How to build trust

How do you gain – and maintain – client confidence? This video provides methods and strategies to put into practice with your clients.

Successful practices that have built high levels of customer loyalty ensure their promises to clients never exceed their capacity to deliver.

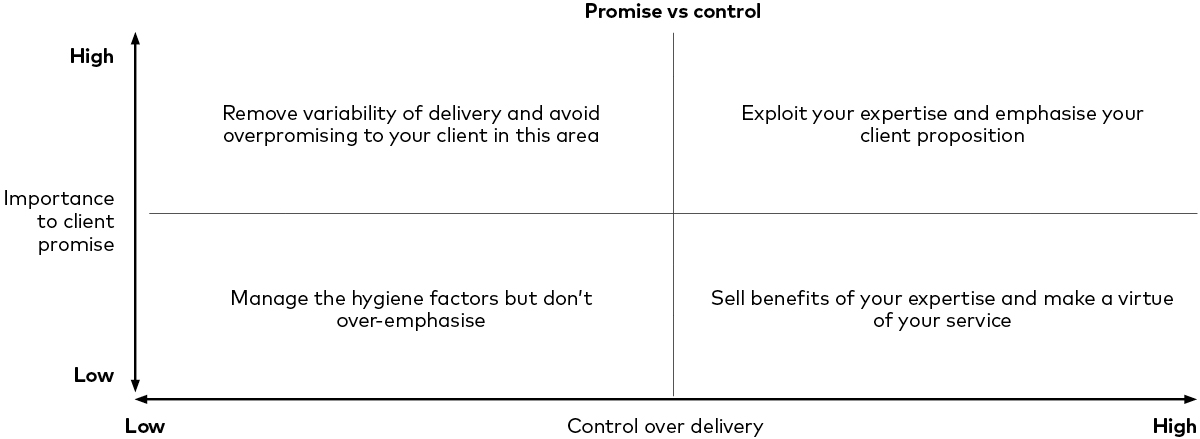

In situations where a task is important to the client but low on the firm’s capability, firms sometimes seek to remove the variability of the outcome by outsourcing. Outsourcing to somebody else to deliver your promise is a significant step, but as the rise in multi-asset funds and model portfolios shows us, advisers are increasingly outsourcing investments to focus their efforts where they add most value: in the client relationship. Where the firm has a high degree of skill or knowledge in the practice, this should be leveraged in the client offering as it is an aspect that can easily be controlled.

Consider the key deliverables from your firm and plot them on the graph below.

Delivering on your promise requires engagement from your workforce:

Ensure you have staff who are organised and incentivised to deliver.

A systematic approach is vital to achieving a consistent outcome. Redistribute staff and tasks as necessary to ensure that the promised outcomes are delivered.

Teamwork is essential.

Everyone should understand the critical role they play; recognise and reward staff who are focused on fulfilling the client promise.

Where you can, automate a low-value task so that your team can focus on delivering value.

Putting together a compelling promise that clients will be delighted to pay for is not an easy task. It takes considerable understanding of your target market alongside successfully setting out what sets you apart from the crowd. What makes you different?

Be authentic, honest and sincere about your capabilities and what you can do for your client. Conversely, it is also good practice to spell out what you don’t or can’t do.

You can use the following metrics to help describe what your clients can expect from you:

Quality: what can you do better (than the client themselves or another adviser) for the client?

Quantity: of what can you deliver more (e.g. plan updates), or less (e.g. admin)?

Cost: what can you offer more cost effectively to the client?

Time: what can you do faster for the client?

When you have worked out the benefits to the client, thread these through your client interactions and reinforce them at each opportunity – for example, on correspondence or during client reviews.

It may also be useful to complete a client value proposition checklist to help define what are the most important things you can and must do for your clients. An example of this is as follows:

Example of a client value proposition checklist:

Have you identified your target client segments? Describe them.

For each segment, do you understand why those clients use the services of others ?

Do you understand why those clients don’t buy your type of service?

Do you understand what troubles your target clients (quality, quantity, cost and time issues)?

Do you understand what your client is looking for (quality, quantity, cost and time)?

Do you understand the risk to your client of choosing you?

Have you captured and articulated your firms’ core values? What are they? How are they seen in action?

Have you identified the specific parts of the service you are offering your client? What are they?

If you are promising these to your client, have you confirmed you are in complete control of the delivery?

If you are not in complete control, how certain of your suppliers are you?

Have you linked your services to your clients’ needs? What are the benefits of your services to your specific client?

Have you checked the competitiveness of your offering (quality, quantity, cost, time) against your Competitors?

Are you able to provide evidence of your success in the things you offer (e.g. client, citations, awards)?

Have you identified your key differentiating messages? Are these threaded through your communication? Are they used consistently by all of your people?

Have you checked that what you want your clients to hear is what they actually hear?

With a well-defined and compelling client promise, you can look to ensure you keep those promises by systematising and automating your processes.

The best advisory businesses have learned how to automate a personal approach. The systems and processes of your business should also be optimised to ensure effortless delivery of your promise. Automate any highly repetitive, but vital, processes whenever possible and save human interaction for the value-adding personal aspects of the client relationship. Take a look at our piece on Human vs Digital for more on this subject.

To successfully build trust with your clients you will need to promise within your capacity and capability, work with a competent and motivated team and engage systems and processes to enable efficient and effective delivery.

Client value proposition checklist

Use this checklist as a tool for you to use to ensure that your company’s CVP effectively communicates the unique benefits and value that you offer to your clients.

If you have completed all content in the module, you are ready to take the quiz and collect your CPD

Ready to test your knowledge?

Take the quizCPD content crafted to empower you to service your client’s needs effectively, build relationships, create loyalty and achieve new business growth.

CPD content structured to give you access to useful tools, guides and multimedia resources covering diverse topics from risk profiling to retirement planning.

CPD content formulated for you to explore in-depth insights on investment principles, portfolio construction and comprehensive product education to expand your technical knowledge.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Important information

This article is designed for use by, and is directed only at persons resident in the UK.

The information contained in this article is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this document does not constitute legal, tax, or investment advice. You must not, therefore, rely on the content of this article when making any investment decisions.

The information contained in this article is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

© 2025 Vanguard Asset Management, Limited. All rights reserved.

Vanguard Asset Management, Limited is authorised and regulated in the UK by the Financial Conduct Authority.