- Germany’s plans to overhaul its conservative fiscal spending policies triggered sharp moves in European equity and bond markets.

- European stocks rallied on the news, while bond markets sold off sharply at the prospect of an unprecedented ramp-up in government debt issuance.

- The fiscal reforms could be a game-changer for Europe. In addition to reviving economic growth, they could be a catalyst for European equity outperformance and bond underperformance.

The incoming German chancellor's announcement on 4 March of an overhaul to its fiscal spending plans triggered an immediate response in financial markets. European equities—and German stocks in particular—rallied sharply on the news, amid hopes of renewed economic growth across Europe. Meanwhile, the prospect of an unprecedented ramp-up in government debt issuance needed to fund the German fiscal package triggered a sell-off in German bund which saw their largest weekly rise in yields since Germany’s reunifiation in 19901.

Here, we outline what is set to change as part of the proposed policy – and what this could mean for equity and bond markets.

Germany’s major fiscal boost

The fiscal changes would mark a major shift in Germany’s historically conservative fiscal spending approach, which sets tight limits on federal borrowing levels – and would pave the way for the largest increase in fiscal spending by Europe’s largest economy in more than a generation.

The new fiscal package includes three significant changes: A new €500 billion infrastructure investment fund; an exemption from Germany’s “debt brake” rule on defence spending above 1% of GDP; and a rise in the net borrowing cap for federal states from 0% to 0.35% of GDP.

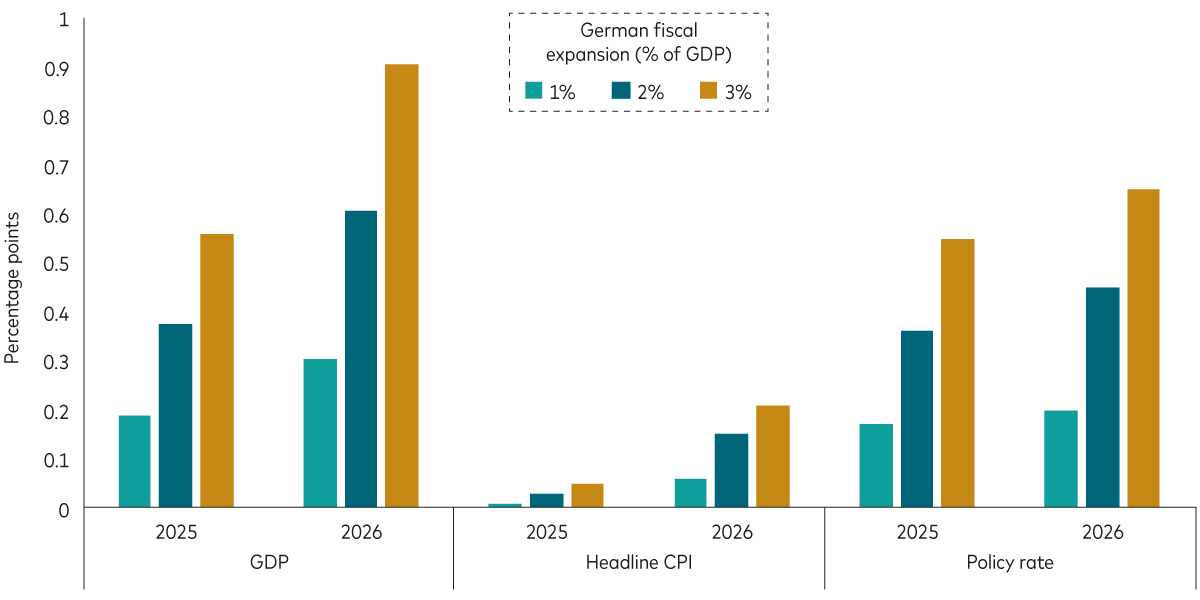

Germany’s fiscal easing could have a significant impact on euro area growth, inflation and monetary policy

Note: The chart shows the modelled impact on euro area macroeconomic fundamentals under three different German fiscal expansion scenarios that include the fiscal deficit widening by 1% of GDP, 2% of GDP and 3% of GDP. The chart shows the deviation from baseline in each scenario and is modelled using the Oxford Economics Model. The model assumes a fiscal multiplier of one. GDP refers to the estimated cumulative impact on the level of euro area GDP by year-end 2025 and 2026. Headline consumer price index (CPI) refers to the average annual headline CPI rates. Policy rate refers to the ECB deposit facility rate by year-end. Our baseline assumption assumes a 1.5% of GDP expansion.

Source: Vanguard calculations, based on data from Bloomberg and Oxford Economics.

If implemented, the plan would unlock billions of euros in spending that could help kickstart Germany’s flagging economy, which has been contracting for more than two years.

Financing for the new plan would come from a significant increase in government-backed debt levels. German and European fixed income markets balked at the potentially huge rise in bund issuance that would be needed to fuel the spending package, with the 10-year German bund yield ending the week of the announcement 43 basis points (bps) higher at 2.84% – its largest weekly yield increase in nearly 35 years1. This is despite an interest rate cut by the European Central Bank (ECB) on 6 March, which lowered the bank’s deposit facility rate to 2.50%.

While Germany’s announcement came too late to be incorporated into the ECB’s March staff forecasts, in its statement, the ECB cast a cautious tone, citing increased uncertainty and fiscal loosening as risks to the euro area’s economic outlook. In our view, this will likely lead to a more non-committal tone around future rate moves by the ECB.

Uncertainties remain around the execution and timing of the fiscal plan, particularly around defence spending. However, if the plan proceeds, a reasonable base case scenario would see the German fiscal deficit rise by 1.5% of GDP over the course of 2025 and 2026, implying a boost to euro area GDP of 0.4 to 0.5 percentage points by the end of 2026. Additionally, stronger growth would be consistent with the ECB reducing its planned rate cutting cycle by 1-2 cuts in 2025.

A key downside risk to these expectations is the prospect of significantly higher US tariffs. Our calculations suggest that if the US were to implement a 25% tariff on EU goods for an extended period, it could offset the expected gains from Germany’s expansionary fiscal policy in both 2025 and 2026.

A game-changer for European equity and bond markets

The announcement signals a regime change in Germany, and we believe it’s a potential game-changer for Europe. As well as reviving growth from 2025 onwards, it could well be a key catalyst for European equity outperformance and bond underperformance.

For equity markets, the immediate rally we’ve seen in German and, more broadly, European, shares could become more sustained, especially once there is more certainty around implementation of the fiscal package. Higher trend growth is positive for German and European equities over the long term.

We anticipate that European bond markets will remain volatile, as they digest the implications of such a significant increase in government debt entering the market, as well as the higher potential future borrowing costs over the longer term.

In our view, the sell-off in German and European bond markets so far in response to the German spending package has been entirely appropriate and could very well extend further, as markets digest the longer-term implications of Germany’s proposed fiscal reforms.

Prior to the news, Vanguard’s active fixed income team had been positioning our portfolios to be short German bunds (relative to US Treasuries and UK government bonds) in anticipation of expected German fiscal loosening. The 4 March announcement only strengthened our conviction in our view of German bund underperformance.

1 Source: Vanguard. The weekly increase in 10-year bund yields is based on the yield at close of day on 28 February 2025 (2.41%) and 7 March 2025 (2.84%).

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Any projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

Important information

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

The information contained herein is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Group (Ireland) Limited. All rights reserved.

© 2025 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2025 Vanguard Asset Management, Limited. All rights reserved.