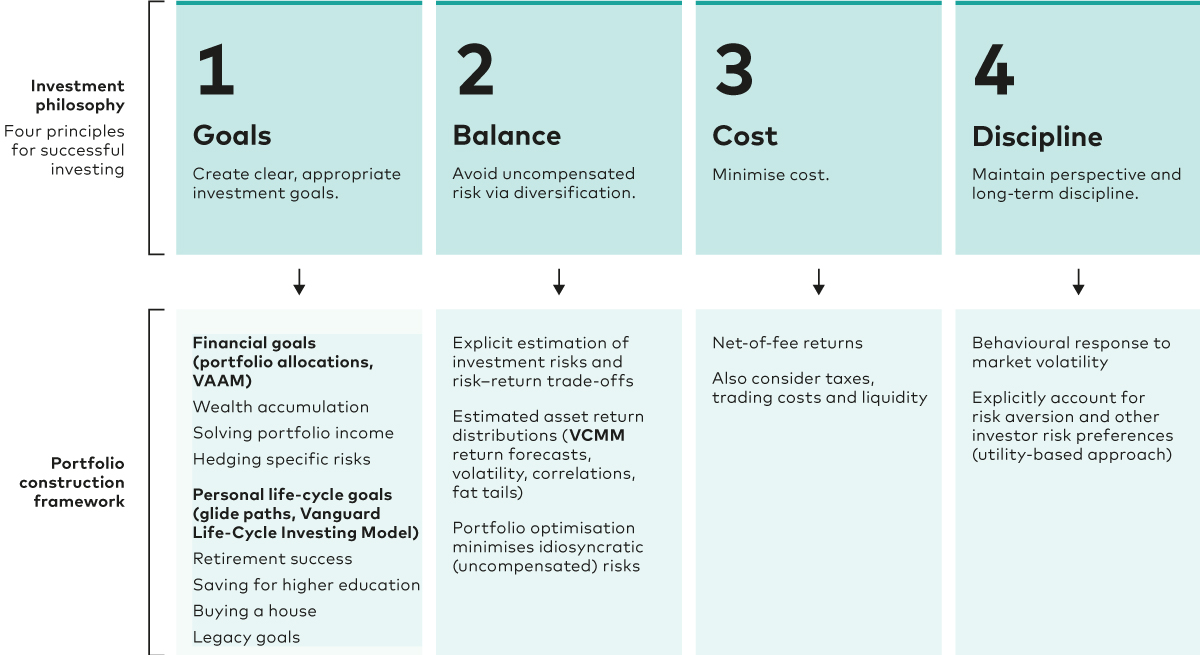

Vanguard has developed a set of investment principles that we believe are important to long-term investment success. Those are: having clear and appropriate investment goals, developing a suitable asset allocation using broadly diversified funds (in other words, balance), minimising costs and maintaining perspective and long-term discipline.

Vanguard’s Principles for Investment Success are foundational and can manifest in a variety of ways. They are not intended to prescribe a one-size-fits-all portfolio, but rather are core tenets that should underlie the different portfolio approaches.

The portfolio construction framework presented in this paper seeks to implement these core principles into practical portfolio construction decision-making that can underpin a wide variety of investor goals, risk profiles and investments, and enable investors to make choices in a rigorous and internally consistent way.

Vanguard's investment principles

Source: Vanguard.

Having clearly defined goals is the first step towards ensuring investment success through portfolio construction. Investment objectives fall broadly into two groups: personal life-cycle goals, such as retirement or higher-education funding, and broader financial goals, such as building wealth or achieving a certain portfolio income.

Balance underscores the importance of avoiding uncompensated portfolio risks through diversification. The portfolio construction framework fulfils this principle through a rigorous quantification of investment risks for all asset classes and investment strategies. This is achieved through asset return forecasts and simulation models, such as our proprietary Vanguard Capital Markets Model (VCMM), which captures all the distributional characteristics of the asset returns. The VCMM produces more than just asset return forecasts; it also provides volatility, correlation and other measures of investment uncertainty that play a critical role in portfolio construction.

A focus on cost encourages prudence about investment fees and other expenses that can compound over time. Our framework accommodates investment cost considerations via net (of fees) returns and can account for more advanced cost aspects such as taxes, trading expenses and the impact of liquidity in asset prices.

Finally, discipline centres on maintaining long-term perspective and avoiding emotional reactions, particularly during periods of market turmoil. A critical element in the framework is an investor’s attitude towards risk, known as investor risk aversion or, alternatively, risk tolerance. Accounting for various degrees of risk tolerance in our portfolio construction models can help investors better withstand periods of market volatility without abandoning the investment programme.

Tailoring portfolios to investor goals

At Vanguard, we believe market-capitalisation-weighted portfolios are the most efficient way to achieve market returns via diversified exposures at low cost.

A market-cap investment approach can also serve as a sound solution for multi-asset portfolios for investors who have a general wealth accumulation goal and are not inclined to bear additional investment risk beyond the broad equity and bond markets.

This methodology might be the right solution for millions of investors but it is not designed to address important portfolio construction questions that extend beyond core equity and bond betas.

These include consideration of active investing, ESG investing, portfolio income, inflation hedging and time-varying market conditions.

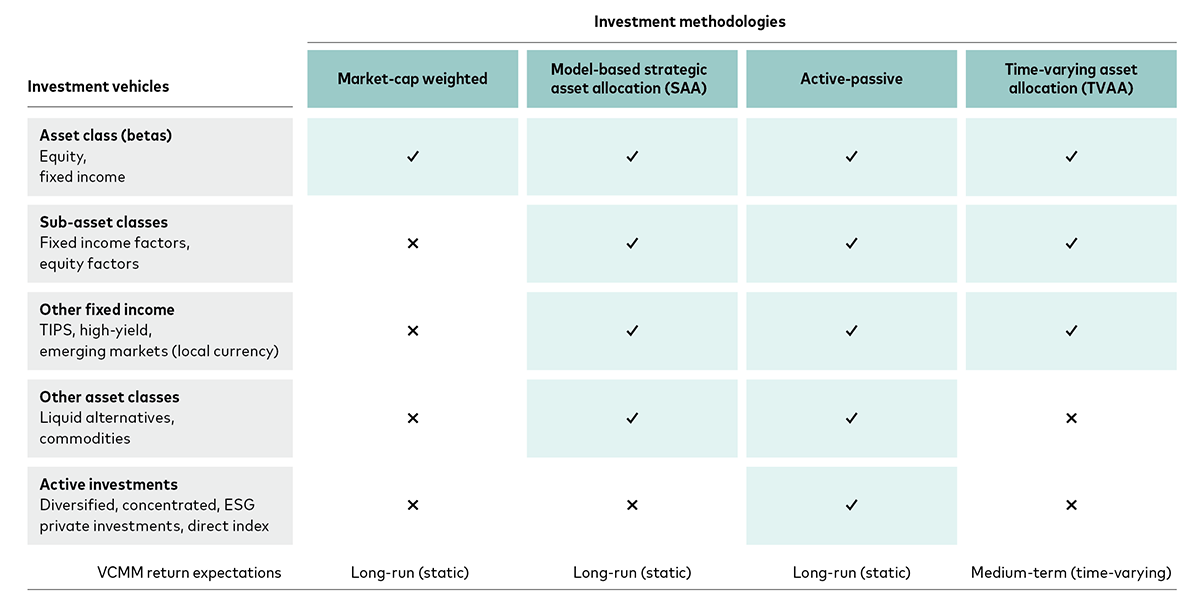

As shown below, for investors who need to go beyond the market-cap approach, there are three additional investment methodologies to consider. While these methodologies underpin Vanguard’s global portfolio construction framework, not all the portfolio solutions referenced are available in Europe.

A range of investment methodologies

Source: Vanguard.

Model-based strategic asset allocation

This methodology uses our proprietary models to combine broad betas with sub-asset class tilts, such as value equities, long-term government bonds or corporate credit indices. This methodology extends to asset classes that fall outside the realm of equity and bond betas, such as commodity futures, Treasury Inflation-Protected Securities, or TIPS (in the US), or high-yield bonds. These are model-based strategic portfolios because they require explicit expectations for sub-asset class returns, factor premia and associated factor risks, such as the ones derived from the VCMM. The second model used, the Vanguard Asset Allocation Model (VAAM), balances risk and return forecasts from the VCMM, along with factor risk and premia, to determine the optimal allocation (or portfolio weights).

Model-based strategic asset allocation (SAA) methodology may also be used to meet different objectives: for instance, when hedging specific investment risks such as inflation or targeting a certain portfolio duration. In those cases, the SAA portfolio derived from the VAAM may feature sub-asset class tilts aimed at improving the odds of meeting those risk hedging goals.

Active/passive methodology

The decision to take active risk is just another form of a risk/return trade-off in investing. Active investments offer the potential to outperform a given benchmark but also introduce the risk of underperformance. Vanguard’s Active-Passive Decision Framework1 involves explicitly quantifying expectations for both estimated outperformance (expected alpha) and active risk (tracking error and odds of underperforming the passive benchmark) and then weighing them against each other to tailor an active/passive mix, based on the investor’s risk tolerance. This methodology is built into the VAAM. It enables active/passive portfolio solutions for many flavours of active funds, from traditional active managers with different degrees of concentration to rules-based active exposures such as ESG.

Time-varying asset allocation

This methodology is similar to the model-based SAA approach but uses time-varying market return expectations from the VCMM instead of long-term static return projections. Achieving a desired target payout through changing market conditions is a common investment goal for institutional investors but can also be relevant for individual investment advice, model portfolios and multi-asset funds. The time-varying asset allocation (TVAA) methodology is appropriate for investors who are willing to take on active risk in the form of ‘model forecast risk’. For investors whose objectives and risk tolerances make it prudent to consider adjusting their asset allocations when market conditions materially change, the VAAM combined with time-varying VCMM asset returns provides a consistent and holistic way to analyse the trade-offs in time varying portfolio solutions.

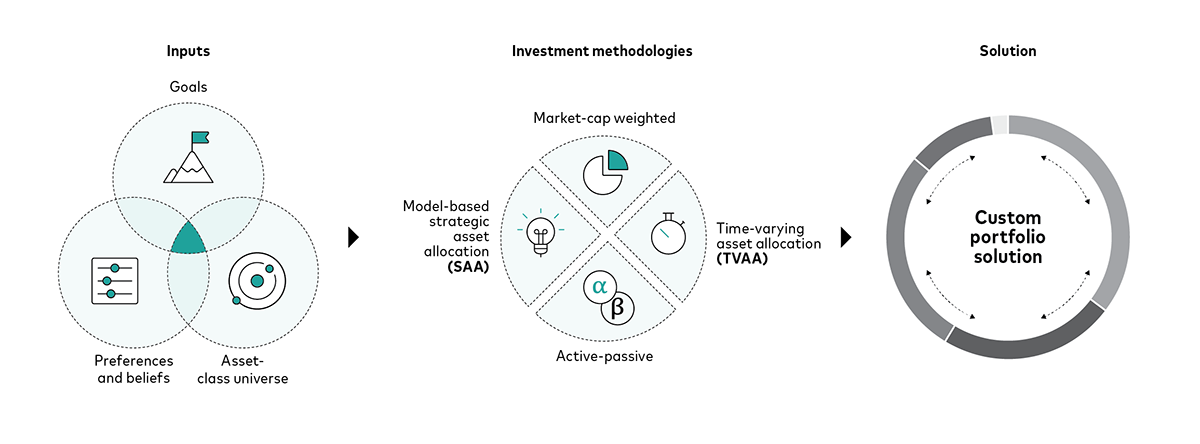

From investment methodologies to portfolio solutions

Arriving at a portfolio recommendation for an investor requires first defining the investor’s specific aim – common goals are wealth growth, risk hedging or a return target. As illustrated below, in pursuing their goals, investors may also wish to express certain investment preferences or beliefs. Examples include ESG preferences, conviction on a selected active manager, belief in a certain factor premium or time-varying asset return expectations.

Portfolio solutions depend on an investor's goals and preferences

Source: Vanguard.

Wealth growth goal

The most common investment goal for investors is wealth growth or wealth accumulation. Because this is the broadest type of investment objective, any of the four investment methodologies can be valid approaches. Investor preferences and beliefs play a critical role in arriving at the right choice.

The first portfolio solution for wealth growth is the market-cap-weighted portfolio. These portfolios follow our market-cap-weighted methodology, offering well-diversified broad exposures at low cost. They provide market-like returns with no potential for outperforming the market, but no risk of underperforming it either. Their simplicity can make them a great starting place for many investors with general wealth accumulation goals.

Portfolios other than the market-cap-weighted option rely on the remaining three investment methodologies: model-based SAA, active/passive and TVAA. These non-market-cap portfolios all require explicit asset return forecasts (from the VCMM) and asset allocation optimisation (from the VAAM). While the use of models introduces certain model risks, the benefits, in the form of robustness and personalisation of portfolio solutions, far outweigh those potential costs to investors. These models include (but are not limited to):

Traditional active-passive portfolios

Investors who prefer active management and are able to select skilled managers (either directly or through their professional consultants or advisers) may wish to adopt active-passive portfolios that combine their index investments with active funds. These portfolios allow the harvesting of potential alpha throughout time, while ensuring that the main asset allocation decision among stocks, bonds and other asset classes remains appropriate.

ESG portfolios

These seek to incorporate investors’ ESG preferences into the portfolio while preserving risk/return efficiency. ESG investments may or may not be expected to outperform their market-cap benchmark. Therefore, for ESG portfolios, the active/passive methodology needs to be adjusted to account for the role of ‘non-financial’ ESG motivations and the extent to which investors are willing to exchange financial outcomes for ESG objectives.

Time-varying portfolios

Vanguard time-varying portfolios differ from other industry tactical asset allocation (TAA) approaches that follow short-term tactical bets based on discretionary market calls. Vanguard’s TVAA methodology is model-based, which means that it’s a systematic and repeatable process, as opposed to being discretionary. The TVAA methodology is based on VCMM predictability of asset returns over the medium term (10-year forecasts), in contrast to the very short-term nature of most TAA approaches. Finally, our model-based time-varying framework carefully discounts model forecast risk in a holistic distributional setting (as opposed to relying on precise point forecasts).

Risk-hedging goal

For certain investors, risk hedging could be more important than seeking long-term wealth growth (which could be a secondary objective).

Inflation-hedging portfolios

These are strategic portfolios designed for inflation-hedging purposes. They seek to shelter investors from loss in real inflation-adjusted value. Inflation-hedging portfolios follow a model-based SAA methodology in combination with a minimum inflation beta constraint in the VAAM optimisation.

Duration target portfolios

Duration risk (also known as interest rate risk) refers to the return sensitivity of an asset or portfolio to movements in interest-rates. Portfolio duration risk can be managed by over- or underweighting different sectors of the fixed income market and possibly even limiting exposure to segments of the equity market more affected by interest rates, such as growth stocks. The resulting duration tilts in the portfolio are not designed for outperformance purposes. Duration-hedged portfolios follow a model-based SAA methodology in combination with a maximum portfolio duration constraint in the VAAM optimisation.

Return target goal

A third type of financial goal is a medium-term return target, which can be used, for example, to fulfil recurring spending needs.

Total return target portfolios

In this portfolio, a minimum expected return constraint is established in the VAAM asset allocation process, along with relaxing risk budget constraints. This is especially relevant in a low-return environment when additional risk and variation in allocation may be needed to meet the return target goal. However, the optimisation involved in the target return portfolio follows a cautious and efficient risk-taking approach in pursuit of that return target goal.

Income target portfolios

This variation of target return portfolios specifically targets portfolio income or yield over a long horizon. Because of the mental accounting behavioural bias in investing, many investors equate portfolio spending with portfolio income. By using the VAAM in combination with TVAA methodology, we impose a minimum income target but without ignoring the portfolio total return in optimising for risk/return efficiency. In this way, these portfolios offer a good compromise between high-income behavioural bias and overall portfolio efficiency.

Vanguard proprietary models for portfolio construction

Vanguard’s proprietary portfolio construction models are the quantitative foundation of Vanguard’s portfolio construction framework. Two models used in tandem are the VCMM, our simulation engine for asset return and risk forecasts, and the VAAM, our portfolio optimisation engine.

VCMM and the role of asset return expectations in portfolio construction

Asset return forecasts (or capital market assumptions) always play a critical role in portfolio construction, either implicitly or explicitly. In the case of ‘model-free’ portfolios such as the 60/40 market-cap-weighted portfolio, the asset return assumptions are implicit in the asset allocation recommendation. For model-based portfolios, the asset return forecasts are an explicit input in the asset allocation process.

The VCMM is our proprietary statistical engine for estimating asset-class expected returns, volatilities, correlations and other statistical distributional properties of asset returns.

Asset return distributions, not just asset return point forecasts, are the main output from the VCMM and the key input in portfolio construction. Since portfolio construction can be defined as the practice of investing amid uncertainty, it’s necessary to go beyond asset-return point forecasts in order to properly capture the role of uncertainty and the benefits of portfolio diversification. Thus, portfolio construction uses the full range of VCMM statistical return distributions, including return volatility and correlations, in addition to the long-term average (or expected) returns.

Important features of the VCMM return forecast include:

- A probabilistic or distributional framework.

- Reliance on key economic and market valuation forecasting signals proven to work better at medium- and long-term horizons. Short-term forecasting is extremely difficult and very inaccurate.

- The context that medium-term return projections are sensitive to initial conditions; over the medium term, expected returns depend on initial valuations such as price earnings ratios and interest rate levels.

- Reliance on forward-looking equilibrium assumptions for certain economic or market drivers, such as long-run inflation, productivity growth, currency trends and central bank neutral policy rates. The VCMM incorporates long-term forward-looking equilibrium views based on inputs from Vanguard’s global economics team.

- Allowance for non-normal distribution, featuring a higher probability of tail events than a normal distribution would suggest.

The VCMM can produce asset and sub-asset class return forecasts at different time horizons. Two sets of forecasts generally used in our portfolios are long-term forecasts (30 years or more) and medium-term forecasts (typically 10 years).

Long-term VCMM forecasts reflect equilibrium of the global capital markets (or steady-state returns), and thus those return expectations (and their bell curves) are essentially constant and don’t change over time (medium-term VCMM forecasts differ from their long-term counterparts in that return expectations may change over time, as market conditions change, making them time-varying.)

You can see the latest VCMM forecasts in our market commentary section.

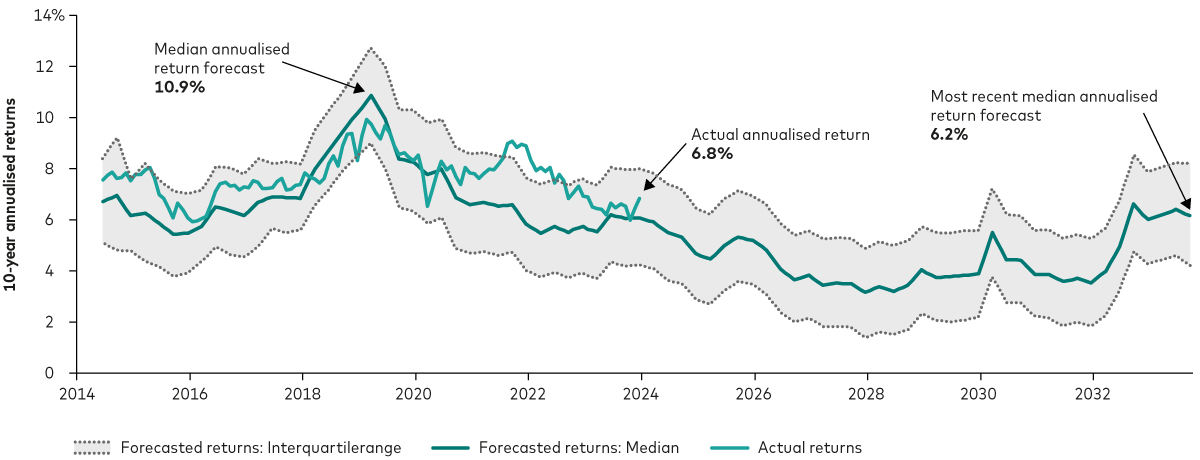

Time-varying expected returns and portfolio implications

Medium-term asset return forecasts (in other words, the full distribution of returns) can change with the market environment, such as periods of extreme equity market valuations, large and persistent shifts in interest rates or high-inflation regimes, to name a few market drivers. As discussed previously, for certain financial goals such as portfolio payout or income targets, it may be appropriate to consider time-varying asset return forecasts.

The figure below illustrates VCMM 10-year annualised return forecasts for a 60% stock/40% bond portfolio. Actual returns have largely fallen within the VCMM’s 25th–75th percentile range, showcasing the imperfect, yet reasonable, accuracy of the model. Importantly, neither the projections nor the actual returns for this portfolio have been constant over the last decade.

VCMM time-varying forecasts

Past performance is not a reliable indicator of future results. Any projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

Notes: This chart shows the actual 10-year annualised return of a 60/40 portfolio in GBP compared with the VCMM forecast made based on data available 10 years earlier. For example, the June 2014 data at the beginning of the chart show the actual return for the 10-year period between 30 June 2004 and 30 June 2014 (red line) compared with the 10-year return forecast made on 30 June 2004 (green line). After September 2023, the green line is extended to show how our forecasts made between 31 December 2013 and 30 September 2023 (ending between 31 December 2023 and 30 September 2033) are evolving. The interquartile range (green shaded area) represents the area between the 25th and 75th percentile of the return distribution. See the Appendix section for further details on asset classes.

*Source: *Refinitiv as at 31 December 2023 and Vanguard calculations in GBP, as at 30 September 2023.

IMPORTANT: The projections and other information generated by the VCMM regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Distribution of return outcomes from VCMM are derived from 10,000 simulations for each modelled asset class. Simulations are every quarter, between 30 June 2004 and 30 September 2023. Results from the model may vary with each use and over time.

VAAM and model-based portfolio construction

There are several dimensions to consider when constructing a portfolio around an investor’s financial goals: the type of financial goal, the assets to be considered, the investment horizon, asset return expectations and the investor’s appetite for financial risk.

Model-free approaches may yield very reasonable portfolios when no more than two or three asset classes are considered. However, for more complex portfolios with numerous asset and sub-asset classes, the simpler mental maths of the model-free portfolio gives way to more complex accounting, and it becomes necessary to rely on a model that can keep track of multiple estimates for average returns, volatilities and their correlations.

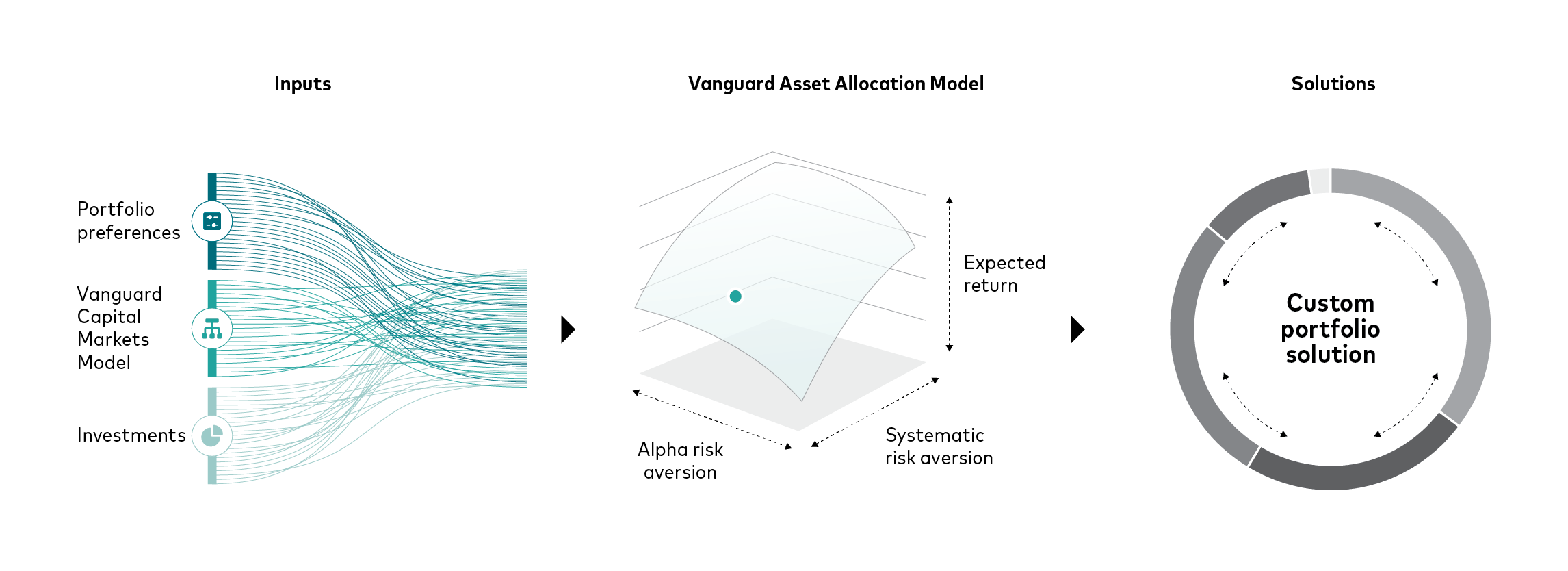

To account for all these dimensions simultaneously in portfolio optimisation, Vanguard’s investment strategy group has created an asset allocation engine called the Vanguard Asset Allocation Model. This model uses a utility-driven representation of investor outcomes to maximise investors’ chances of achieving their financial goals, conditional on their risk tolerance.

One of the main benefits of a utility-based approach is that it explicitly takes into account investors’ tolerance for risk, including different types of risk, such as active manager risk, factor risk and illiquidity risk. The VAAM is constructed to simultaneously optimise asset allocation solutions among key elements – asset class, sub-asset class and active investments. This way, the VAAM can implement both model-based SAA and active/passive methodologies. Additionally, by using the VCMM time-varying forecasts over medium-term horizons, the VAAM can also accomplish TVAA methodologies.

The figure below illustrates how the VAAM embodies the overall portfolio construction process. The process begins with establishing an investor goal, along with its corresponding investment horizon, investor preferences and risk tolerances. Next, the set of eligible investments is defined, and can include asset classes, sub-asset classes including factors and actively managed products. Distributions of asset returns from the VCMM are an input for each eligible asset. VCMM distributions include asset return volatility, and correlations, in addition to return expectations. The VAAM is then able to weigh the trade-offs between the potential benefits and risks of each investment while considering the investor’s risk tolerance via the utility-driven optimisation.

VAAM-based portfolio construction process

Source: Vanguard.

There are four key benefits to using the VAAM. First, by directly leveraging VCMM simulations, the VAAM inherits some important VCMM features, such as sensitivity to current market conditions, forward-looking capital market equilibrium assumptions, non-normal distributions and important linkages between asset returns and macroeconomic fundamentals.

Second, the model codifies Vanguard’s portfolio construction framework into a digital technology platform. This allows for full customisation of portfolios to specific client financial goals and needs, while at the same time enabling scalability and ensuring consistency of the underlying investment methodology across the different portfolio solutions.

Third, from a portfolio due-diligence perspective, using the VAAM injects more transparency into the portfolio construction process. This added transparency leads to more straightforward oversight and review processes for portfolio recommendations. After all, the model’s methodological underpinnings are based on well-established theories in the academic literature on portfolio choice and household finance.

Fourth, the VAAM forces investors to think through many decisions that they may otherwise make in a subconscious or implicit way if they are selecting portfolio allocations in an ad hoc manner. The input requirements in the VAAM enable a conversation between investors and advisers about the conscious and explicit choices that must be made and that are critical to the portfolio. These topics include setting realistic alpha expectations for the active strategies under consideration, selecting the best estimates for the associated alpha risk and even reconsidering the investor’s own risk aversion.

Key takeaways

There are different portfolio solutions for specific investor goals and preferences.

Vanguard’s portfolio construction framework consists of investment methodologies and portfolio tools to help investors tackle a variety of important portfolio construction decisions.

The framework has been ‘codified’ into proprietary models such as the Vanguard Capital Markets Model and the Vanguard Asset Allocation Model.

The framework is at the core of Vanguard’s investment advice methodology, global model portfolios and funds-of-funds multi-asset portfolios.

To read more about VCMM forecasts, visit our market commentary page. To learn more about outsourced model portfolio solutions, visit our model portfolio solutions pages.

1 Making the Implicit Explicit: A Framework for the Active-Passive Decision, The Vanguard Group, Wallick, Daniel W, Brian R Wimmer, Christos Tasopoulos, James Balsamo and Joshua M Hirt, 2017.

This is a summary of Vanguard’s Portfolio Construction Framework: From Investing Principles to Custom Portfolio Solutions by Roger A Aliaga-Díaz PhD, Harshdeep Ahluwalia MSc, Giulio Renzi-Ricci MSc, Todd Schlanger CFA, Victor Zhu CFA, CAIA, and Carole Okigbo. Published in 2022.

IMPORTANT: The projections or other information generated by the Vanguard Capital Markets Model® regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time. The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More importantly, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The Vanguard Capital Markets Model® is a proprietary financial simulation tool developed and maintained by Vanguard’s primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include US and international equity markets, several maturities of the US Treasury and corporate fixed income markets, international fixed income markets, US money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.

If you have completed all content in the module, you are ready to take the quiz and collect your CPD

Ready to test your knowledge?

Take the quizOther Vanguard 365 pillars

Client relationships

CPD content crafted to empower you to service your client’s needs effectively, build relationships, create loyalty and achieve new business growth.

Practice management

CPD content designed to help you build your practice, market your services effectively and cultivate a thriving professional network.

Financial planning

CPD content structured to give you access to useful tools, guides and multimedia resources covering diverse topics from risk profiling to retirement planning.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Important information

This article is designed for use by, and is directed only at persons resident in the UK.

The information contained in this article is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this document does not constitute legal, tax, or investment advice. You must not, therefore, rely on the content of this article when making any investment decisions.

The information contained in this article is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

© 2025 Vanguard Asset Management, Limited. All rights reserved.

Vanguard Asset Management, Limited is authorised and regulated in the UK by the Financial Conduct Authority.