Investing entails a level of risk and, to help mitigate this, investors often seek to diversify their investments by spreading their capital across different asset classes with low and negative return correlations – meaning those assets that tend to move in different directions relative to each other. This principle of portfolio diversification is the foundation of an effective multi-asset investment strategy.

Traditionally, multi-asset strategies have leaned on the long-term negative return correlation between global equity and bond markets, with the value of the bond component tending to rise when stock markets fall sharply or for a sustained period of time. The key benefit of this approach is that portfolio returns are smoothed over the long term, with stock markets driving the majority of returns and bonds acting more as a ballast to stock market volatility.

It is possible for advisers to construct their own multi-asset portfolios for clients. Or, increasingly, many advisers are turning to pre-packaged multi-asset solutions for their clients, constructed and managed by an investment company on their behalf. For many advisers, low-cost multi-asset solutions can be a simple and effective way to help their clients achieve their long-term financial goals, serving as the core of a well-diversified portfolio or as an all-in-one solution.

What is a multi-asset solution?

Before we explore the key benefits of pre-packaged multi-asset solutions, let’s establish precisely what we mean by a multi-asset solution: a multi-asset solution is a single fund, ETF or model portfolio that combines different types of investments. Traditionally, multi-asset solutions have combined investments in equities and bonds, with the exact blend of the two asset classes depending on the specific strategy. Strategies with higher equity allocations have typically delivered greater returns over the long term, but at the expense of greater short-term volatility. Multi-asset managers tend to provide different mixes of stocks and bonds to cater for different investor preferences and goals, including their tolerance for risk and their investment horizon.

Some multi-asset solutions invest directly in a blend of individual equities and bonds, while others invest in funds and ETFs that in turn invest in equities and bonds. The latter are known as funds of funds. These blended funds can give advisers and their clients access to hundreds or even thousands of equities and bonds in a single investment. This means they can spread their money across a wide range of securities to achieve a high level of diversification.

Now we’ve established the definition of a multi-asset solution, let’s explore the key benefits for investors of using a single multi-asset fund, ETF or model portfolio.

Benefits of using a multi-asset solution

1. Expert portfolio construction

Portfolio construction is arguably one of the most important parts of the investment process and yet the optimal portfolio can elude many investors without the resource and scale of an international investment company. Hidden biases, such as outsized allocations, or overweights to specific countries, sectors or even individual securities can lurk unseen in multi-asset portfolios, resulting in unintended concentrations and sub-optimal diversification. Note that we are speaking about unintended biases – in some cases, investors may express a preference for a bias or overweight in their portfolio, such as a tilt to their home market, for example.

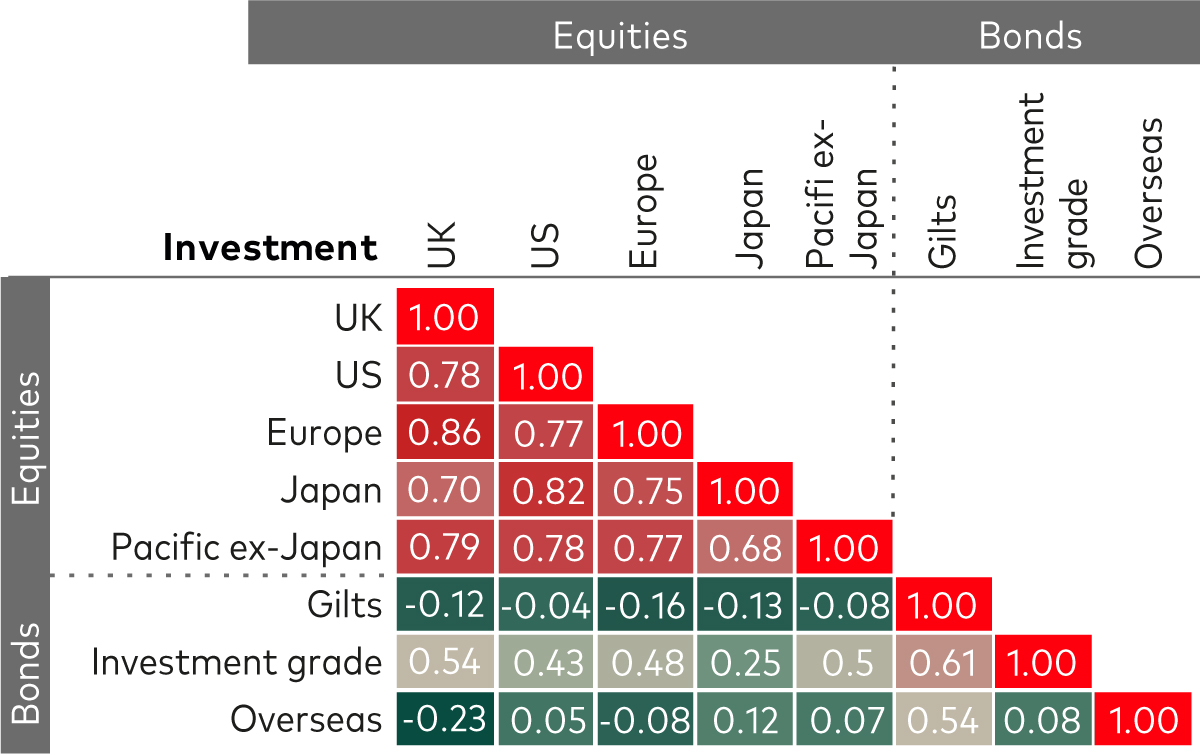

By investing in a pre-packaged multi-asset solution, advisers and clients can lean on a wealth of experience and expertise to invest in highly diversified portfolios that minimise biases and inefficiencies. The chart below offers a basic example of the type of analysis that shows the correlation and diversification benefits between underlying funds in a portfolio. A score of ‘1’ indicates a 100% correlation, i.e., the two asset classes move by the same proportion and in the same direction 100% of the time. So, the lower the number, the better the diversification benefit of holding both asset classes in the portfolio.

Source: Vanguard. For illustrative purposes only.

2. All-weather portfolios

Well-constructed, globally diversified multi-asset portfolios are designed to deliver value to advisers and their clients through various economic and market environments. That doesn’t mean investors will always get positive returns, but an appropriate allocation to global bonds and global equities according to the investor’s goals and tolerance for risk can smooth returns over the long term relative to more concentrated investment strategies1.

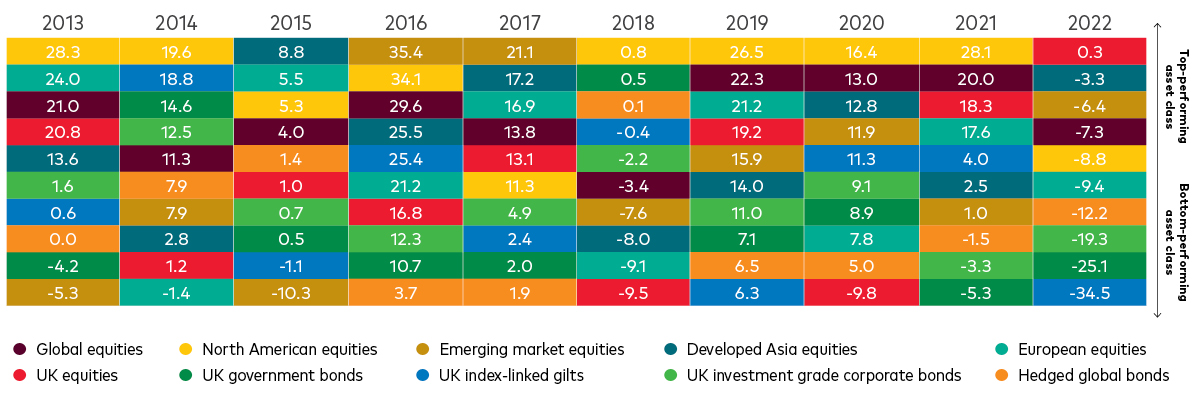

The chart below, which shows the annual return of different equity and bond market sub-asset classes over the past 10 years, illustrates why broad diversification across markets is a sensible approach for the vast majority of long-term investors.

As the data highlights, it’s difficult to say exactly which investments within equity and bond markets will perform well from year to year. For example, some investors might look at the chart and think that an overweight to North American equities would serve investors well, but in four of the past 10 years at least one different asset class delivered better returns, while two of those four years saw North American equities ranked sixth and fifth, respectively.

Key bond and equity index returns (%), ranked by performance

Past performance is not a reliable indicator of future results.

Source: Vanguard calculations, data from 1 January 2013 to 31 December 2022, using data from Barclays Capital and Thompson Reuters Datastream and FactSet. Global equities as the FTSE All-World Index, North American equities as the FTSE World North America Index, Emerging market equities as the FTSE All-World Emerging Index, Developed Asia equities as the FTSE All-World Developed Asia Pacific Index, European equities as the FTSE All-World Europe ex-UK Index, UK equities is defined as the FTSE All Share Index, UK government bonds as Bloomberg Sterling Gilt Index, UK index-linked gilts as Bloomberg UK Govt Inflation-Linked UK Index, UK investment grade corporate bonds as Bloomberg Sterling Aggregate Non-Gilts – Corporate Index, Hedged global bonds as Bloomberg Global Aggregate Index (hedged in GBP). Performance shown is cumulative and denominated in GBP. It includes the reinvestment of all dividends and any capital gains distributions.

By investing across global markets, multi-asset solutions can capture the returns from the best-performing securities in any given year and minimise the impact of the poorest-performing securities on total returns.

3. Cost efficiency

Building a globally diversified portfolio of stocks and bonds can be costly. Our research has shown that low-cost solutions have a higher probability of outperforming costlier ones2. The higher the cost, the less of their returns investors get to keep for themselves. By investing in a low-cost, well-diversified multi-asset solution, advisers can provide clients with a level of product diversification that would be much more expensive to achieve by investing in individual funds themselves, given the costs involved.

For example, a globally diversified multi-asset solution with 60% invested in equities and 40% invested in bonds could feasibly provide exposure to global markets through 18 different underlying funds and ETFs and more than 24,000 constituent securities. And an investor would only pay one fee, which would be considerably lower than that of buying the constituent securities individually.

Low-cost multi-asset funds that are well-diversified can deliver value to investors – however, not all multi-asset funds, ETFs and model portfolios are created equal. The onus is on advisers to ensure that clients can achieve a good level of diversification and that the ongoing costs are low before deciding to allocate client investments into a multi-asset solution.

4. More time back

Multi-asset funds and model portfolios can free up time for advisers to focus on adding value through the range of adviser services beyond portfolio construction. Using an all-in-one investment solution means that advisers needn’t spend significant amounts of their time choosing individual funds or managing client portfolios – or undertaking the administrative tasks that go with it.

Whether it’s behavioural coaching to improve client outcomes and strengthen relationships or focusing on more specific client needs like estate planning, advisers who use appropriate multi-asset solutions get the value of having more time back to dedicate to their clients’ financial planning needs.

For example, depending on the asset allocation strategy of the fund or model portfolio, multi-asset managers will typically rebalance client portfolios to either maintain a pre-determined mix of equities and bonds or to one that is commensurate with the objective of the fund, for example achieving a certain level of return.

Automatic rebalancing means there is no need for advisers to manually rebalance portfolios, allowing them to avoid the associated complexity that can come from gaining permission from each and every investor before changes can be made. As well as preserving a portfolio’s risk profile, the process ensures both advisers and clients are clear on how the portfolio is invested at any time.

Another time-saving factor when deciding to invest in a multi-asset solution is the simplicity of choice when picking the appropriate multi-asset solution. Most multi-asset managers offer a range of different portfolios with different levels of potential risk and return, usually based on their equity-to-bond ratios, meaning advisers simply need to pick the portfolio that best reflects the client’s goals and attitude towards risk.

5. Peace of mind

The foundation underpinning every successful advisory business is trust. Investors must trust their adviser to make sound investment decisions on their behalf, according to their goals and objectives, while advisers in turn need to trust investment managers to safeguard client savings appropriately. By using a multi-asset solution constructed and overseen by an investment manager with global scale and a strong track record in delivering effective multi-asset strategies, advisers and clients alike benefit from the peace of mind that comes from knowing their investments are in capable hands.

Multi-asset managers often employ large teams of investment professionals dedicated to the ongoing management of multi-asset portfolios, providing a depth of expertise and a layer of comfort for advisers and clients.

6. Support

Effective communication also promotes trust among clients. This is why some multi-asset managers regularly provide advisers with materials to aid client conversations by keeping them informed and helping to instil confidence.

For example, quarterly fund performance updates and regular macroeconomic insights can help advisers provide clarity and context for clients, while behavioural coaching tips and aids can support advisers in having effective conversations with clients during difficult and even sanguine market conditions. In some cases, multi-asset managers offer practice management insights for advisers to help strengthen their businesses. All-in-all, advisers can leverage the insights and thought leadership provided by multi-asset managers to strengthen their business and deliver better outcomes for clients.

In today’s fast-paced market and economic environment, more and more advisers are outsourcing their investment proposition and entrusting their clients’ capital to a robust multi-asset solution.

In doing so, advisers can leverage the portfolio construction expertise of multi-asset managers to provide clients with an all-weather portfolio at a low cost without having to spend a significant amount of time on building and maintaining the portfolio.

At the same time, advisers can get more time back by using an all-in-one multi-asset solution to spend on higher-value tasks and achieve the peace of mind that comes from the knowledge that client capital is in reliable hands, while using the materials and guidance made available by their chosen multi-asset manager to deliver more value to clients.

1 Source: Vanguard Research: “How to increase the odds of owning the few stocks that drive returns”, February 2019, C. Tidmore, F. M. Kinniry, G. Renzi-Ricci; E. Cilla. Data between 1 January 1987 to 31 December 2017. Based on quarterly Russell 3000 Index constituents’ return data from Thomson Reuters Market QA.

2 Source: Morningstar and Vanguard. In a 2010 analysis across universe of funds, researchers found that, regardless of fund type, low expense ratios were the best predictors of future relative outperformance (Kinnel, 2010).

If you have completed all content in the module, you are ready to take the quiz and collect your CPD

Ready to test your knowledge?

Take the quizOther Vanguard 365 pillars

Practice management

CPD content designed to help you build your practice, market your services effectively and cultivate a thriving professional network.

Client relationships

CPD content crafted to empower you to service your client’s needs effectively, build relationships, create loyalty and achieve new business growth.

Financial planning

CPD content structured to give you access to useful tools, guides and multimedia resources covering diverse topics from risk profiling to retirement planning.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Important information

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained in this document is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this document does not constitute legal, tax, or investment advice. You must not, therefore, rely on the content of this document when making any investment decisions.

The information contained in this document is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2024 Vanguard Group (Ireland) Limited. All rights reserved.

© 2024 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2024 Vanguard Asset Management, Limited. All rights reserved.