- Germany’s economy, often considered the powerhouse of Europe, has struggled in recent years.

- The energy crisis initially caused Germany’s economic weakening; but today the main driver is a significant drop in external demand, particularly from China.

- New fiscal measures by the government and improvements in business and labour market dynamics could help revitalise the German economy.

"Germany has an outsized impact on Europe’s economic health. The spillover effect from lacklustre growth in Germany will act as a drag even if other European economies continue to grow.”

Chief Economist and Head of Investment Strategy Group, Vanguard Europe

Anaemic growth could unfortunately be the norm in the coming years for Germany’s economy because of three structural challenges: an overreliance on external demand, unfavourable demographics and stagnant productivity. The spillover effect from lacklustre growth in Germany will act as a drag on the European Union’s collective GDP, even if other European economies continue to grow.

The energy crisis is not the main culprit anymore

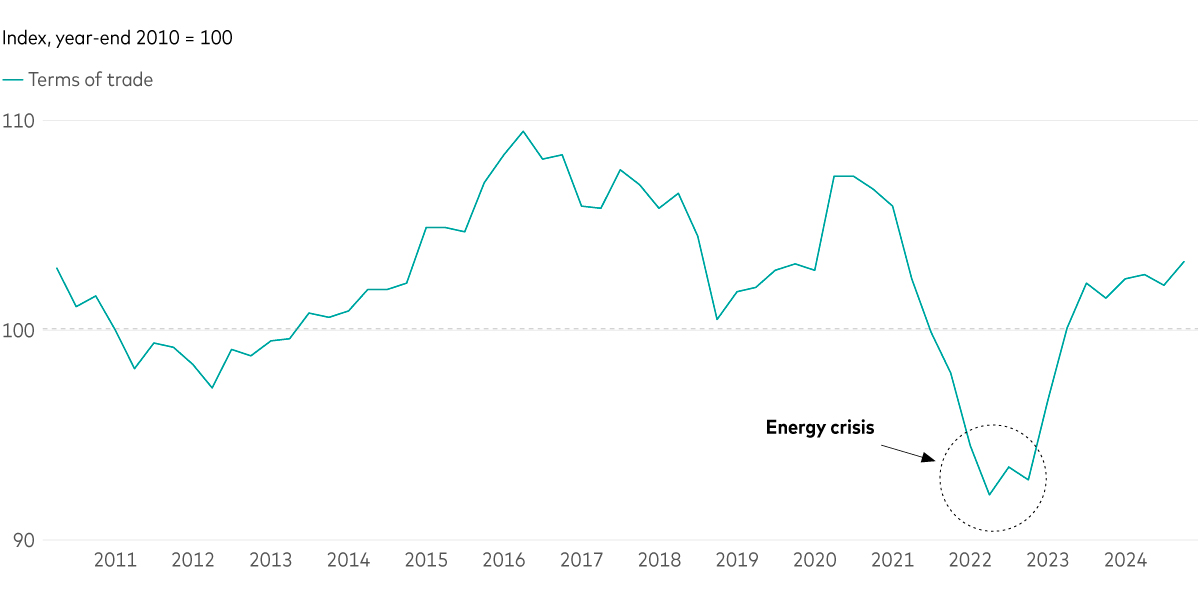

A common narrative is that the energy crisis precipitated by the war in Ukraine is the source of Germany’s woes. Although this was true for most of 2022 and 2023, the evidence points to a different narrative in 2024.

The German economy is highly dependent on exports. And although energy prices remain high relative to pre-Ukraine war levels, Germany’s trade balance and measures of international competitiveness have now returned close to levels last seen before the energy crisis. The economy has shown remarkable adaptability in finding alternatives to Russian oil and gas and in doing more with less.

Germany’s international competitiveness has recovered from the energy crisis

Notes: Chart shows Bloomberg’s German Terms of Trade Index—the ratio of export prices to import prices. Vanguard adjusted the index to have a value of 100 at year-end 2010.

Sources: Vanguard, based on data from Bloomberg and Deutsche Bundesbank, as at 30 September 2024.

The energy crisis is no longer the cause of German malaise. Instead, Germany’s economic weakness in the second half of 2024 can largely be attributed to a significant drop in external demand, particularly from China.

Overreliance on exports, unfavourable demographics and weak productivity growth

For growth, Germany is overly reliant on exports, mainly to China. But this dependency also extends to imports that go into making German goods. Indeed, about 43% of German industrial sectors depend on Chinese imports. Although 81% percent of German manufacturers acknowledge that replacing critical inputs from China would be “difficult” or “very difficult,” the majority (60%) say they have taken no measure to reduce their dependency on China1.

That leaves Germany vulnerable to growing global trade restrictions, on both the import and export sides.

As in other developed countries, aging demographics are also not in Germany’s favour. Over the past decade, immigration has offset a shrinking native labour pool. But this supplemental labour supply could diminish in coming years with potential policy changes.

And weak productivity growth is holding the economy back. A lack of investment in technologies such as artificial intelligence (AI), an inflexible labour market and red tape are all inhibiting innovation and the efficient allocation of resources.

It’s not all doom and gloom

It’s tempting to draw a comparison to Japan in the early 1990s—that Germany could be on the cusp of its own Lost Decade. But there are mitigating factors.

First, the government’s recent move to relax its fiscal constraint—the so-called debt brake, the law mandating a balanced budget—is a welcome one, especially if it allows greater investment in new technologies such as AI to support productivity growth. Second, structural reforms, particularly those targeted to improve business and labour market dynamics, hold the key to a more vibrant economy.

It might not be wise to count Germany out, given its history and resilience during the energy crisis. A 16 December 2024 no-confidence vote in the current government, setting up early parliamentary elections in February, underscores a desire for change. Whatever the outcome of the elections, the obstacles remain formidable, and success will require cooperation in Germany and more broadly across the euro area.

1 Based on the latest available survey data from the Organisation for Economic Co-operation and Development, the German Federal Statistical Office and the Bundesbank Online Panel, as at 30 September 2023.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Important information

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained in this article is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this article does not constitute legal, tax or investment advice. You must not, therefore, rely on the content of this article when making any investment decisions.

The information contained in this article is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Group (Ireland) Limited. All rights reserved.

© 2025 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2025 Vanguard Asset Management Limited. All rights reserved.