- Uncertainty surrounding US tariff policy outcomes has shaken global credit markets, but the investment case for corporate bonds remains strong.

- Increased volatility can create opportunities for active managers to generate alpha and outperform in global credit markets.

- In an uncertain market backdrop, investors should look for active bond fund managers with a track record of consistent, long-term performance in both up and down market environments.

“In an uncertain environment, active managers should be disciplined with their risk-taking and manage their portfolios within deliberate beta thresholds to avoid large relative drawdowns.”

Lead Portfolio Manager, Vanguard Global Credit Bond Fund

Recent tariff policy announcements by the US administration have caused turmoil in global credit markets, as investors speculate about their potential impact on global trade, corporate earnings and growth. As markets remain on heightened alert, the disruption to market sentiment is likely to continue.

Despite these concerns, we expect inflows into corporate credit funds to remain robust, driven by attractive yields and levels of income – which can also serve as a hedge against heightened volatility in other risk assets.

So what is the outlook for credit markets in an environment of elevated uncertainty? And what should investors look for in an active credit manager in this uncertain market environment?

Corporate bonds are still attractive

When markets are volatile, investors tend to look for risk assets that offer a generous risk premium to compensate for the higher uncertainty. In this respect, high-quality, investment-grade corporate bonds continue to provide an attractive opportunity to find this.

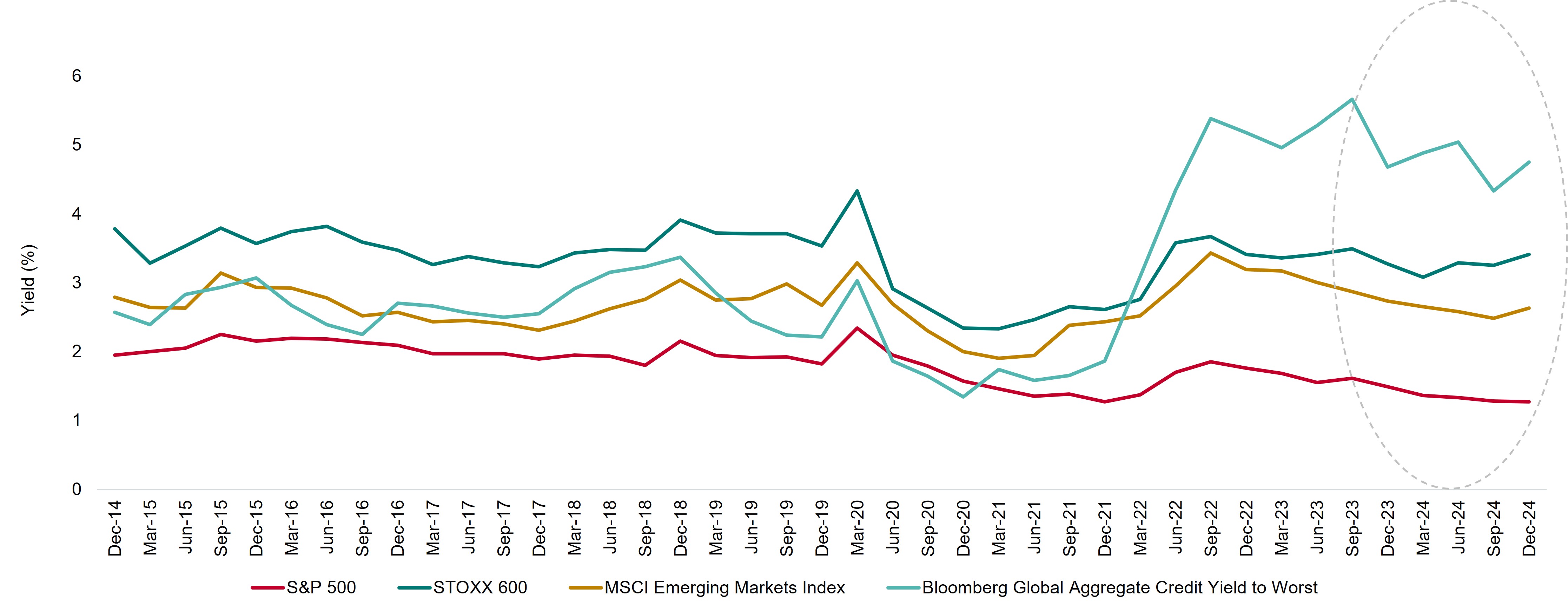

Credit yields are at attractive levels compared with other risk assets

Past performance is not a reliable indicator of future results. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Note: The data in the chart represent the 1-year forward-looking yields of the indicated indices for the period 31 December 2014 to 31 December 2024. Forward-looking yields include income reinvested and expected capital appreciation. Calculations are in USD.

Source: Bloomberg.

Fundamentally speaking

Despite uncertainties around the impact that potential tariffs could have on future earnings, corporate fundamentals look broadly healthy, and continue to bolster investor confidence in high-quality corporate bonds.

Over the past several years, companies have be deleveraging their balance sheets, with cash balances at many firms now above their 20-year averages.

At the sector level, there are some signs of earnings dispersion, particularly in areas such as European consumer cyclicals and the automotive industry, which are more sensitive to a weakening economy and a slowdown in consumer spending. We expect this variability among sectors and issuers to continue.

Supportive technicals

In 2024, corporate bond issuance exceeded expectations, with a large proportion of new supply front-loaded in the first half of the year1. Yet strong demand meant the wave of new issuance was well-absorbed, with lower issuance at the back end of the year setting up for a supportive technical backdrop heading into 2025.

This year, we’re already seeing similarly strong investor demand for new issuance of investment-grade bonds, with some bond issues as much as 15 times oversubscribed. Overall, we expect gross new issuance in 2025 to be higher than last year.

Robust credit outlook in 2025

Tariff concerns notwithstanding, markets are now focused on potential rate cuts in the coming year – particularly in Europe, where investors and policymakers are monitoring inflation and economic data to gauge the scope of further policy easing.

Additional cuts would likely help stimulate consumer confidence and boost economic activity, benefitting corporate earnings and revenues. This, coupled with the deleveraging we’ve seen across investment-grade companies, puts the fundamental outlook for high-quality credit in a favourable spot.

Valuations, meanwhile, remain stretched and we expect this to continue. However, higher yields, strong fundamentals and a positive technical backdrop remain supportive of the credit asset class. We expect the robust demand for corporate bonds to carry on through 2025, supported by additional policy easing in Europe and a steeper yield curve.

What does this mean for credit investors?

While yields are still attractive, credit spreads are near historical lows – creating ample opportunities for active managers to harvest additional value from global credit. In this environment, active bond managers with the right approach can look beyond their benchmark for opportunities, focusing on bottom-up security selection to find pockets of value that can deliver alpha, even under strained conditions.

For some active managers, the easiest way to add value is to go down the quality spectrum to invest in lower-rated corporates that can offer a pickup in yield. In a supportive economic environment, this can be an effective strategy – but when conditions weaken, having a large exposure to lower-rated corporate issuers can have an outsized impact that outweighs the added risk. This is because in such an environment, the credit spreads of lower-quality issuers are likely to be hit the hardest. Plus, a weakening environment is when investors most need their fixed income allocations to act as a protector in their portfolios, helping absorb at least some of the volatility in other risk assets – not as a potential source of additional drawdowns. This is why having the right active approach to credit is key.

What to look for in an active credit manager

With tariffs and other uncertainties causing heightened levels of volatility in fixed income markets globally, it is more important than ever for investors to choose active strategies that have strong track records of consistent performance across a variety of market environments.

Investors should look for managers that incorporate deep fundamental research into their credit selection process, so they can uncover undervalued opportunities and build portfolios that offer better returns for each unit of risk. This also allows managers to remain disciplined during volatile times, and avoid the temptation to take large directional bets in an effort to chase returns, which seldom consistently pay off.

At Vanguard, our active fixed income portfolio managers work closely with our in-house team of credit research analysts to identify potential risk factors at both the sector and issuer level. The breadth of our coverage allows our analysts to find pockets of opportunity within an individual sector, even when the sector overall may seem unattractive from a valuations or fundamental standpoint.

Consistency is key

Tariffs may be causing uncertainty right now – but they’re far from being the only disruption to markets in recent times. Over the last five years, markets have experienced some of the most significant economic shocks of our lifetimes – such as the Covid-19 pandemic, Russia’s invasion of Ukraine and one of the steepest rises in interest rates on record. Through it all, markets and economies have endured.

Vanguard’s consistent, long-term approach to managing active fixed income portfolios is testament to our track record of delivering successful outcomes to our investors through all types of market environments.

1 Source: Vanguard, as at 31 December 2024.

Related funds

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Past performance is not a reliable indicator of future results.

Important information

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained in this document is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this document does not constitute legal, tax, or investment advice. You must not, therefore, rely on the content of this document when making any investment decisions.

The information contained in this document is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Group (Ireland) Limited. All rights reserved.

© 2025 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2025 Vanguard Asset Management, Limited. All rights reserved.