By Shaan Raithatha, senior economist, Vanguard, Europe

- History shows that equity markets tend to anticipate recovery by rebounding during recessions.

- US stock market recoveries during recessionary periods have commenced anywhere between two months and 16 months into the recession.

- Recessions have been relatively short compared with most investors’ time horizons.

Central banks on both sides of the Atlantic are raising interest rates at a pace not seen in decades as they battle to bring inflation down from multi-decade highs, slowing economic activity in the process and raising the prospect of a recession.

Third-quarter GDP data showed that euro area countries were able to avoid recession – for now. UK third-quarter GDP data is not yet available, but leading indicators in both the euro area and the UK point to a deterioration in economic momentum. We expect a recession from the fourth quarter 2022 for two quarters in the euro area, and for the UK recession to last for three quarters and be deeper than in the euro area. We also think there is a 65% chance of a US recession in 2023, as defined by the National Bureau of Economic Research (NBER)1.

At the forefront of the accelerated drive to tighten policy has been the Federal Reserve, which has delivered four straight 0.75 percentage-point hikes since the start of the summer. The federal funds rate currently sits in a target range of 3.75% to 4.0% and we don’t expect it to peak until early 2023, at around 4.5% to 4.75%.

Such is the importance of the US to the global economy that the Fed’s actions are reverberating through global markets and increasing the pressure on the European Central Bank and Bank of England to raise policy rates too.

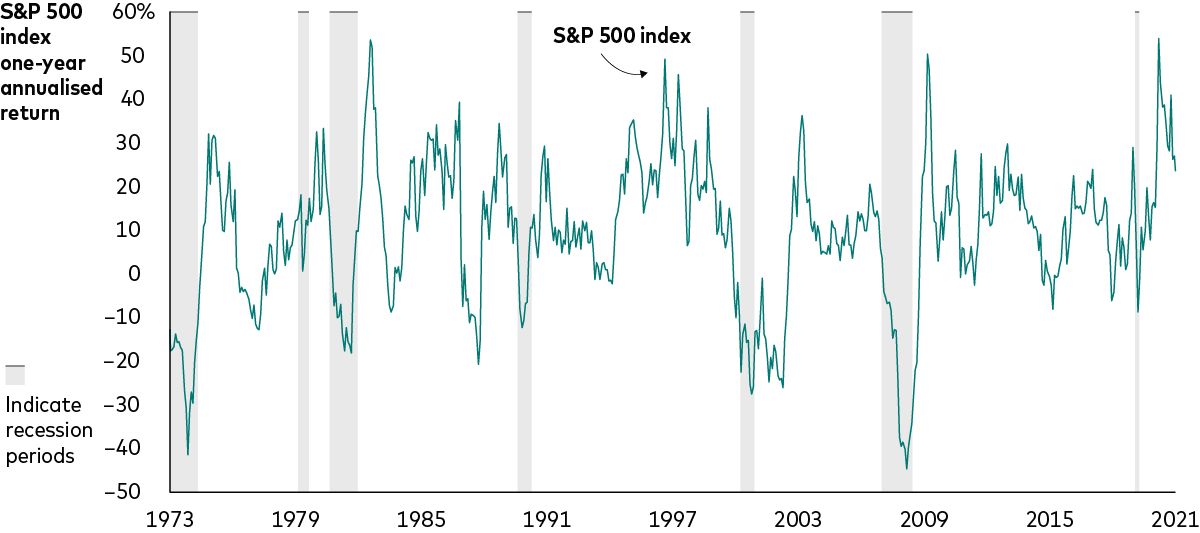

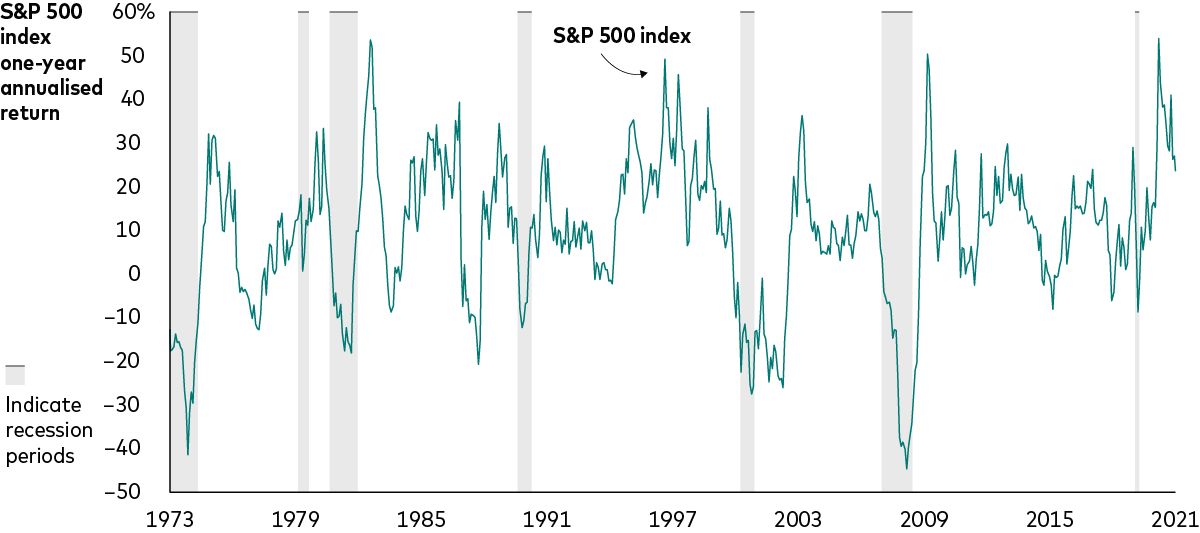

Given that outsized influence, investors wondering whether they should adjust their portfolios in anticipation of a US recession should consider the chart below. This is because history shows that shares tend to begin to rebound during recessions, not after, as they begin anticipating a return to economic and corporate earnings growth.

Stocks start to recover before recessions end

Sources: Vanguard calculations as of 31 December, 2021, using data from Refinitiv.

Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Since the focus of this article is on the US economy, the chart shows the one-year return of the Standard & Poor’s 500 Index in US dollar terms from 1973 to 2021. This includes its performance during the period’s seven US recessions, as defined by the NBER and represented by the grey bars.

In all cases, the US stock market began to recover even as the economy continued to shrink.

There are several key lessons from the historical performance of shares during recessions.

- Stock market recoveries may begin soon after recessions commence. Over the last half century, the earliest recessionary recovery in stocks began just two months into the brief economic downturn of 2020. The latest recovery started 16 months into the recession of 2007–2009.

- Recessions have been relatively short compared with most investors’ time horizons. The length of the last seven recessions varied, from just two months in 2020 to 18 months during the 2008 global financial crisis. Of course, recent experiences do not preclude a longer recession.

- Investing defies certainty. We don’t know how long any recession may last or how long stock market recoveries may take. Indeed, official declarations of recessions by NBER are backward-looking. A recession can end before it’s been declared, reflecting the challenge economists face in assessing the level of growth in real time.

Our consistent principles

Whether the US or any other country or region is in a recession or not, investors should avoid overreacting to the latest economic news and stick with well-considered, long-term investment plans. There’s no evidence that efforts to time the markets reward investors. Quite the opposite, in fact.

1 Data showing the US economy contracted this year between April and June, for a second straight quarter would suggest the US economy is, technically, already in a recession. However, the preferred US measure, as determined by the private National Bureau of Economic Research (NBER), shows it is still above water.