- Given the current geopolitical tensions and the rise in trade barriers, it might seem reasonable to predict a reversal of globalisation and a potential spike in inflation.

- At Vanguard, however, we believe that the worst-case inflation scenario is unlikely, particularly in the US.

- We believe the US economy is well-positioned to adjust to shifting global trade dynamics.

“While the peak era of globalisation may be behind us, the worst-case inflation scenario is unlikely, particularly in the US. To understand why, we need to look back over recent decades.”

Senior International Economist, Vanguard.

In the decades preceding the Covid-19 pandemic, low levels of inflation were often attributed to the rise in globalisation. As such, it may seem logical to assume that as global trade decreases, particularly between the US and China, that this might lead to higher levels of inflation in the near term. However, our latest research suggests that the impact of decreasing globalisation on inflation is likely to be modest.

The conventional narrative includes how the low levels of inflation that we’ve seen for most of the past 30 years can largely be attributed to the reduction in trade barriers, notably following the North American Free Trade Agreement (NAFTA) in 1993 and China’s entry into the World Trade Organization (WTO) in 2001. The ready availability of inexpensive imports from China has been a significant factor in driving this narrative.

Given the current geopolitical tensions and the rise in trade barriers, it might seem reasonable to predict a reversal of globalisation and a potential spike in inflation, reminiscent of the post-pandemic period or the pre-globalisation years of the 1980s.

However, while the peak era of globalisation may be behind us, the worst-case inflation scenario is unlikely, particularly in the US. To understand why, we need to look back over recent decades.

Globalisation’s mild impact on inflation

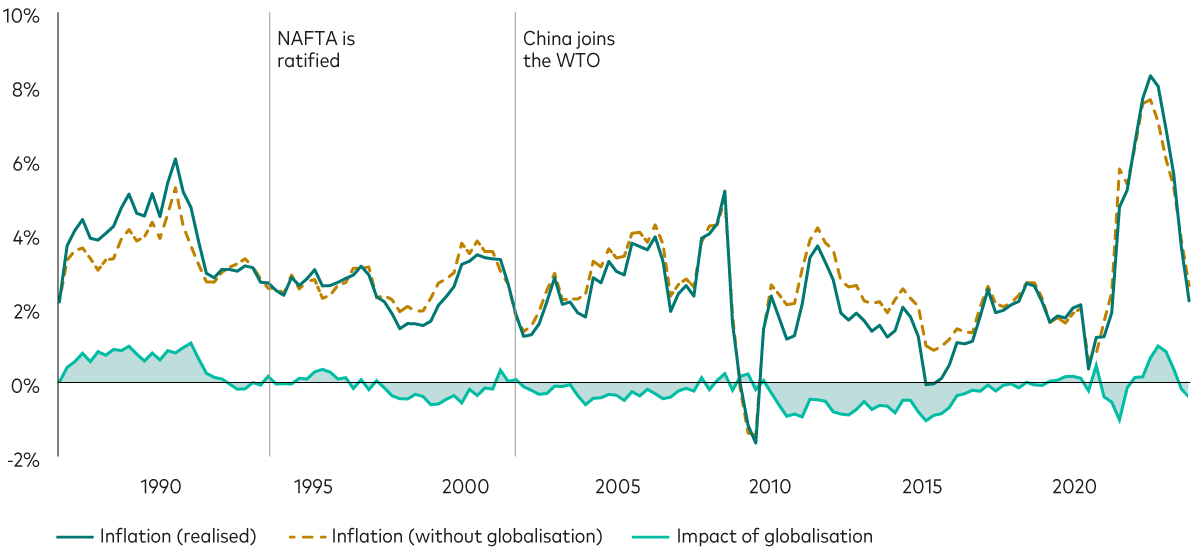

Contrary to popular belief, globalisation has historically had only a modest impact on inflation. The chart below illustrates this point.

Globalisation has mildly lowered inflation, but “slowbalisation” is not to be feared

Notes: Figure shows year-over-year inflation from 31 March 1987 through to 30 September 2023, and hypothetical inflation, assuming that the globalisation driver neither added to nor subtracted from inflation during that period. The shaded area represents the difference between the two lines. A negative value indicates that realised inflation was lower because of the impact of the changes in globalisation. NAFTA stands for the North American Free Trade Agreement and WTO stands for the World Trade Organization.

Source: Vanguard, as at 11 June 2024.

The chart covers 1987 through to late 2023, a period which included cycles of both accelerating and slowing globalisation. While globalisation helped contain inflation in the 1990s and 2000s, the magnitude of its impact was modest—far less significant than that of monetary policy. Even with the recent slowdown in globalisation—a trend we refer to as "slowbalisation"—its influence on inflation remains minimal. This is largely due to the structure of the US economy.

The US depends less on trade

The US economy is more self-sufficient than some may realise, with almost 90% of its goods and services produced within its borders - a much higher proportion compared with most other countries.

Take personal consumption as an example. By dollar value, only about 10% of goods and services consumed in the US are imported. While it might be surprising given the origins of many consumer goods like clothing and footwear, these imported nondurable goods constitute only around 4% of the US consumption basket.

With services such as healthcare, education and housing making up almost 70% of total US consumption and predominantly sourced domestically, the impact of globalisation on inflation has been limited. It’s why we expect slowbalisation to have a minimal impact on the US economy and inflation going forward.

Notes: The figure shows the composition of US personal consumption expenditures (PCE) by category (durable goods, nondurable goods and services) and by source (imported or domestic). We used data as at 31 January 2019, as disruptions from Covid-19 and its aftermath in the early 2020s caused consumption patterns to deviate significantly from the long-term trend.

Source: Vanguard calculations based on data as at 31 January 2019 from the San Francisco Federal Reserve Bank.

Economies adapt to changes in global trade

We should not underestimate the ability of countries to adapt. Since the 2008 global financial crisis, for instance, there has been a shift towards “nearshoring” or “friendshoring” - shifting trade to countries that are closer geographically or geopolitically to mitigate risks like supply chain disruptions.

As a result, clothes labels in the US are more likely to say: “Made in Vietnam” or “Made in Mexico” instead of the once-ubiquitous “Made in China.” Long before the latest trade disputes and pandemic-related supply shocks, these shifts have helped alleviate inflationary pressures stemming from any one region.

Given these forces—a domestic production base, service-oriented consumption and adaptive trade strategies—we believe the US economy is well-positioned to adjust to shifting global trade dynamics. While globalisation has slowed, and it may continue to decelerate further, any resulting inflationary pressures in the US are expected to remain marginal.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Important information

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

The information contained herein is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

Issued in EEA by Vanguard Group Europe Gmbh, which is regulated in Germany by BaFin.

© 2024 Vanguard Group (Ireland) Limited. All rights reserved.

© 2024 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2024 Vanguard Asset Management, Limited. All rights reserved.

© 2024 Vanguard Group Europe GmbH. All rights reserved.