- Today’s higher starting yields have materially improved the risk/return trade-off for fixed income in 2025 and beyond.

- In this environment, coupon payments comprise more of a bond investor’s total returns - which should also provide a cushion against losses if interest rates were to rise and bond prices fall.

- As the global easing cycle continues in 2025, we do not expect bonds to experience a material price appreciation from falling yields, but we do continue to expect solid income returns to support bonds globally.

In our 2025 Vanguard economic and market outlook, we explore how higher starting yields should set the foundation for solid fixed income returns over the next decade. Here, we take a closer look at how the higher income generated by bonds creates a more positive risk-reward trade-off for investors in 2025 and beyond.

After two years of sharply declining inflation across developed markets, 2024 brought the start of a global easing cycle that will be in full swing in 2025.

At the same time, long-term government bond yields in the UK, euro area and US have been hovering near the relatively high levels reached in late 2022. Despite elevated levels of volatility—driven by temporary setbacks in the fight against inflation and uncertainties around events such as the elections in the US and France—global bonds posted a second straight year of positive returns in 20241.

Today’s higher starting yields have materially improved the risk/return trade-off for fixed income. In this environment, more of a bond investor’s total returns come from coupon payments - which should also provide more of a cushion against losses if interest rates were to rise and bond prices fall.

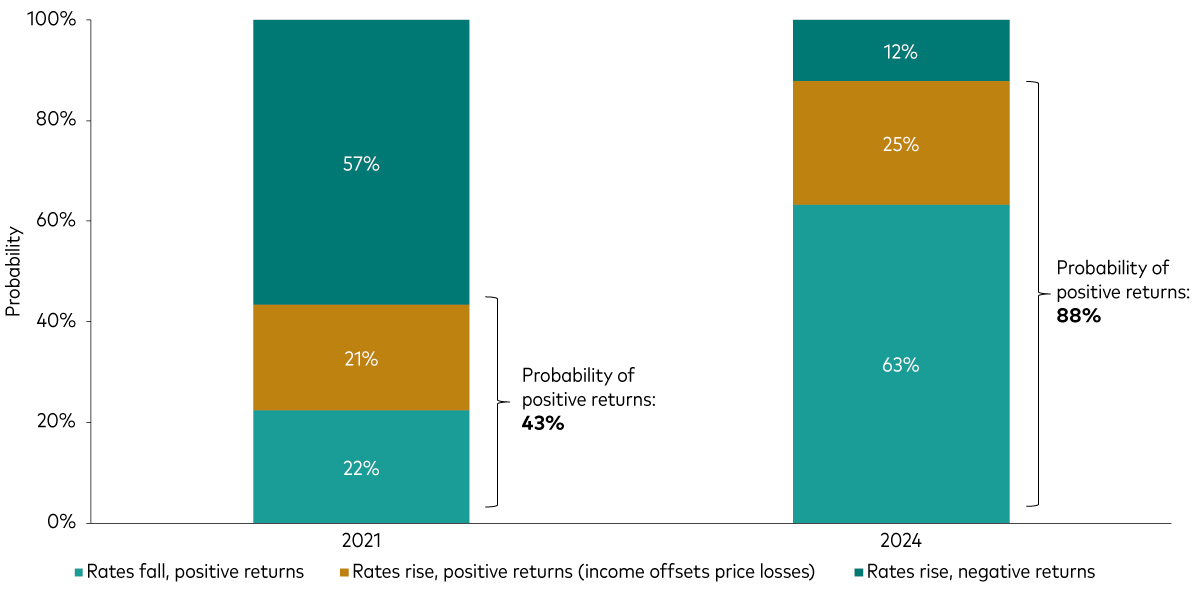

We estimate an 88% probability that global bonds2 will deliver positive total returns over the next year. The chances of investors earning negative total returns are greatly reduced, and would likely only result if yields were to rise substantially such that capital losses exceeded the increased income generated from higher coupon payments. This “coupon wall” means the income from bonds should be sufficiently large enough to protect investors against even modest increases in interest rates and their associated price declines, so that total returns remain positive.

Before the global hiking cycle began three years ago, low bond yields did not offer the same protection. Even more modest yield increases than what we experienced in 2022 would have pushed bond returns into negative territory.

An improved risk/reward environment for fixed income relative to before the global hiking cycle began

Probability of returns for global bonds: 2024 versus 2021

Any projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

Notes: The chart is based on the distribution of one-year-ahead price and income return projections from the Vanguard Capital Markets Model (VCMM) for the Bloomberg Global Aggregate Bond Index Sterling Hedged. The forecasts are sorted by positive price returns (interest rates fall) and two scenarios under negative price returns (interest rates rise) - income returns from coupons offset price losses and income returns do not offset price losses, leading to negative total returns. The bars indicate the proportion of simulations falling into each of these three buckets.

Source: Vanguard calculations, based on data from Bloomberg as at 31 May 2021 and 8 November 2024.

IMPORTANT: The projections and other information generated by the VCMM regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Results from the model may vary with each use and over time.

Bonds: An all-weather asset class

Across developed markets, we expect long-term yields to remain elevated over the next decade as the era of sound money lives on – characterised by positive real interest rates and a higher neutral rate3 than during the 2010s. While this means we do not expect material price appreciation from falling yields, we do continue to expect solid income returns to support bonds globally.

Near-term risks to this view hinge on the balance of global growth and inflation dynamics. If a significant shock to demand with falling equity prices were to spur a return to monetary easing and declining rates, bonds should provide a hedge in diversified multi-asset portfolios.

Alternatively, if inflation were to resurface, we believe yields across the curve would likely rise and the correlation between equities and bonds would turn positive as investors demanded more compensation for increased uncertainty. For investors with sufficiently long time horizons, the coupon payments from bonds would eventually catch up and replenish any near-term capital losses so that any rise in yields would ultimately improve bonds’ total returns over the long term.

Getting the credit you deserve

Corporate credit spreads are currently near 20-year lows4, having tightened further in 2024. Near-term economic risks could lead to wider spreads, which would hurt credit investors; however, continued economic strength could keep spreads at these tightened levels for some time to come.

Despite compressed spreads, credit markets can continue to do well. While there’s limited room for spreads to narrow further, overall yields are high and the outlook for fundamentals remains positive.

We think corporate credit plays an important role in portfolios, given its premium over government bonds and low correlation with other assets. Overall, credit is expected to produce better returns than government bonds, with lower volatility than equities.

A strong outlook for fixed income

Looking ahead, the outlook for fixed income remains strong – bonds are still back. In the higher-rate environment that we believe is here to stay, we expect long-term bond returns to be closer to the levels seen in the early 2000s. However, more of a bond investor’s returns are likely to come from higher coupon payments that get reinvested at higher rates, than from price appreciation.

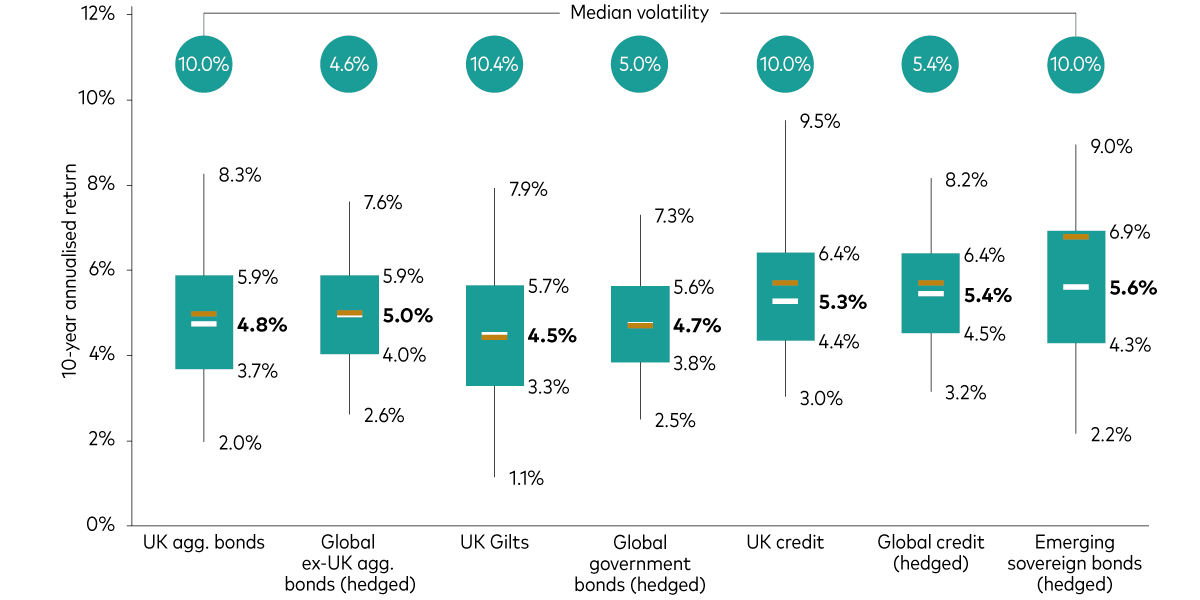

Our current return expectations for aggregate bonds, government bonds and credit are similar to our forecasts in last year’s Vanguard economic and market outlook. Over the next decade, we expect annualised returns for UK aggregate bonds and hedged, global ex-UK aggregate bonds to be around 4.8% and 5.0%, respectively, with slightly lower expected returns for UK and global government bonds (4.5% and 4.7%) and slightly higher expected returns for UK and global credit (5.3% and 5.4%) and emerging market sovereign bonds (5.6%), though with higher uncertainty.

10-year forecasted annualised returns for fixed income assets

Any projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

Notes: The forecast corresponds to the distribution of 10,000 VCMM simulations for 10-year annualised nominal returns in GBP for assets highlighted here. Median volatility is the 50th percentile of an asset class's distribution of annualised standard deviation of returns. The median 10-year annualised nominal return forecasts as at the end of last year are shown by the brown bars. Asset-class returns do not take into account management fees and expenses, nor do they reflect the effect of taxes. Returns do reflect the reinvestment of income and capital gains. Indices are unmanaged; therefore, direct investment is not possible. Benchmarks used for asset classes: UK agg. bonds: Bloomberg Sterling Aggregate Index; Global ex-UK agg. bonds: Bloomberg Global Aggregate ex-Sterling Index Sterling Hedged; UK Gilts: Bloomberg Sterling Gilts Total Return Index; Global government bonds: Bloomberg Global Treasury Index Sterling Hedged; UK credit: Bloomberg Sterling Aggregate—Credit Index; Global credit: Bloomberg Global Aggregate—Corporates Sterling Hedged; Emerging sovereign bonds: Bloomberg Emerging Markets USD Sovereign Bond Index—10% Country Capped Sterling Hedged.

Source: Vanguard calculations, based on data from Refinitiv, as at 8 November 2024.

IMPORTANT: The projections and other information generated by the VCMM regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Results from the model may vary with each use and over time.

1 Based on the Bloomberg Global Aggregate Index Sterling Hedged, which returned 3.0% for the period 31 December 2023 to 31 December 2024.

2 Global bonds are represented by the Bloomberg Global Aggregate Index Sterling Hedged.

3 The neutral rate is the equilibrium rate at which no easing or tightening pressures are being placed on an economy or its financial markets.

4 In November 2024, the option-adjusted spreads (OAS) of the Bloomberg US Credit Index and the Bloomberg US Corporate High Yield Index tightened to levels last seen before 2008.

IMPORTANT: The projections or other information generated by the Vanguard Capital Markets Model® regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time. The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The Vanguard Capital Markets Model® is a proprietary financial simulation tool developed and maintained by Vanguard’s primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include US and international equity markets, several maturities of the U.S. Treasury and corporate fixed income markets, international fixed income markets, US money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.

The primary value of the VCMM is in its application to analysing potential client portfolios. VCMM asset-class forecasts—comprising distributions of expected returns, volatilities, and correlations—are key to the evaluation of potential downside risks, various risk–return trade-offs, and the diversification benefits of various asset classes. Although central tendencies are generated in any return distribution, Vanguard stresses that focusing on the full range of potential outcomes for the assets considered, such as the data presented in this paper, is the most effective way to use VCMM output.

The VCMM seeks to represent the uncertainty in the forecast by generating a wide range of potential outcomes. It is important to recognise that the VCMM does not impose “normality” on the return distributions, but rather is influenced by the so-called fat tails and skewness in the empirical distribution of modelled asset-class returns. Within the range of outcomes, individual experiences can be quite different, underscoring the varied nature of potential future paths. Indeed, this is a key reason why we approach asset-return outlooks in a distributional framework.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Important information

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

The information contained herein is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Group (Ireland) Limited. All rights reserved.

© 2025 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2025 Vanguard Asset Management, Limited. All rights reserved.