- Chinese companies, especially state-owned enterprises in the financials and energy sectors, propelled payout growth in Q3 along with North American firms.

- China’s strong showing countered the overall weakness of emerging markets ex-China, where tech and industrials companies led declines.

- Against this backdrop, we continue to see a case for broad exposure to dividends as a way to enhance total returns and diversify portfolios.

Pockets of strength lead to further year-on-year dividend growth

In Q3, dividend distributions globally rose 5.1% year on year (y/y) to $583 billion, with 12-month payouts expanding 7.5% y/y to $2.1 trillion1. Accelerating global payouts were underpinned by pockets of strength in certain regions and industries, coupled with Australian mining groups, which showed signs of renewed financial confidence.

China and North America contributed $15 billion each to Q3 payout growth y/y. In contrast, we saw lacklustre contributions from the rest of the world, which as a group made $2 billion of cuts from payouts globally, resulting in a net global increase of $28 billion y/y.

Stocks from Taiwan featured prominently in the round of payout reductions we saw in Q3 across emerging markets ex-China. The sharpest cuts came from technology and industrials firms, amounting to -$5 billion and -$7 billion y/y, respectively. The reduction of distributions overwhelmed bumper payouts from select bellwether stocks in the region, notably TSMC (Taiwan) and Infosys (India). If not for the strong contributions from US stocks, technology would have been among the most notable industries slashing dividends.

Consumer stocks propelled China’s strong showing, helped notably by large payouts from BYD and a special dividend from Alibaba. In North America, technology, telecommunications and health care companies contributed $5 billion (or about one third) of the payout growth.

China’s major state-owned enterprises accounted for some of the largest dollar payouts in Q3, thanks to sizeable annual distributions by banks, including China Construction Bank, Bank of China and ICBC (Agricultural Bank of China—another large bank in the country—paid its annual dividend in Q2). We also saw large semiannual payouts from China’s oil majors, including Sinopec (China Petroleum & Chemical Corp) and PetroChina.

Outside of the Chinese financials and energy sectors, Alibaba’s $4 billion payout in Q3 stands out as the largest in the consumer discretionary sector, thanks to its special dividend ($0.08 per share) topping up the regular quarterly dividend ($0.13 per share). Aramco retains its spot as the world’s largest dividend payer, distributing $31 billion in Q3 ($20 billion base plus $11 billion performance-linked). Emerging markets (including China) paid a total of $294 billion in dividends during Q3, or 50% of the global total.

Australian miner BHP Group’s 3 October payment date, for the second distribution in 2024, was a departure from the usual September month-end schedule of final semi-annual distributions (including last year’s payout of $4 billion). This backloading by BHP caused the steep year-on-year fall of payouts by basic materials payers in Q3 and, as base effects roll over, a subsequent jump is expected in Q4. Nonetheless, basic materials firms’ payouts globally reversed the slump in the seasonally adjusted trend growth, coming off the post-pandemic low in Q2 (-28% y/y).

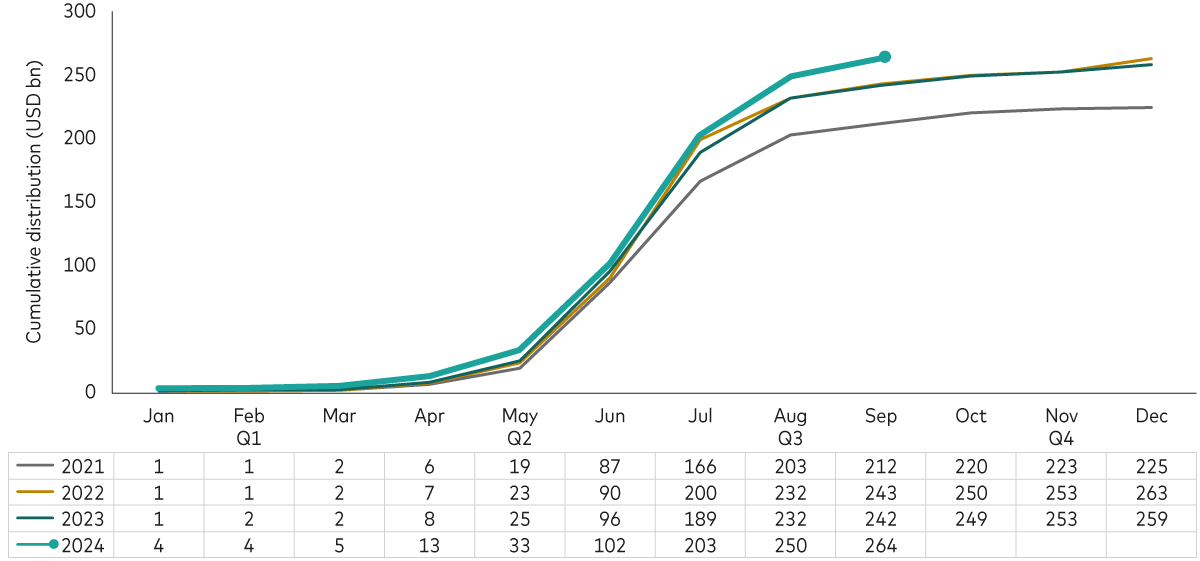

China’s cumulative payouts show continued growth in 2024

Past performance is not a reliable indicator of future returns.

Source: FactSet, Vanguard. Data as of 30 September 2024 and based on FTSE All-World Index constituents.

A look ahead

As Japan and emerging markets (ex-China) will feature heavily in Q4 payouts, all eyes will be on the impact of the yen’s sharp devaluation on dollar distributions by Japanese stocks. In addition, investors should also monitor how well emerging market sectors such as consumer discretionary, industrials and basic materials are coping with China’s ongoing domestic woes.

The case for dividends

We previously laid out the case for investing in dividends given the market landscape. Importantly, following strong performance from growth equities, we believe investors may want to diversify their core beta holdings with dividend exposure. In addition, dividends can afford portfolios a buffer against inflation and recession, which could help in the face of uncertainty. Exposure to global dividends, in particular, can allow investors to counteract the seasonality of distributions while reducing the risk associated with relying on specific markets.

1 Source: FactSet, Vanguard. Data as of 30 September 2024 and based on FTSE All-World Index constituents.

Related funds

Vanguard’s 2025 economic and market outlook

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Past performance is not a reliable indicator of future results. The performance data does not take account of the commissions and costs incurred in the issue and redemption of shares.

Important information

This is a marketing communication.

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

The information contained herein is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2024 Vanguard Group (Ireland) Limited. All rights reserved.

© 2024 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2024 Vanguard Asset Management, Limited. All rights reserved.