In this article, we consider the key findings from the Vanguard paper, The value of personalised advice1, which offers a methodology for measuring the value of advice for an individual client. The question “What is the true value of financial advice?” is of huge importance to financial advisers. By quantifying the value of your advice you can, more easily, convey the benefits to new and existing clients, ensuring they understand how you offer value over and above your fees.

In this article we will look at:

The four pillars of advice value

How to measure the value of advice

Introducing the Vanguard Financial Advice Model (VFAM)

The benefits of the VFAM

Applying the framework: a case study

Firstly, here are some key findings:

Communicating the true value of financial advice to existing and potential clients is not easy.

Calculations of value are often anchored in investment performance and fail to recognise the value of financial planning interventions outside of portfolio construction.

Vanguard has expanded its research on quantifying the value of advice to include four key sources of advice value – financial, portfolio, emotional and time.

Understanding how these sources of value apply to different clients – and therefore understanding the value of personalized advice – can help you to retain and attract more clients.

1. A new framework for valuing advice

Vanguard has expanded its original three-pillar value of advice framework to include a fourth dimension – time savings:

Financial value: advisers help investors to meet their financial goals and overcome obstacles and challenges along the way.

Portfolio value: building a well-diversified portfolio matched to the client’s risk tolerance.

Emotional value: helping investors achieve financial wellbeing or peace of mind and instilling confidence in them.

Time savings value: performing tasks for your clients that they may not have the capacity or knowledge to undertake themselves.

Figure 1 provides examples of the four different sources of advice value within the framework.

You can maximise your value with individual clients by matching the advice interventions in each of the four pillars that are likely to provide them with the most value in the most efficient manner. In many ways, your most valuable task is choosing which advice opportunities you should implement with each client.

Advice as an ongoing process

Whilst financial value and portfolio value are most often delivered through the specific interventions that you recommend to your clients, emotional value and time value are most often delivered through the ongoing process of regularly engaging with your clients and monitoring their portfolios. Through this regular engagement, you will earn the trust of your clients, which is one of the primary drivers of successful long-term advisory relationships.

Examples of ongoing emotional and time-value activities that you may undertake for your clients could include:

Following up with clients to ensure they are saving as much as they need to.

Showing clients how their investment plans will give them the flexibility to spend and enjoy life.

Educating clients through times of economic euphoria and turmoil.

Why is personalisation important?

For your clients to engage with you, they are undertaking an emotional, as well as a financial, commitment. Understanding your clients' needs, goals, values, objectives and lifestyle will enable you to craft a tailored and personalized investment plan that aligns with their views. By engaging with your clients in this way, you are reassuring them that your advice and offering is designed and personalized for them. If your clients does not feel that you understand their needs, it is unlikely that they will be confident in your ability to deliver results.

At Vanguard, our research shows that the more personal an advice plan is, the more value it can deliver.

2. How to measure the value of your advice

To assist you in using our new framework, Vanguard has developed a three-step process for measuring the value of a set of advice interventions for individual clients relative to their existing ‘baseline’ investment strategy. The process can also be used to discover higher-value advice opportunities that can assist clients in their decision-making2.

Figure 2. To measure value, compare the advised alternative to a baseline.

Source: Vanguard.

Establish a baseline model: What will an investor do absent the advice interventions that we want to measure?

Model the interventions: Once a baseline is established, we can change the modelled outcomes by adding the advice interventions we want to value. How does the range of potential outcomes improve when we undertake the suggested interventions?

Add to the baseline model to match value: Return to the original baseline model and determine how much additional wealth or extra annual return the investor would need to achieve across a distribution of outcomes, using their current approach, that is equivalent to the advised alternative.

The Vanguard Financial Advice Model

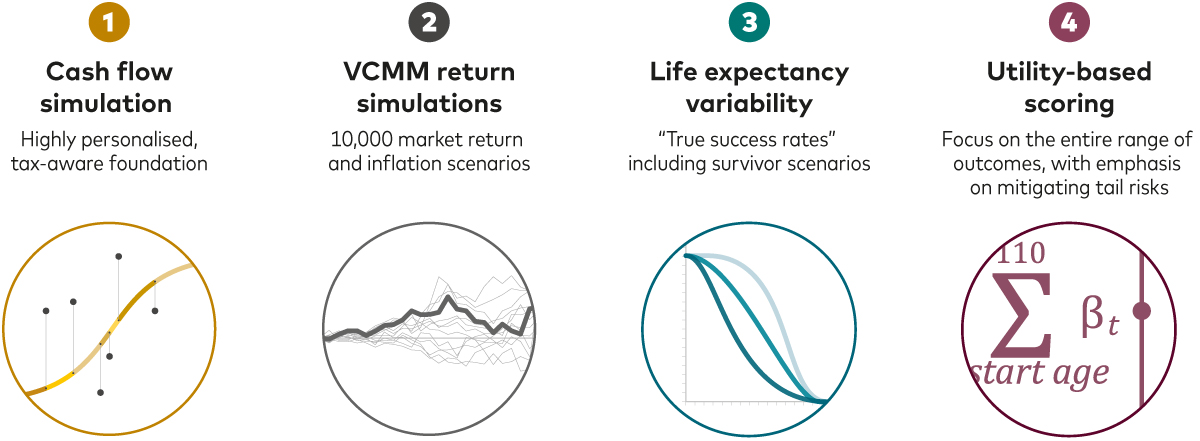

The Vanguard Financial Advice Model (VFAM) was developed in conjunction with our new framework to enable calculations of value provided by advice for individual clients relative to their current investment and financial planning strategies.

To calculate the value of a specific set of advice interventions, VFAM draws on the unique needs and goals of the individual client, taking into account the tax and regulatory landscapes of the client’s home market. The model’s results are primarily expressed in terms of the annualised return value provided to the individual investor, in basis points (a basis point is a hundredth of a percentage point), as well as in 'windfall equivalent dollars' — the amount that would need to be added to a taxable account held by the individual today — as an alternative measure.

Currently, the VFAM is configured to calculate the value of advice for US-based investors only. UK and European versions of the VFAM are under development. In the interim, there is more information about the model in the diagram below:

S

Source: Vanguard

The sources of advice value

The benefits of the VFAM measurement approach

The VFAM approach improves on traditional metrics in the following ways:

Personalisation: The VFAM assesses value at the individual level and accounts for differences in client tax brackets and other attributes. This means that the value of advice interventions can be calculated on an individual basis. Additionally, it can help advisers discover and prioritise higher-value interventions for individual clients and assist in decision-making conversations.

Multi-strategy effects: Whilst each potential advice intervention can add value in isolation, measuring a set of interventions together won’t necessarily equate to a total value which is the sum of its parts. Sometimes multiple interventions can overlap, whilst others can work together to create superior outcomes.

Distributional outcomes: The VFAM method explicitly values each possible outcome and weighs them appropriately. It also explicitly accounts for the variability of life-expectancy outcomes whereas most advice conventions project to a given age.

Utility-based scoring: At Vanguard we believe that utility-based scoring provides a better measurement of value for individual clients.

Utility-based scoring: a more meaningful measure of success

Traditional financial planning often uses a “portfolio success rate” to measure results and score a portfolio’s preparedness, as well as the quality of the financial planning strategy or decision. While a portfolio success rate is useful for conveying the longevity of a portfolio at a specific age, it has clear shortcomings. With the VFAM, we use a utility framework to score the lifetime spending and bequest distributions of a client’s baseline and advised scenarios.

In essence, utility scoring is not strictly a measure of wealth, but rather of the life satisfaction or usefulness that wealth can provide. When considering utility scoring, greater wealth does not necessarily lead to greater outcomes for your client.

Utility scoring does not simply recommend the best average outcome; it also penalises strategies that risk extremely negative outcomes. The VFAM model considers these downside risks and chooses options that result in utility maximisation across a wide range of potential outcomes.

How to apply the new framework

The advice activities that prove most valuable will vary from client to client depending on their individual circumstances, life stage and market conditions. To illustrate how personalized advice interventions can provide significant value to your clients, let’s look at a case study from Vanguard’s US research3.

Tristan is a 25-year-old high earner with an annual income of $120,000. His financial goals are vague and he tends to buy shares in companies recommended by friends, family and social media. He recently saw the value of his portfolio drop by 50% so has decided that the 1% annual fee of a professional financial adviser might be worthwhile.

Advice interventions

Tristan’s adviser needs to focus on his informal savings strategies and haphazard investments. They will also need to be attentive to him going forwards as without behavioural reinforcement it is likely he will drift from his plan and react to market movements. With advice and instruction, he can avoid these potential pitfalls.

Specific advice interventions:

Establish a formal, disciplined savings and investment plan.

Move him away from haphazard saving in taxable accounts.

Formalise and automate his savings.

Increase his annual savings from $10,000 to $11,000 per year.

Use tax-advantaged accounts.

Switch him from individual securities into a globally diversified portfolio.

The advice suggested, if implemented faithfully, could provide an expected equivalent return value of 2.85% annually, even after accounting for the adviser’s 1% annual fee. This equates to a substantial cash equivalent windfall value of about $489,000.

Source: The Value Of Personalized Advice, Vanguard, August 2022.

Conclusion

Financial advisers provide value in many ways, but by making the value measurable, you can improve client outcomes, attract new clients and retain your existing clients in the long-term. To provide the most valuable advice, however, the key is to understand and know your client so that your advice can be tailored to their goals and aspirations along with being structured to manage their behaviours and keep them on track.

Identifying the right set of advice interventions for your client and their situation is critical to maximising your value. Measuring this is a key way to help you discover the most valuable advice recommendations and also to communicate to your clients the value of following through.

Review the four sources of advice value and consider which elements you historically have a tendency towards highlighting with your clients. Do you tend to focus on financial or portfolio value? Spend some time thinking and writing down ways in which you add value in all four areas.

Read through the list of ongoing emotional or time value activities above. Are there any activities here that you do consistently? Are there any that you have not carried out at all? What other activities do you carry out for your clients which have emotional or time-value? Which of these could you do better, or more often, for your clients?

Whilst the UK version of the VFAM is still under development, you can familiarise yourself with how the model calculates the value of personalized advice interventions for individual clients. Review the three-step process for calculating personalized values above, along with the underlying concepts of the VFAM’s approach, to ensure you have a clear understanding of the model’s unique benefits.

Read our article, “The role of emotions” to understand the importance of emotional value in your client relationships and how this can be measured.

1 The value of personalized advice, Vanguard, 2022.

2 The value of personalized advice, Vanguard, 2022.

3 The case study applies the US version of the VFAM and is based on the US financial and tax environments. While the outputs may differ in the UK and Europe, the principles apply across these regions and demonstrate how different personalised advice interventions can provide significant value to individual clients.

Source: The value of personalized advice, Vanguard, June 2023. A UK version of this research will be available in 2024.

If you have completed all content in the module, you are ready to take the quiz and collect your CPD

Ready to test your knowledge?

Take the quizOther Vanguard 365 pillars

Practice management

Tailored content to help you build your practice, market your services effectively and cultivate a thriving professional network.

Financial planning

CPD content structured to give you access to useful tools, guides and multimedia resources covering diverse topics from risk profiling to retirement planning.

Investment knowledge

CPD content formulated for you to explore in-depth insights on investment principles, portfolio construction and comprehensive product education to expand your technical knowledge.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Important information

This article is directed at professional investors and should not be distributed to or relied upon by retail investors.

This article is designed for use by and is directed only at persons resident in the UK.

The information contained in this article is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this article does not constitute legal, tax or investment advice. You must not, therefore, rely on the content of this article when making any investment decisions.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2024 Vanguard Asset Management Limited. All rights reserved.