

Before engaging with any client, it’s important to recognise that while some changes from the Budget are immediate and locked in, most of the changes will take some time for the full legislation to be clarified and to emerge, including IHT reliefs.

Take a pause before entering full solution mode. Each client is unique and will be uniquely impacted, so it’s important to personalise each engagement for individual clients. There will be differences around wealth, life stage, goals, the route by which they have built wealth, and sensitivity to taxation. And you can’t always assume that clients will have a problem with paying a bit more tax.

It’s important to make sure that the costs of taking action are proportionate with the benefits. For example, a strategy that saves 20% in tax liabilities may be appealing, but if there are entry costs and high ongoing product costs, it doesn’t take all that long for benefits to be wiped out.

The Budget changes offer an opportunity to proactively engage with those most affected on estate planning with a positive, solutions-oriented conversation.

When taxes are higher there becomes a greater difference in being efficient versus inefficient and that’s exactly what advisers are here to help with.

1 Source: Cerulli Associates. Notes: Only 13% of adult children would use parents’ adviser

UK Budget and beyond: What it means for you and your clients

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Important information

This is directed at professional investors and should not be distributed to, or relied upon by retail investors.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

The information contained herein is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2024 Vanguard Asset Management Limited. All rights reserved.