In summary

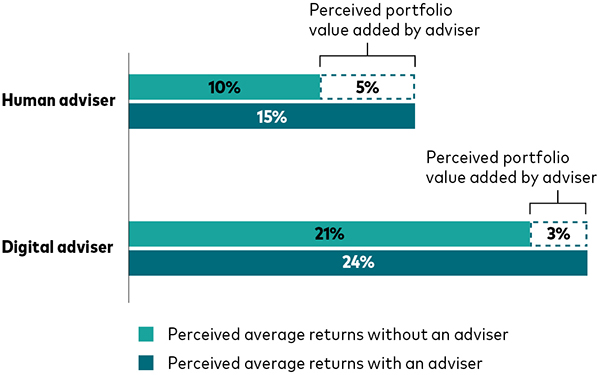

Advice adds value across the board: Investors believe advice provides higher incremental portfolio value than going it alone. The perceived value-add to annual performance was 5% for human advice and 3% for digital-only advice.

Loyalty to human advisers is enduring: 90% of human-advised clients would not consider switching to digital, but 88% of robo-advised clients would consider switching to a human adviser.

Clients prefer emotional support from human advisers: Three times as many investors report having strong peace of mind when working with a human adviser than going it alone. Investors using human advisers estimate being $160,000 closer to achieving their financial goals.

Digital advice serves a role: Digital advice is preferred by investors for portfolio-management services including diversification and tax optimisation.

Client age or wealth does not dictate advice delivery type: Across the board, clients suggest that humans should consider automating their portfolio-management services, leveraging technology to scale their business.

Why did we carry out this research?

News headlines may lead people to believe that human advisers are under threat from technology. In the past decades, many fintech firms have entered the advice marketplace, while the impact of Covid-19 further affected face-to-face models, and virtual interactions have gained traction in most business sectors.

To assess whether there is a potential impact to human advisers, we considered the following questions:

Is technology a threat to financial advisers?

Is there a possibility that digital-advised clients could consider switching to human advisers?

What is the perceived value of digital and human advisers to investors?

Investors prefer loyalty

Should advisers view robo-advice as a cannibalising threat to their existing client base?

Data from our research suggests that investors have a strong loyalty to their financial advisers. For investors who already use a human adviser, 93% state that they would continue to use a service that includes a human adviser in future. See Figure 1 below for the breakdown of statistics.

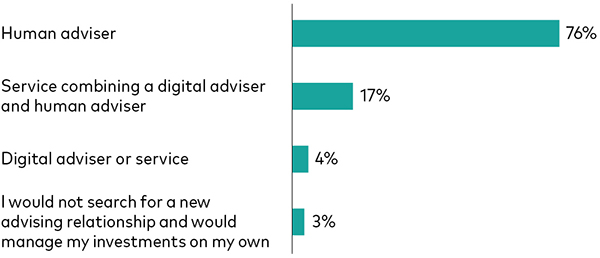

FIGURE 1. Investors with human advisers are not likely to switch to a digital service

Question: If you had to leave your current [human] adviser today, what type of advising relationship would you search for in the future?

Note: The sample in this figure includes all clients who only have human advisers

(1,175 in total).

Source: Vanguard, 2021.

When asking current robo-advised clients about their future preference, 88% of respondents said they would be willing or extremely willing to work with a human adviser in future (see Figure 2 below).

FIGURE 2. Investors with digital advisers are likely to switch to human advisers

Question: On a scale from 1 to 7 where 1 means “not at all willing” and 7 means “extremely willing,” how willing are you to work with a human financial adviser in the future?

Note: The sample in this figure includes all clients who only have digital advisers

(135 in total).

Source: Vanguard, 2021.

With the above in mind, robo-advised clients could represent an untapped and under-targeted market to convert to human advisers, especially as their needs become more complex.

How do investors define the value of advice?

What drives customer loyalty?

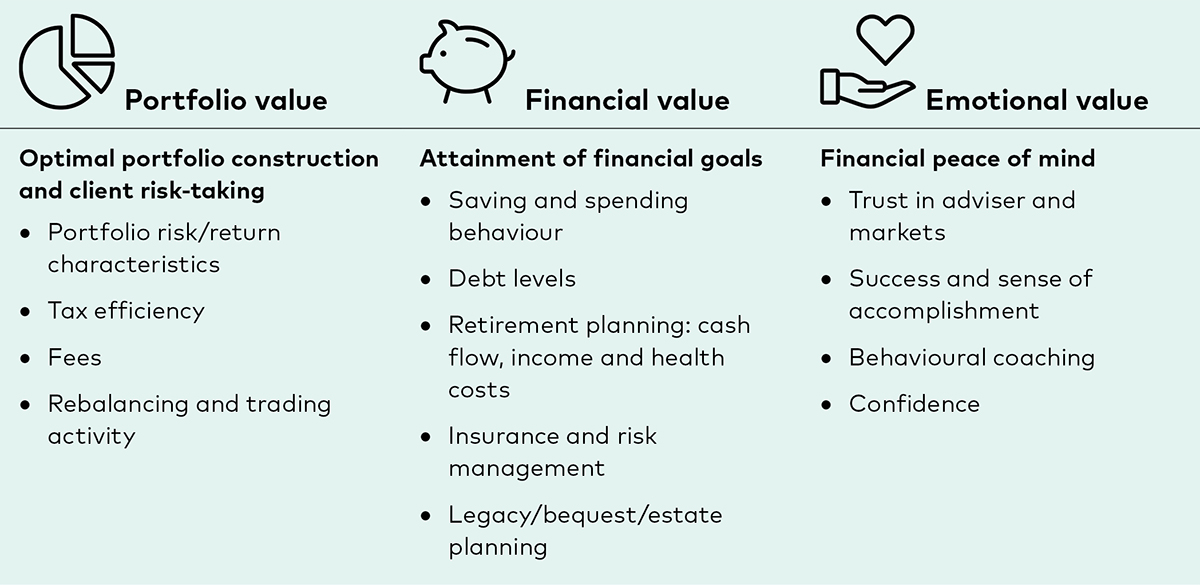

At Vanguard, we propose that for the investor, the value of advice goes beyond investment returns. We believe in a three-part value framework (see Figure 3) comprising:

- Portfolio value

- Financial value

- Emotional value

FIGURE 3. The value of advice can be broken down into portfolio, financial and emotional value

Source: Vanguard.

In seeking to convert robo-investors, advisers can leverage emotional value to help position their services.

FIGURE 4. Investors believe that human-advised clients derive more emotional value from advice than digital-advised clients get from theirs.

The investors were asked two questions:

Within each of the boxes below (portfolio value, financial value, and emotional value), please allocate points based on the relative value you [would] receive from a human adviser.

Now please allocate points based on the relative value you [would] receive from a digital adviser.

Notes: In the survey, portfolio, financial and emotional value are defined as follows: Portfolio management includes activities such as asset allocation, diversification, rebalancing, and performance; financial planning includes establishing goals, saving and spending strategies, debt management, retirement, and estate planning; and emotional outcomes includes trust and confidence in your adviser, peace of mind that you will achieve your goals, and assurance in times of market volatility. The sample includes all clients who answered the question (1,222).

Source: Vanguard, 2021.

Portfolio value

Definition: The outcome of building a well-diversified portfolio tailored to an investor’s preferences.

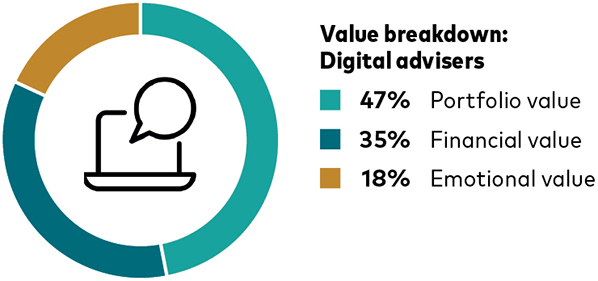

It is difficult to calculate the value advisers add to a client’s investment portfolio1. Our research extracted the perceived value of clients’ performance by asking them what they believed their performance was with a financial adviser and what they believed it would have been without an adviser. By calculating the difference, investors’ perceived portfolio value of advice can be measured.

FIGURE 5. Investors believe human and digital advisers provide substantial portfolio value

Question 1: In your experience with your human/digital adviser, what would you estimate your average annual investment returns to be in the past three years? If you have not had an adviser for three years, think about the relationship you have had with your adviser thus far.

Question 2: You mentioned that your estimated average return whilst working with your human/digital adviser was [insert answer to question 1]%. Imagine you did not have an adviser and were managing investments on your own, what would you imagine your average investment returns to be in the same period?

Notes: In this figure, the sample includes all who responded to the question and had an answer of between ‒50% and 50% of average annual returns, to avoid outliers. In total, 802 human-advised and 187 digital-advised clients met these criteria. The portfolio value added is qualitatively similar across groups even in the presence of outliers.

Source: Vanguard, 2021.

From Figure 5 it is evident both human- and digital-advised clients perceive getting substantial portfolio value from their advisers, human-advised clients five percentage points, and digital-advised adding on three percentage points.

In terms of absolute performance, digital-advised investors believe they achieve higher returns than human-advised investors do. One explanation for this could be that the two samples of investors are different. For example, digital-advised investors skew younger and self-report being more aggressive in their investments, which could have led them to higher performance. Also, digital-advised investors believe that they could achieve a large portion of their performance on their own.

Financial value

Definition: The ability to meet one’s goals as articulated in a financial plan.

To determine what clients perceive financial value to be, we asked three questions:

What is your financial goal (in US dollars)?

How far are you in percentage terms in your journey towards achieving your goal?

How far do you think you would be in achieving your goal if you did not have a financial adviser?

Figure 6 shows responses to these questions. By subtracting the percentages in question 2 and 3 we can provide an estimate of their perceived financial value of advice. By determining the investor’s financial goal in USD, this can be quantified.

FIGURE 6. Investors believe both human and digital advisers provide high financial value

Notes: In this figure, the sample includes all who responded to the question, for a total of 835 human-advised and 238 digital-advised clients. The median financial goal for both sets of clients is $1,000,000.

Source: Vanguard, 2021.

We find that human-advised clients believe they are $160,000 closer to achieving their financial goals while digital-advised clients attribute a more modest $50,000 to the advice they receive. Both human- and digital-advice clients believe that their advisers add substantial financial value in helping them achieve their goals.

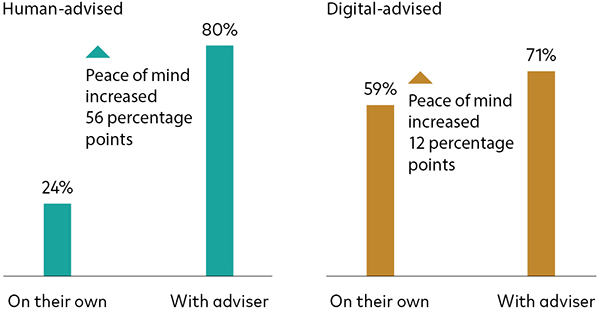

Emotional value

Definition: The embodiment of the idea of financial peace of mind.

This is the hardest component to measure as emotions are subjective. For this research we used the measure of financial peace of mind as a proxy for the emotional value of advice.

We asked our investors two questions:

Do you have peace of mind knowing a human (or digital) adviser is looking after your investments?

Would you have peace of mind managing your own investments?

The lower increase can be attributed to the fact that most of these clients believe they would have had peace of mind if they were investing their own money (giving them a higher starting baseline). Second, even after receiving financial advice, digitally advised clients report lower levels of peace of mind than human-advised clients do.

FIGURE 7. Human advisers dramatically increase their clients’ peace of mind

Notes: In this figure, the sample includes all who responded to the question, for a total of 1,308 human-advised and 337 digital-advised clients. Clients could rate peace of mind from 0 (“No peace of mind at all”) to 10 (“A great deal of peace of mind”). Clients were considered to have peace of mind if their rating was between 8 and 10.

Sources: Vanguard and Escalent, 2021.

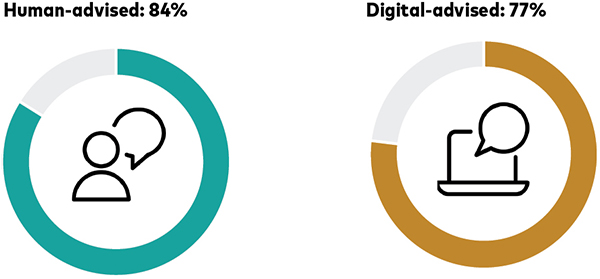

How satisfied are investors overall with human- and digital-advice services?

Investors believe advice adds value. However, does the advice satisfy their expectations?

84% of human-advised investors report being satisfied with their advice compared with only 77% of digital-advised investors.

FIGURE 8. Human-advised investors have higher levels of satisfaction

Question: How satisfied are you with your human/digital advice service] overall?

Notes: In this figure, the sample includes all who responded to the question, for a total of 1,377 human-advised and 337 digital-advised clients. They could rate satisfaction from 0 (“No satisfaction at all”) to 10 (“Completely satisfied”).

They were considered satisfied if their rating was between 8 and 10.

Sources: Vanguard and Escalent, 2021.

This gap further reinforces the opportunity for switching from digital services to a human adviser and could explain why the preference for human advisers is stronger.

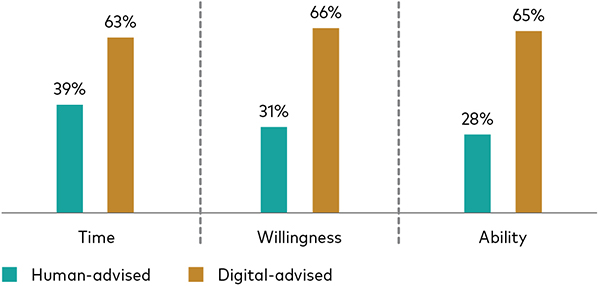

We asked investors whether they would have the time, willingness and ability to manage their investments without an advice service and the outcome painted a clear picture.

The majority of digital-advised investors report having time, willingness and ability to manage their own investments, whereas human-advised investors report having fewer of these characteristics.

FIGURE 9. Digital-advised clients report higher levels of time, willingness and ability to manage their own investments

The investors were asked the following questions:

Imagine you did not have a human/digital adviser and were managing investments on your own, how much would you agree with the following statements?

Do you have time to manage your investments personally?

Are you willing to manage your investments?

Do you feel you have the knowledge and ability to manage your investments properly?

Notes: In this figure, the sample includes all respondents. In total, 1,352, 1,354, and 1,351 human-advised clients and 341, 338, and 340 digital-advised clients answered the time, willingness and ability questions, respectively. They could rate the statements from 0 (“Not at all agree”) to 10 (“Completely agree”). They were considered to agree with the statement if their rating was between 8 and 10.

Source: Vanguard, 2021.

It is possible that digital-advised investors may have less-complex financial needs. Digital-advised clients tend to be much younger and therefore potentially have fewer financial goals. Whilst the research did not study this element further, it digital-advised clients perceive less value from advice consider switching to a human adviser in the future, their financial situation become more complex.

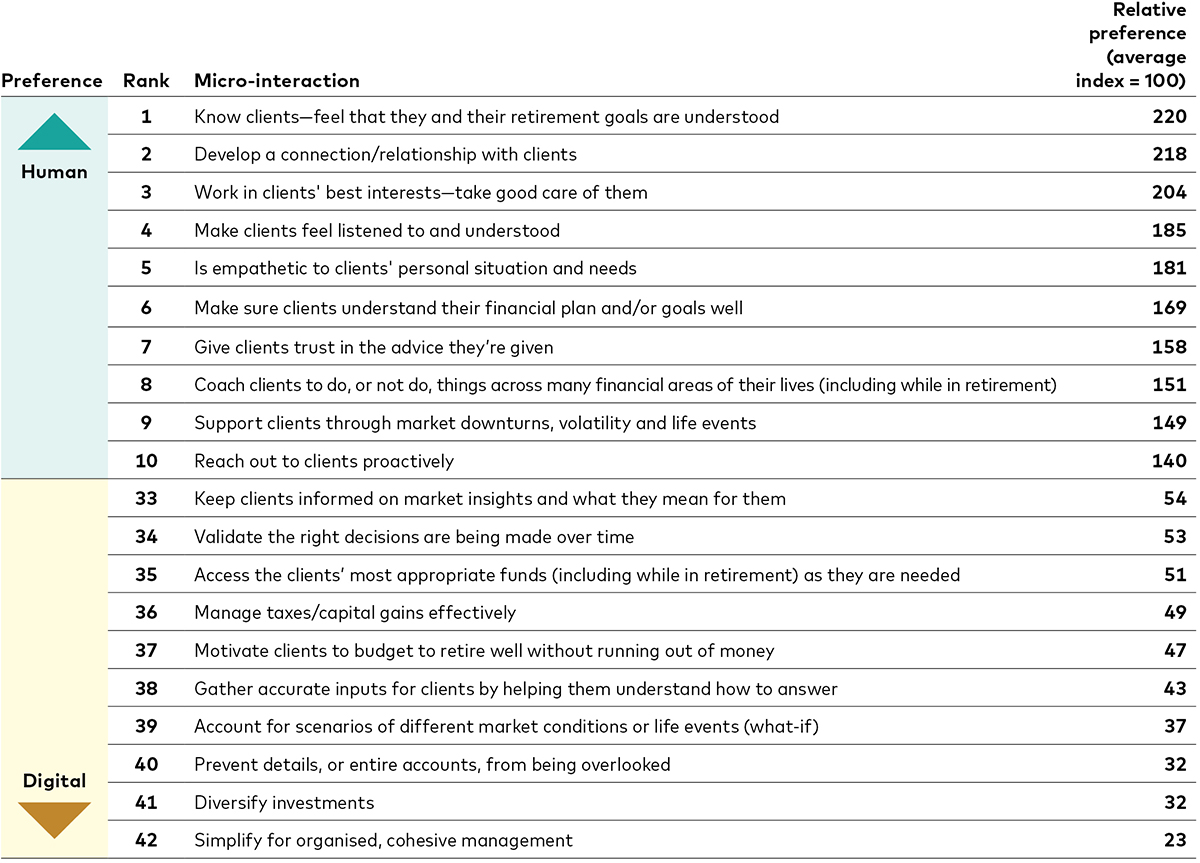

Investor preference: breaking down advice into the sum of the parts

Which services within advice do investors prefer to be delivered by a human and which are best delivered by automation?

There is a strong predilection for human delivery of many advice services; it is preferred over digital delivery by at least 40 percentage points. Most of these preferences align to the emotional and financial success components of the value-of-advice framework rather than portfolio dimension.

Services that investors prefer to be delivered digitally are related to functional tasks and portfolio management, such as “manage taxes/capital gains efficiently” and “diversify investments”. This aligns with research that stresses how work related to portfolio outcomes has been commoditised and how advisers should focus on services in which humans excel, such as behavioural coaching.

Optimising human and digital delivery for business growth

Knowing relative preference for is important as:

- It helps advisers optimise their service and ensure they are pursuing the right clients based on their service model.

- Advisers’ time is a scarce resource, so it is beneficial for them to understand which services can be outsourced to automation to help scale their practices in a cost-efficient manner.

Our research (see Figure 10 below) shows that clients prefer emotional and financial outcomes to be delivered by humans and portfolio and functional tasks digitally. The margin for this preference in the emotional and financial areas is large.

FIGURE 10. Human advisers should focus on delivering emotional and financial outcomes while automating portfolio construction and functional tasks

Notes: In this figure, all 1,518 clients answered the question. They were presented with four micro-interactions / relative-preference scores at a time, 12 times in different screens, and asked which they most preferred to be delivered by a human or digital service so that we could rank each micro-interaction as well as relative preferences. The statistical technique used to calculate the rank and relative preference scores is called MaxDiff. The relative-preference score should be interpreted as follows. Take the micro-interactions ranked #8—“Coach clients to do, or not do, things across many financial areas of their lives (including while in retirement),” and #36—“Manage taxes/capital gains effectively,” for example. Their relative-preference scores are 158 and 49. This means that investors prefer that micro-interaction #8 be delivered by a human 3.2 times (158 divided by 49) more than micro-interaction #36.

Sources: Vanguard and Escalent, 2021.

One of the most discussed new trends in advice is what type of delivery millennials would prefer. Our research deduced that demographics are not an important factor when considering relative preference for delivery.

Contrary to popular belief, we do not find that millennials have distinct preferences that differ from other generations when it comes to automaton of service within advice. do not need to customise their offerings based on perceived generational differences.

Key points

The research findings represent good news for advice of all forms, because investors perceive substantial value across portfolio, financial and emotional outcomes.

Human-advised investors are substantially more likely to say they do not have the time, willingness or ability to manage their investments on their own. This finding supports framing an advice offer as a potential way for clients to free up time, leave behind an undesirable task and improve their portfolio, financial, and emotional outcomes.

Across all generations, wealth levels and advice-delivery types, clients suggest that human financial advisers should consider automation to outsource portfolio construction. This will allow advisers to scale technology to their entire client base. Investors also agree that human advisers excel in helping them achieve financial success and providing emotional peace of mind.

Advisers are not under threat from robo-services. Client loyalty to human advisers is durable, whilst investors choosing robo-services are open to selecting a human adviser in future.

Advisers should leverage both automation and upskilling about emotional needs of clients to optimise their value, scale their practice and target the unmet needs of current robo-advised clients who would be willing to switch their business in the future.

For further insight into emotional value as a significant component of the perceived value of financial advice, consult the value of personalised advice document.

Conclusion

We conducted a survey of 1,518 US investors to understand whether technology or digital advisers are a threat to human financial advisers.

We found that:

Digital services do not pose a threat to an adviser’s existing book of business as nine out of ten human-advised clients would not consider switching. The inverse was true for robo-advised clients, where 88% would consider switching to a human.

Human agents excel in all dimensions by providing an additional perceived 5% in returns, $160,000 in financial success towards goals, and three times the emotional support received by investors managing their investments on their own.

Investors prefer some portfolio management tasks to be automated.

Human advisers excel at delivering emotional outcomes.

Human advisers should leverage technology to scale their business whilst strengthening their uniquely human value proposition to address investors’ emotional needs.

Want to learn more? Read the research paper Quantifying the investor’s view on the value of human and robo-advice in full and view the complete appendix.

1 Kinniry et al., 2019. Putting a Value on your Value: Quantifying Vanguard Adviser's Alpha. Valley Forge, Pa.: The Vanguard Group.

If you have completed all content in the module, you are ready to take the quiz and collect your CPD

Ready to test your knowledge?

Take the quizOther Vanguard 365 pillars

Practice management

Tailored content to help you build your practice, market your services effectively and cultivate a thriving professional network.

Financial planning

CPD content structured to give you access to useful tools, guides and multimedia resources covering diverse topics from risk profiling to retirement planning.

Investment knowledge

CPD content formulated for you to explore in-depth insights on investment principles, portfolio construction and comprehensive product education to expand your technical knowledge.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Important information

This document is directed at professional investors and should not be distributed to or relied upon by retail investors.

This document is designed for use by, and is directed only at persons resident in the UK.

The information contained in this document is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this document does not constitute legal, tax, or investment advice. You must not, therefore, rely on the content of this document when making any investment decisions.

The information contained in this document is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued by Vanguard Asset Management Limited , which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2024 Vanguard Asset Management Limited. All rights reserved.