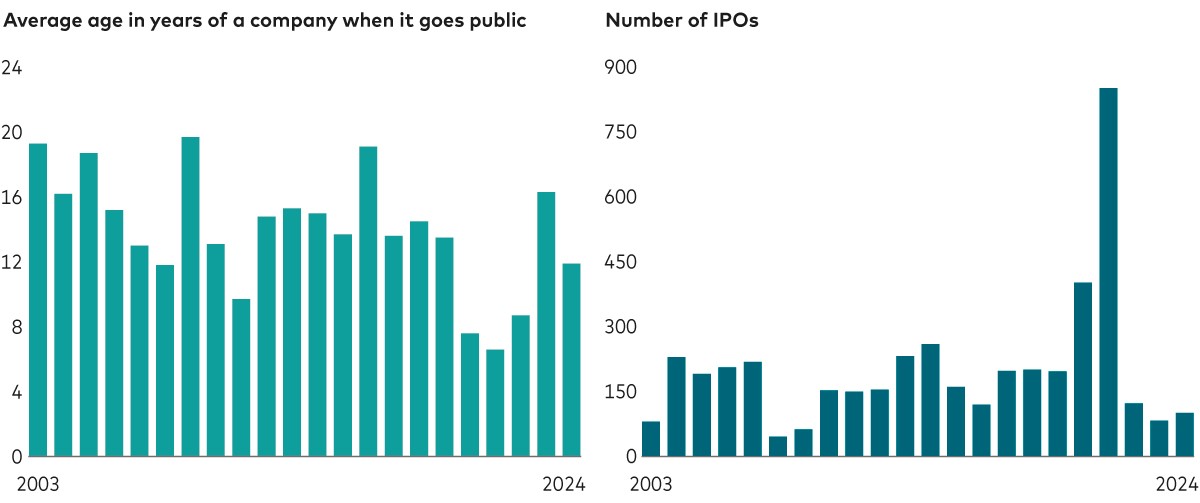

- In spite of the claim that firms are staying private for longer, the average age of US companies when they go public has not changed materially in the past 20 years.

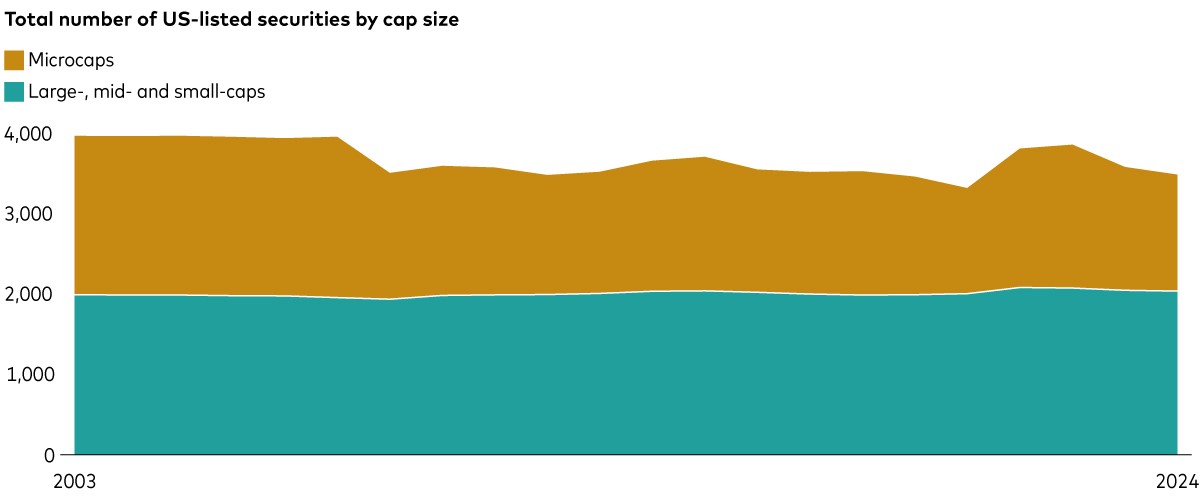

- The number of companies in the more investable portion of public markets has stayed consistent.

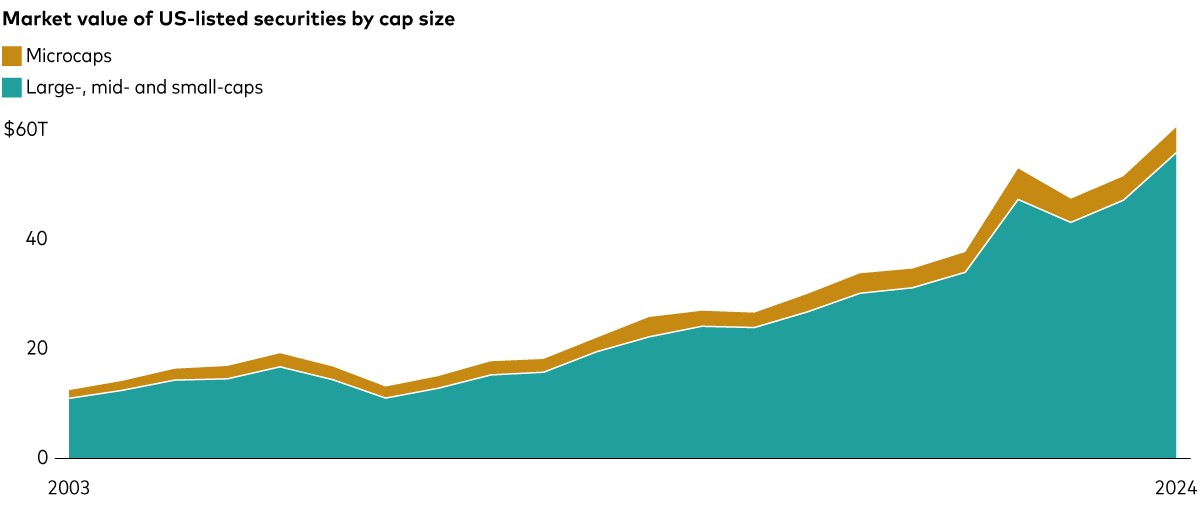

- While the number of investable public companies has remained stable, their market value has risen, suggesting that investors who take a broadly diversified approach to equity investment have benefitted.

It has been a longstanding claim that firms are staying private for longer, reducing the number of public companies – and investors’ chances of benefitting from early company growth. But is that true? To find out, we analysed initial public offering (IPO) and public company data in the US from 2003 to 2024.

IPOs: Steady as they go

Over the last two decades, the average age of a company at the time of IPO hasn’t changed materially, while the number of IPOs per year has generally fluctuated within a consistent range. Although 2020 and 2021 saw a spike in the number of IPOs and a dip in average age, these developments were likely due to uncertainty caused by the Covid-19 pandemic.

Notes: These charts refer to companies completing an IPO between 1 January 2003 and 23 December 2024. The sample is restricted to companies incorporated in the United States and reporting a founding date at or before the time of the IPO. IPOs of companies without a founding date or whose founding date is reported as occurring after the IPO—combined, approximately 1% of all deals—are excluded. The age of a company at the time of IPO is the difference in years between the founding year and the IPO year and is averaged equally over all IPOs.

Source: Vanguard calculations, using FactSet data.

Investable universe remains steady, but number of microcaps varies

Over the last two decades, the number of companies in the investable part of the public market—including large-, mid- and small-capitalisation stocks—has remained stable. The number of publicly listed companies is largely influenced by the number of microcap stocks, which range from about $50 million to $300 million in market cap. Microcaps are generally considered less investable because they suffer from illiquidity, resulting in high transaction costs, and are typically only included in total market indices.

Notes: Large-, mid- and small-cap stocks are defined as stocks in the Russell 3000 Index, a broad US equity index, that are not also included in the Russell Microcap Index. Microcaps are defined as all stocks included in the Russell Microcap Index. Index inclusion is calculated as of 31 July each year from 2003 to 2024.

Source: Vanguard calculations, using FactSet data.

Market value of investable securities continues to grow

As the number of investable market public companies has remained constant, their market value has grown. Investors have participated in these gains because the equity portions of their portfolios are composed primarily of large-, mid- and small-cap stocks. The market value of less-investable companies has remained a consistently small fraction of the overall market. By investing in broadly diversified equity index funds and ETFs, investors can continue to gain access to the universe of publicly listed companies – and any future growth in equity market value.

Past performance is not a guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Notes: The market value shown in this chart for large-, mid- and small-cap stocks reflects the market value of stocks in the Russell 3000 Index that are not also included in the Russell Microcap Index. The market value of microcaps reflects the market value of the Russell Microcap Index. Index inclusion and market values are calculated as of 31 July each year from 2003 to 2024.

Source: Vanguard calculations, using FactSet data.

Acknowledgment: The author would like to thank Steve Lawrence for his substantial contributions to this article.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Past performance is not a guarantee of future returns. The performance data does not take account of the commissions and costs incurred in the issue and redemption of shares.

Important information

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

The information contained herein is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Group (Ireland) Limited. All rights reserved.

© 2025 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2025 Vanguard Asset Management, Limited. All rights reserved.