Financial wellbeing or how well a person, household or family manages the financial aspects of their life can play an important role in our overall sense of health and happiness.

Though some advisers may not call it financial wellbeing, the concept lies at the heart of financial planning. One of the key roles of advisers is to help clients make financial decisions that will enable them to meet their goals. But to meet those goals, clients first need to be able to allocate their budgets to pay current bills, tackle debt, prepare for unexpected circumstances and invest to achieve goals.

By encouraging clients to practise good money habits, set appropriate goals and maintain the discipline to achieve those goals, advisers can help them to cultivate a feeling of financial wellbeing. Achieving financial wellbeing is one thing; maintaining it is another. For most people, the path to feeling financially resilient and confident is an ongoing process which involves staying on top of their finances both now and in the future.

In many ways, financial advice has always had an element of wellbeing, in terms of empowering clients to create, protect and grow their wealth, which in turn can improve their overall quality of life.

Financial wellbeing is unique to each of us. What may help one client to feel financially well may not work for another. Our sense of financial wellbeing will depend on our own personal circumstances, as well as our financial needs and aspirations.

What is common to many clients, however, is that money can be a significant cause of stress. Further, there are some key checkpoints on the road to financial wellbeing that we all tend to pass. Discussing financial planning through a lens of enhancing a client’s wellbeing can underline the value that the adviser brings to the journey. This is especially true when speaking to prospective clients who may not have consulted a financial adviser before.

Discussing financial wellbeing with clients who have already achieved financial independence or are well on their way to it can also be valuable because this can hold the key to building the same sense of security in younger generations. In this way, the concept can help advisers to capture intergenerational wealth opportunities and instil in younger generations the importance of financial planning.

1. Help clients to take control of their finances

The first checkpoint is an assessment of the client’s current situation. A focus on broader financial wellbeing to help clients feel in control is always important – but it is particularly so during challenging economic and market environments, 'such as the cost-of-living crisis'. With the cost of living high, many clients may feel like they are losing control, but your relationship with them could be a key way of helping them regain confidence.

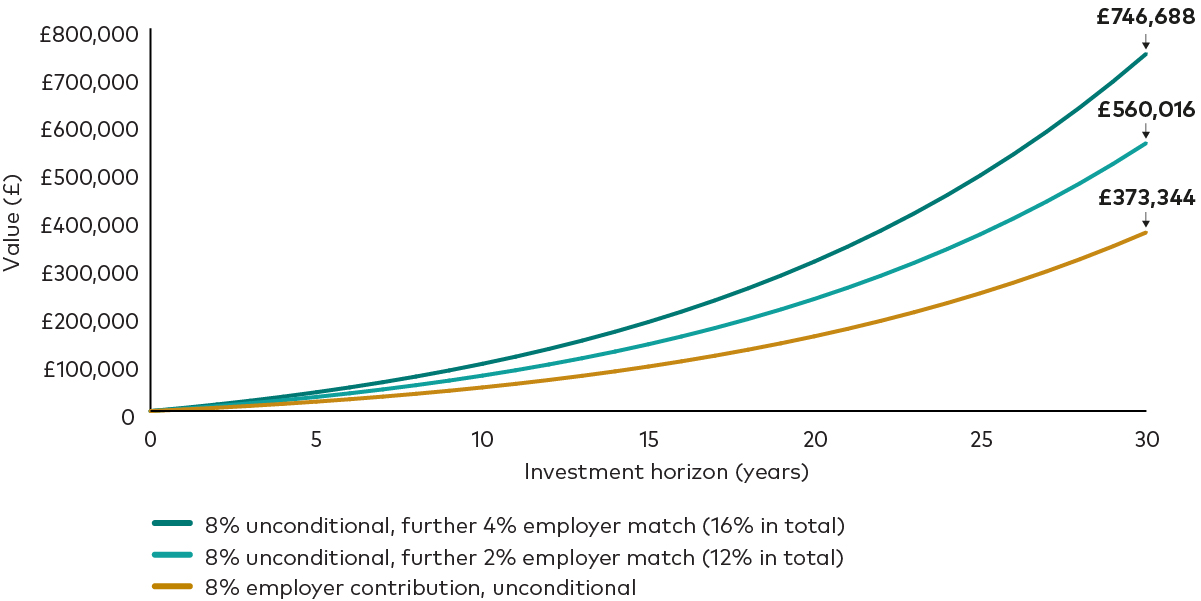

Could they use budgeting to get their finances under better control? Do they have debt and, if so, what type and at what rate of interest? Is there high-interest debt they would benefit from paying off early? Are they making full use of employment benefits, such as employer-matched pension contributions?

When trying to encourage a client to balance long-term goals such as saving for retirement against the more immediate needs such as servicing debt, it can help to focus on the long-term benefits.

Employer matching pay off

Source: Vanguard calculations. This hypothetical scenario is for illustration purposes only and doesn’t represent a particular investment or its expected returns. Assumes annual returns of 6% per annum, while monthly returns are assumed to be the geometric averages of these values. Input figures are based on an annual starting salary of £40,000 increasing at 3% per year, over a period of 30 years.

Helping clients take these actions can give them the financial flexibility to balance their current and future goals or expenses, which in turn builds financial confidence and freedom.

All clients have unique circumstances. But by helping their clients start down the path to financial wellbeing by taking a few small steps at a time, advisers can set them up for a more sustainable and successful financial future.

2. Enable clients to prepare for the unexpected

Financial resilience is about being able to meet unexpected expenses and protect against unanticipated life events. This starts with ensuring clients have sufficient cash and readily accessible investments for unexpected costs and income shocks.

Help your client to distinguish between one-off spending shocks – such as having to replace something – versus income shocks, which affect the amount they have coming in on a regular basis.

Maintaining emergency savings will help to give clients peace of mind and avoid taking out short-term high-cost debt. For one-off expenses, one rule of thumb is to keep the greater of £2,000 or half a month’s expenses in a bank account.

When it comes to an income shock, however, they may want to set more aside. While the rule of thumb of holding three to six months’ worth of expenses can be a reasonable starting point, a number of factors can affect clients’ liquidity needs. These can include their level and variability of income, number of dependents, job security and skill transferability.

Further, while assets held to cover income shocks need to be liquid or accessible at a minimal cost, that’s not to say they necessarily need to be free from market risks. For clients with sufficient risk tolerance, it can be useful to rely on accessible assets invested as appropriate for their other long-term financial goals.

Many factors can affect liquidity needs

Factor |

More liquidity needed |

Less liquidity needed |

Income |

Single |

Dual |

Dependents |

Yes |

No |

Income variability |

More |

Less |

Spending flexibility |

Low |

High |

Job security |

Less |

More |

Job skill transferability |

Highly specialised |

Generalised |

Insurance |

Less |

More |

Alternative financing |

Low borrowing ability |

Alternatives available |

Portfolio structure |

Exposure to market risks |

Cash |

Source: Vanguard.

3. Set clients up for the long term

After assisting them in getting their finances under control and building some financial resilience, advisers can help clients to think about their longer-term goals. These can include funding a comfortable retirement, paying for children’s education expenses and providing deposits for home purchases.

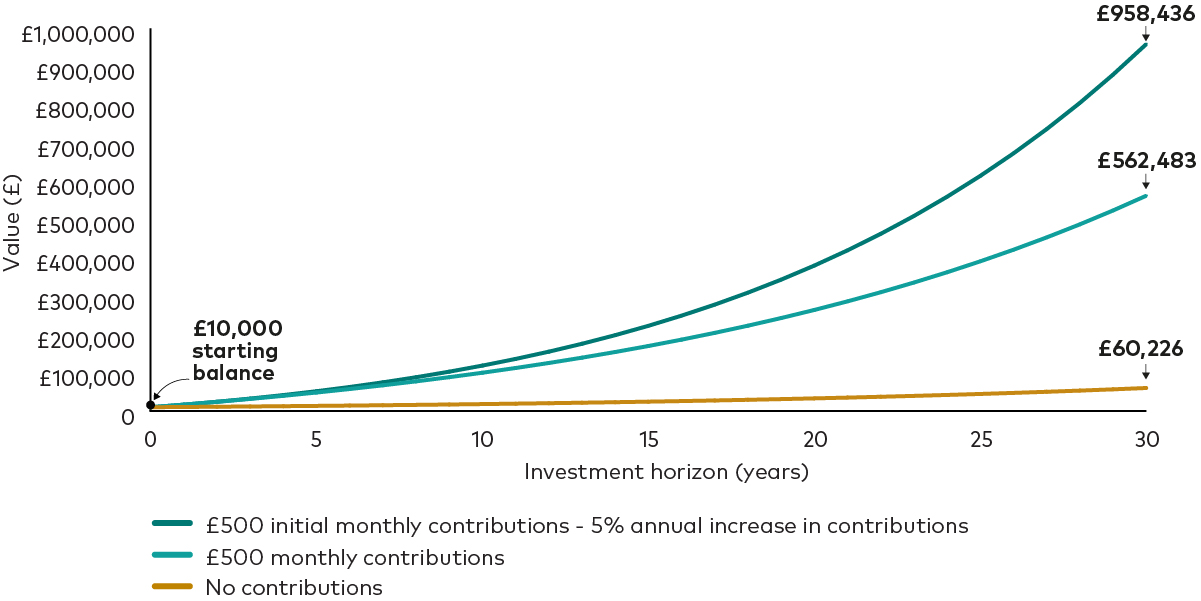

When encouraging clients to save for longer-term goals, explaining the power of compounding can help them understand that saving even a little in the early days of capital accumulation can make a big difference.

Talking points with clients around this checkpoint might include:

Increasing their savings rate and making the most of tax-advantaged accounts;

Using taxable and general accounts flexibly after exhausting tax advantages;

Considering whether paying off lower-interest debt works for them;

Establishing an efficient strategy for charitable giving, if that is one of their goals.

Invest more, get much more

Notes: This hypothetical scenario is for illustration purposes only and doesn’t represent a particular investment or its expected returns. It assumes annual returns of 6%, while monthly returns are assumed to be the geometric averages of these values. Contributions are monthly and are made at the end of each period. Balances reflect the value at the end of each period. The chart doesn’t account for taxes and management or platform fees.

4. Help clients to pass it on

Some clients may want to use their wealth to make a positive impact on the people or organisations they care most about, and this can be hugely rewarding. By helping clients think through the benefits, timing and amount of gifts, advisers can guide clients to maximise the impact of their gifts. Not only can this make gifts go further – it can also benefit clients’ financial wellbeing.

Having constructive conversations about family wealth-transfer can also give clients comfort that their family and loved ones will be taken care of.

Key takeaways

The first step to financial wellbeing is to take stock of clients’ current situations and identify opportunities to get their finances more under control.

Instil financial resilience in clients so they are equipped to meet unexpected expenses and protect against unanticipated life events.

Set clients up for the long term by helping them increase their investment capacity and probability of meeting their goals.

Guide clients to make the most of the impact of their gifts.

If you have completed all content in the module, you are ready to take the quiz and collect your CPD

Ready to test your knowledge?

Take the quizOther Vanguard 365 pillars

Client relationships

CPD content crafted to empower you to service your clients' needs effectively, build relationships, create loyalty and achieve new business growth.

Practice management

CPD content designed to help you build your practice, market your services effectively and cultivate a thriving professional network.

Investment knowledge

CPD content formulated for you to explore in-depth insights on investment principles, portfolio construction and comprehensive product education to expand your technical knowledge.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Important information

This article is directed at professional investors and should not be distributed to or relied upon by retail investors.

This article is designed for use by – and is directed only at – persons resident in the UK.

The information contained in this article is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this article does not constitute legal, tax or investment advice. You must not, therefore, rely on the content of this article when making any investment decisions.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2024 Vanguard Asset Management Limited. All rights reserved.