At Vanguard, we recognise the value of good financial advice in helping investors achieve their financial goals. At the same time, we appreciate the pressures facing advisers today, with more demands and less time to manage complex and varied client needs. For example, the range of an adviser’s investment responsibilities may include:

Ongoing monitoring

Reviewing portfolios to ensure they stay in line with a client’s objectives.

Client communications

Clearly explaining the reasons for a portfolio’s performance when there are multiple factors involved.

Evaluating funds

Selecting new funds and identifying potential areas for concern.

Avoiding unintended consequences

For portfolios made up of multiple underlying funds from across many asset classes and sub-asset classes, understanding the portfolio’s exposures can be complicated. Using too many funds with similar exposures can lead to unintended risks or biases that can result from overweighting a country, sector, currency or style, for example.

Looking beyond returns

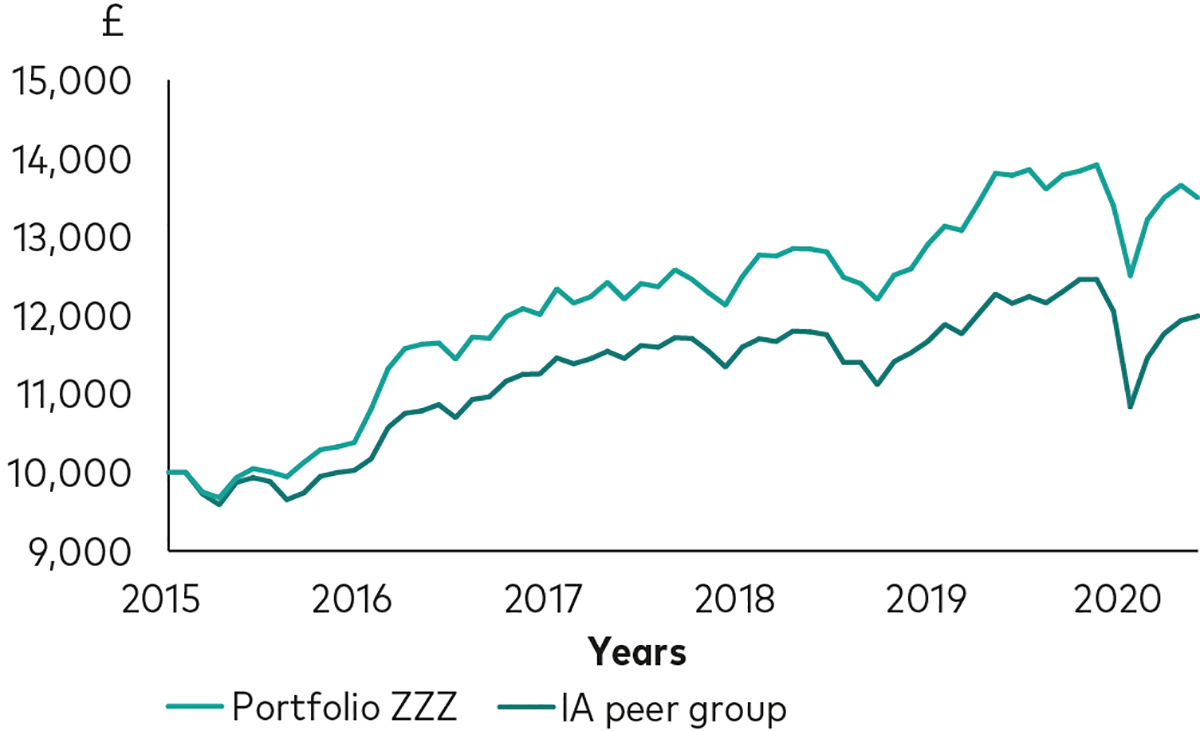

In order to demonstrate the potential risks or unintended consequences that can occur, we created a hypothetical client portfolio, Portfolio ZZZ. We then subjected it to the types of analysis our consultants use when evaluating a portfolio for back-tested returns, aggregate exposure, historical correlation and costs.

As we see below, the adviser may feel very positive about Portfolio ZZZ as it has outperformed the relevant peer group for a number of years. However, we all know that past performance is not an indicator of future returns, and in this case it does pay to dig a little deeper.

Past performance is not an indicator of future returns.

Source: Morningstar data, Vanguard calculations; 31 July 2015 to 31 July 2020.

Getting the balance right

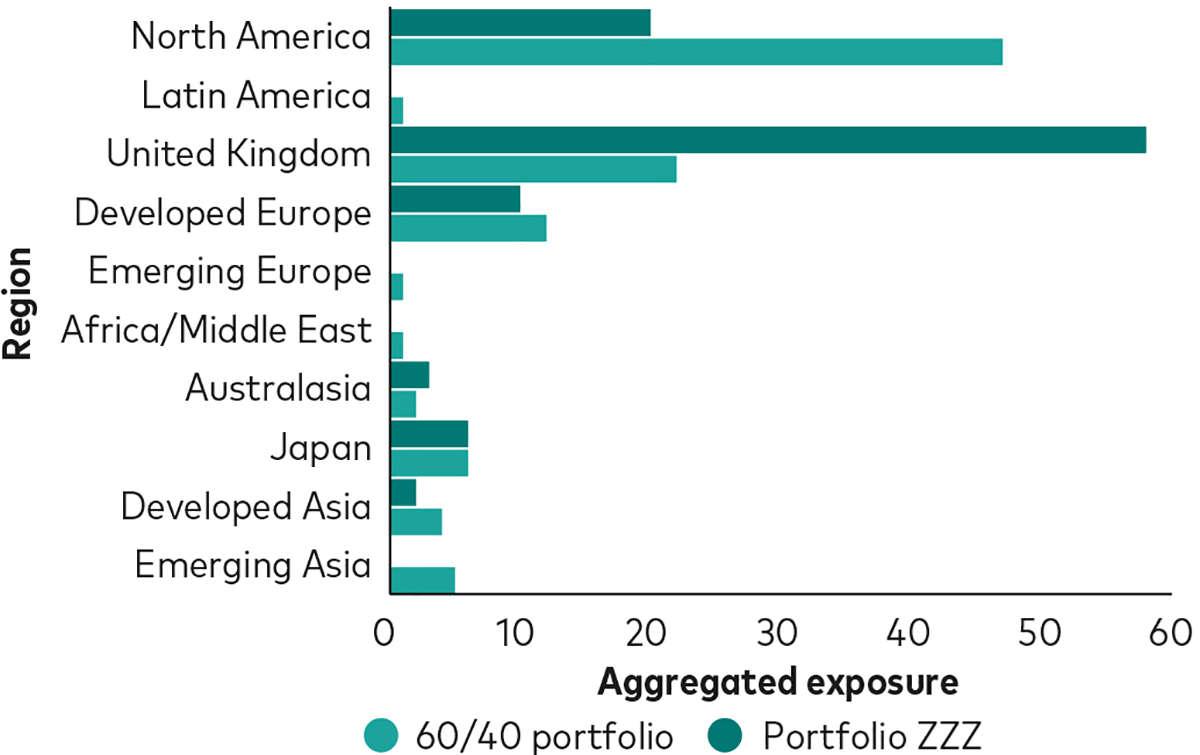

One of Vanguard’s core investment principles that runs through the management of all Vanguard funds and portfolios is the need for balance. This is because a well-diversified, balanced global portfolio allocated across equities and bonds from multiple countries and sectors can help to ride out the ups and downs of investment markets over the long term.

Going back to our hypothetical example of Portfolio ZZZ, we can see how our portfolio analytics consultants can provide insight into a portfolio’s overall exposure, whether that’s to different regions, styles, company sizes and sectors within the equity sleeve, or to different credit qualities and durations in the fixed income investments. In this example we can see a very clear overweight to the UK at the expense of the US; does this represent a conscious decision by the adviser, or is it an indication of an unintended bias?

Aggregated exposure of Portfolio ZZZ versus a 60/40 multi-asset portfolio

Source: Morningstar data, Vanguard calculations as at 31 July 2020.

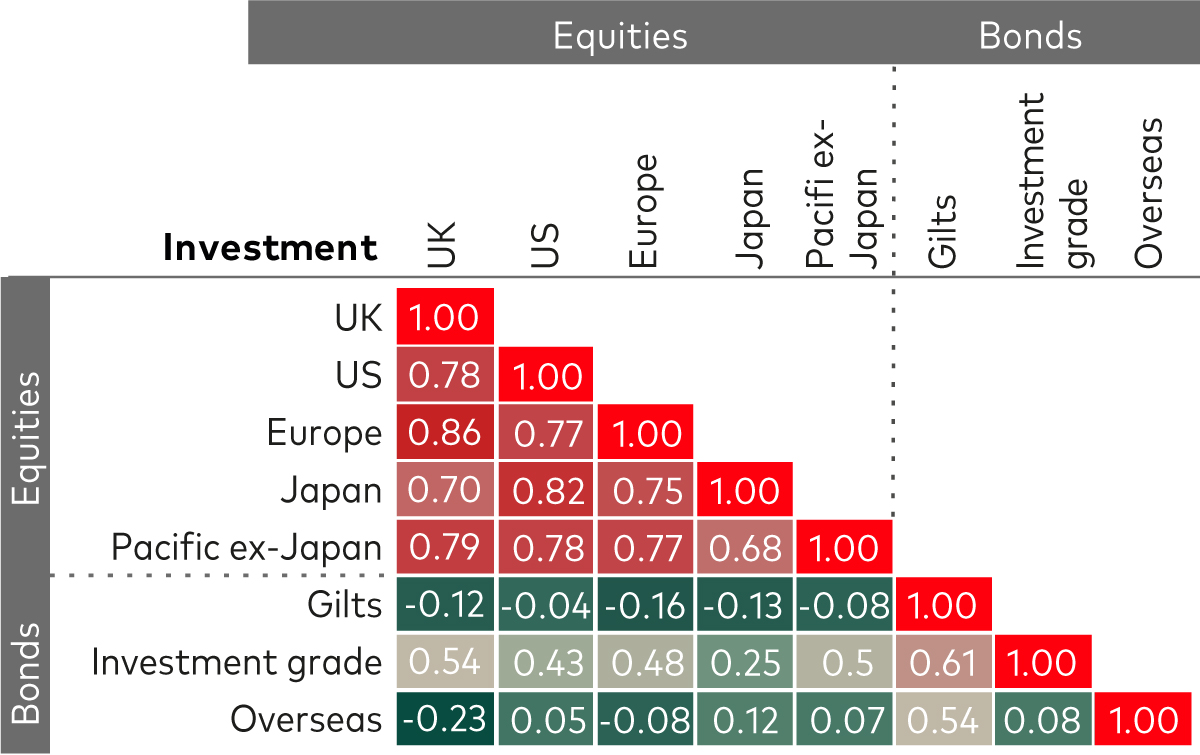

Taking the analysis further, Vanguard’s Portfolio Analytics & Consulting team can also dive deeper into the underlying funds to better understand the correlation and diversification benefits they bring to a portfolio. This kind of analysis can illustrate how well diversified the portfolio is, and where it might make sense to make adjustments. The matrix below shows the return correlations between the different components of the portfolio. As shown by the bottom left part of the matrix, the return correlations between the equities and bonds sleeves of the portfolio might not be as low as some investors would expect in order to give them the diversification properties they are looking for.

Source: Morningstar data, Vanguard calculations; 31 July 2015 to 31 July 2020.

Correlations shown are for funds within an illustrative client portfolio.

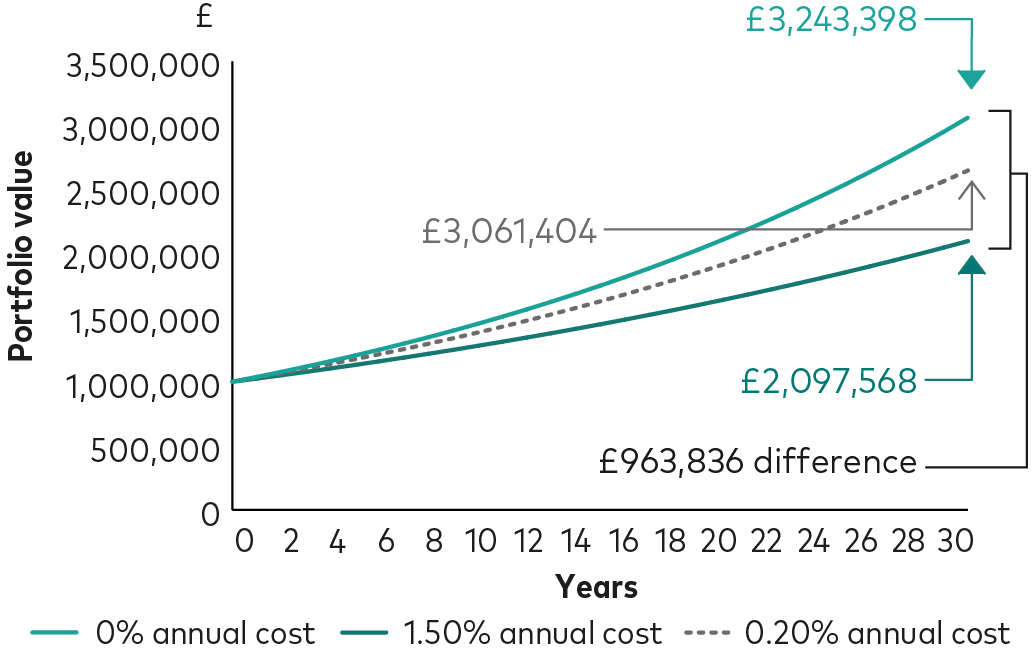

Costs matter

Another core principle that unites all Vanguard funds and portfolios is the importance of keeping costs low, because high investment costs reduce the returns that investors get to keep for themselves over the long term. This is why cost efficiency is a key part of our analysis when looking at any portfolio for an adviser.

The hypothetical example below assumes an initial investment of £1,000,000 is held over 30 years at a 4% annual rate of return, reinvested. Over 30 years, the difference between a 0.20% and 1.50% cost on returns is stark: paying 1.3 percentage points less in portfolio fees can improve portfolio returns over 30 years by almost £1 million.

Source: Vanguard.

Building lasting client relationships

By taking the time to really understand the dynamics of a portfolio, advisers can easily see how they can better position their clients’ portfolios for long-term returns in line with their risk tolerances and goals. It can also aid client conversations considerably, enhancing trust and serving to cement positive adviser/client relationships that last long into the future.

How our portfolio analysts can help

Our Portfolio Analytics & Consulting service is a free resource, independent of our product offering, to help advisers build and enhance client portfolios while giving you more time back to focus on strengthening client relationships and other high-value tasks.

The Portfolio Analytics & Consulting team’s focus is to help advisers identify potential improvements in a portfolio. For example, they may highlight the opportunity to simplify and consolidate investments, reduce costs, tilt the portfolio in line with the client’s investment beliefs or improve diversification and reduce risks.

The benefits of the service include:

A holistic overview of client portfolios to identify tilts, biases, gaps and concentrations.

Back-tested portfolio performance versus an investable, market-capitalisation index-based benchmark.

Correlation analysis of underlying investments.

Time back to focus on strengthening client relationships.

If you have completed all content in the module, you are ready to take the quiz and collect your CPD

Ready to test your knowledge?

Take the quizOther Vanguard 365 pillars

Client relationships

CPD content crafted to empower you to service your client’s needs effectively, build relationships, create loyalty and achieve new business growth.

Practice management

CPD content designed to help you build your practice, market your services effectively and cultivate a thriving professional network.

Financial planning

CPD content structured to give you access to useful tools, guides and multimedia resources covering diverse topics from risk profiling to retirement planning.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Important information

This article is designed for use by, and is directed only at persons resident in the UK.

The information contained in this article is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this document does not constitute legal, tax, or investment advice. You must not, therefore, rely on the content of this article when making any investment decisions.

The information contained in this article is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

© 2025 Vanguard Asset Management, Limited. All rights reserved.

Vanguard Asset Management, Limited is authorised and regulated in the UK by the Financial Conduct Authority.