- The announcement of US tariffs has delivered one of the largest shocks we’ve seen in a century, resulting in significant market turbulence.

- With volatility likely to persist in the coming months, investors will need to find ways to provide ballast in their portfolios against turbulence and potential market downturns.

- Bond ETFs offer investors a way to add a buffer to their portfolios while also providing exposure that could benefit from a potentially supportive environment for fixed income returns.

US tariffs usher in period of uncertainty

On Wednesday, 2 April the US announced plans for broad-based tariffs that took financial markets by surprise. While we had expected tariffs from the US, based on the administration’s previous comments, the announced tariffs are higher and broader than anticipated.

We’re now in a period of heightened uncertainty. There will likely be ramifications in terms of spending, especially for consumers, as prices rise – perhaps resulting in stagflation (high inflation and slowing demand). Retaliatory tariffs could compound the challenges. While we expect to see negotiations on tariffs, the timeline is not clear. The combination of uncertainty, slowing growth, higher inflation and already-elevated US equity valuations leaves markets vulnerable.

In this environment, we could see further bouts of volatility as we wait for clarity on the path forward. Broadly diversified bond exposures are among investors’ most effective tools to insulate their portfolios and provide downside mitigation.

Bond exchange-traded funds (ETFs) as a portfolio shock absorber

Against this backdrop of heightened market volatility, it’s important to remember the role bonds can play in a portfolio context. Hedged global bonds, in particular, can provide a helpful illustration.

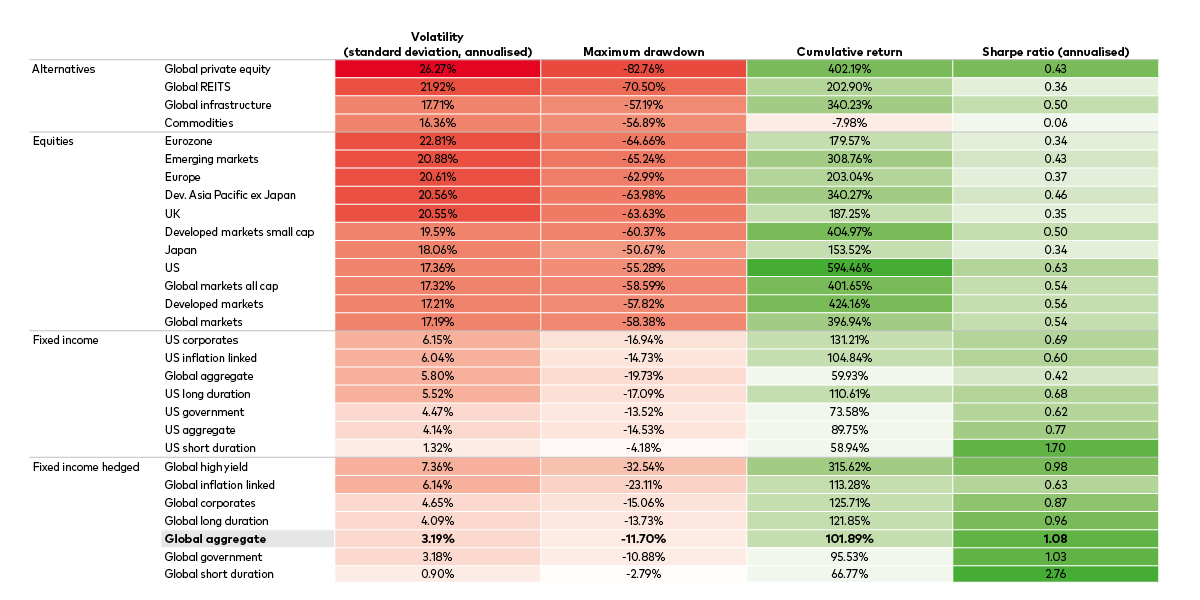

While fixed income exposures generally exhibit lower volatility than equities, hedged global bonds have consistently stood out from the pack. For example, in the past 20 years, hedged global bonds have had volatility of approximately 3% a year. This contrasts dramatically with the volatility of above 16% for equities and alternative exposures, as the table below shows.

This lower volatility is important given what it signifies with respect to drawdown protection. While equities have enjoyed higher absolute returns than bonds in recent years, the difference between the asset classes’ drawdown profiles is much more stark. For example, US and global equities have suffered declines of as much as -55% and -58%, respectively, over the past 20 years. For hedged global bonds, the maximum drawdown was -12%.

Hedged global bonds: An all-weather shock absorber

Asset classes ranked by volatility, 31 May 2004 to 31 December 2024

Past performance is not a reliable indicator for future results. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Source: Bloomberg, Vanguard. Data is for the period 31 May 2004 to 31 December 2024 and in USD2. Annualisation is based on weekly returns. The Sharpe ratio assumes a zero risk-free return.

For investors seeking ways to mitigate the risk of drawdowns on portfolios, the shock-dampening properties offered by hedged global bonds can be significant. From a risk-adjusted perspective, global hedged bonds have comfortably beaten most other asset classes—except for short-duration bond exposures—during the past 20 years3.

How Vanguard adds value when managing indexed fixed income ETF strategies

A common misconception is that the managers of index exposures follow a ‘set-it-and-forget-it’ approach.

In reality, managing fixed income index funds and ETFs requires a high degree of expertise. A clear illustration of the skill required, and which plays a key part in keeping investor costs low, are the sampling techniques that some index portfolio managers use. Holding every single constituent of a fixed income benchmark is often not possible, practicable or cost-effective for the fund manager tasked with tracking the index. Through sampling, portfolio managers aim to match the characteristics and the performance of the benchmark index without incurring unnecessary transaction costs, which can erode long-term returns.

For index ETFs, the primary objective is to track the performance of a benchmark with as little tracking error as possible.

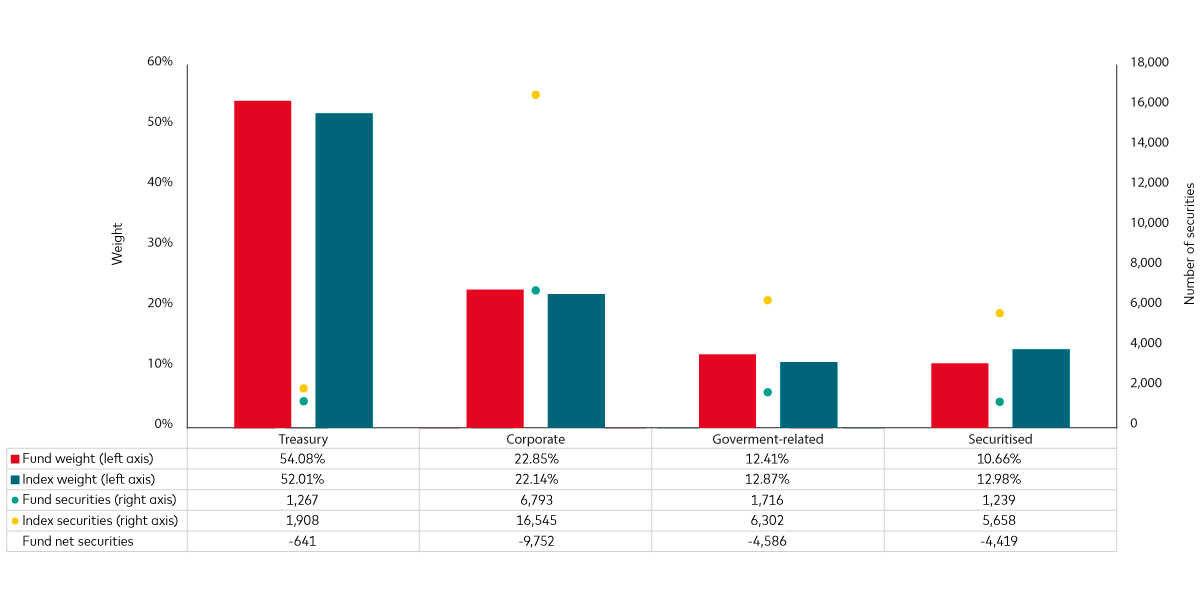

The global bond universe, which comprises tens of thousands of individual fixed income securities, is a case in point. When Vanguard’s portfolio managers aim to replicate the Bloomberg Global Aggregate Float Adjusted and Scaled Index, they hold around one third of the constituents from the 30,000+ total names in the index4. And, although the Vanguard Global Aggregate Bond UCITS ETF only holds one third of the individual securities, its holdings still comprise almost two-thirds of the universe by market capitalisation.

As the chart below illustrates, portfolio managers can closely match the weightings of the underlying index while holding only a portion of the index constituents. They do this by targeting specific bond issues after assessing metrics such as liquidity, credit quality, maturity and other key considerations, minimising transaction costs. Such sampling techniques also work as a liquidity management tool, which is vital during periods of market turmoil.

Index sampling: An efficient liquidity management tool

Fund and index weights by category

Source: Bloomberg, as at 30 December 2024. Data are derived from constituents for the Vanguard Global Aggregate Bond UCITS ETF and the Bloomberg Global Aggregate Float Adjusted and Scaled Index.

Even while a fund holds far fewer bonds than the index, its portfolio managers can closely match the benchmark’s essential risk characteristics such as duration, credit risk and yield as they seek to mirror the index’s performance. In the case of managing a global aggregate bond ETF, our managers have kept tracking error consistently tight across market cycles and environments – for further information, please visit our fund pages.

Want to learn more about investing with bond ETFs?

For investors who would like to explore the topic further, our ETF resources page has information on our ETF offering and fixed income exposures more specifically. For a deeper macroeconomic picture, our economic and market outlook for 2025 elaborates on how we expect the era of sound money (or the persistence of higher real interest rates) to provide a strong foundation for fixed income.

In addition, our Going global with bonds: The benefits of a more global fixed income allocation research provides a comprehensive explanation of how hedged global bond exposures can complement investor portfolios.

1 The S&P 500 returned 25.7% in 2023 and 24.5% in 2024. Source: Vanguard. Data as at 31 December 2024, USD net total return. Past performance is not a reliable indicator of future results. The performance of an index is not an exact representation of any particular investment as you cannot invest directly in an index. The performance of the index reflects the reinvestment of Distribution and dividends but does not reflect the deduction of any fees or expenses which would have reduced total returns.

2 Benchmarks and indices used: US equities = S&P 500 Net Total Return Index, UK equities = FTSE All Share Net Total Return Index, developed market equities = MSCI World Net Total Return Index, global markets all cap equities = MSCI ACWI IMI Net Total Return Index, Europe equities = MSCI Europe Net Total Return Index, eurozone equities = MSCI EMU Net Total Return Index, developed Asia Pacific ex Japan equities = MSCI Pacific ex Japan Net Total Return Index, Japan equities = MSCI Japan Net Total Return Index, emerging market equities = MSCI Emerging Net Total Return Index, global market equities = MSCI ACWI Net Total Return Index, developed market small-cap equities = MSCI World Small Cap Net Total Return Index, global aggregate fixed income = Bloomberg Global-Aggregate Total Return Index Unhedged USD, US aggregate fixed income = Bloomberg US Aggregate Total Return Index Unhedged USD, US short-duration fixed income = Bloomberg US Aggregate 1-3 Year Total Return Index Unhedged USD, US long-duration fixed income = Bloomberg US Aggregate 7-10 Year Total Return Index Unhedged USD, US government fixed income = Bloomberg US Treasury Total Return Unhedged USD, US inflation-linked fixed income = Bloomberg US Government Inflation-Linked All Maturities Total Return Index Unhedged USD, US corporates fixed income = Bloomberg US Corporate Total Return Index Unhedged USD, global short-duration fixed income hedged = Bloomberg Global Aggregate 1-3 Year Total Return Index Hedged USD, global long duration fixed income hedged = Bloomberg Global Aggregate 7-10 Year Total Return Index Hedged USD, global government fixed income hedged = Bloomberg Global Aggregate Treasuries Total Return Index Hedged USD, global inflation-linked fixed income hedged = Bloomberg Global Inflation-Linked Total Return Index Hedged USD, global corporates fixed income hedged = Bloomberg Global Aggregate Corporate Total Return Index Hedged USD, global high yield fixed income hedged = Bloomberg Global High Yield Total Return Index Hedged USD, global aggregate fixed income hedged = Bloomberg Global Aggregate Total Return Index Hedged USD, commodity alternatives = Bloomberg Commodity Index Total Return, global REITS alternatives = S&P Global REIT Net Total Return Index, global infrastructure alternatives = S&P Global Infrastructure Net Total Return Index, global private equity alternatives = S&P Listed Private Equity Net Total Return Index.

3 Sharpe ratio is a measure of risk-adjusted return. To calculate a Sharpe ratio, an asset’s excess return (its return in excess of the return generated by risk-free assets such as Treasury bills) is divided by the asset’s standard deviation.

4 As at 31 December 2024, the index had 30,448 securities.

Related ETFs

Build your knowledge and earn CPD

Discover tools, guides and multimedia resources. Built for (and with) financial advisers.

Events and webinars

Explore upcoming events and our on-demand library. All CPD accredited.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Performance figures shown may be calculated in a currency that differs from the currency of the share class that you are invested in. As a result, returns may decrease or increase due to currency fluctuations.

Some funds invest in emerging markets which can be more volatile than more established markets. As a result the value of your investment may rise or fall.

Investments in smaller companies may be more volatile than investments in well-established blue chip companies.

ETF shares can be bought or sold only through a broker. Investing in ETFs entails stockbroker commission and a bid- offer spread which should be considered fully before investing.

Funds investing in fixed interest securities carry the risk of default on repayment and erosion of the capital value of your investment and the level of income may fluctuate. Movements in interest rates are likely to affect the capital value of fixed interest securities. Corporate bonds may provide higher yields but as such may carry greater credit risk increasing the risk of default on repayment and erosion of the capital value of your investment. The level of income may fluctuate and movements in interest rates are likely to affect the capital value of bonds.

The Funds may use derivatives in order to reduce risk or cost and/or generate extra income or growth. The use of derivatives could increase or reduce exposure to underlying assets and result in greater fluctuations of the Fund's net asset value. A derivative is a financial contract whose value is based on the value of a financial asset ( as a share, bond, or currency) or a market index. For further information on risks please see the “Risk Factors” section of the prospectus on our website.

Important information

This is a marketing communication.

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information is general in nature and does not constitute legal, tax, or investment advice. Potential investors are urged to consult their professional advisers on the implications of making an investment in, holding or disposing of shares and /or units of, and the receipt of distribution from any investment.

For Swiss professional investors: Potential investors will not benefit from the protection of the FinSA on assessing appropriateness and suitability.

Vanguard Funds plc has been authorised by the Central Bank of Ireland as a UCITS and has been registered for public distribution in certain EEA countries and the UK. Prospective investors are referred to the Funds' prospectus for further information. Prospective investors are also urged to consult their own professional advisers on the implications of making an investment in, and holding or disposing shares of the Funds and the receipt of distributions with respect to such shares under the law of the countries in which they are liable to taxation.

The Manager of Vanguard Funds plc is Vanguard Group (Ireland) Limited. Vanguard Asset Management, Limited is a distributor for Vanguard Funds plc.

For Swiss professional investors: The Manager of Vanguard Funds plc is Vanguard Group (Ireland) Limited. Vanguard Investments Switzerland GmbH is a financial services provider, providing services in the form of purchase and sales according to Art. 3 (c)(1) FinSA . Vanguard Investments Switzerland GmbH will not perform any appropriateness or suitability assessment. Furthermore, Vanguard Investments Switzerland GmbH does not provide any services in the form of advice. Vanguard Funds Series plc has been authorised by the Central Bank of Ireland as a UCITS. Prospective investors are referred to the Funds' prospectus for further information. Prospective investors are also urged to consult their own professional advisors on the implications of making an investment in, and holding or disposing shares of the Funds and the receipt of distributions with respect to such shares under the law of the countries in which they are liable to taxation.

For Swiss professional investors: Vanguard Funds plc has been approved for offer in Switzerland by the Swiss Financial Market Supervisory Authority. The information provided herein does not constitute an offer of Vanguard Funds plc in Switzerland pursuant to FinSA and its implementing ordinance. This is solely an advertisement pursuant to FinSA and its implementing ordinance for Vanguard Funds plc. The Representative and the Paying Agent in Switzerland is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich. Copies of the Articles of Incorporation, KID, Prospectus, Declaration of Trust, By-Laws, Annual Report and Semiannual Report for these funds can be obtained free of charge from the Swiss Representative or from Vanguard Investments Switzerland GmbH via our website.

The Manager of the Ireland domiciled funds may determine to terminate any arrangements made for marketing the shares in one or more jurisdictions in accordance with the UCITS Directive, as may be amended from time-to-time.

The Indicative Net Asset Value (“iNAV”) for Vanguard’s ETFs is published on Bloomberg or Reuters. Refer to the Portfolio Holdings Policy.

For investors in Ireland domiciled funds, a summary of investor rights can be obtained via and is available in English, German, French, Spanish, Dutch and Italian.

For Dutch investors only: The fund(s) referred to herein are listed in the AFM register as defined in section 1:107 Dutch Financial Supervision Act (Wet op het financieel toezicht).For details of the Risk indicator for each fund listed, please see the fact sheet(s) which are available from Vanguard via our website.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Group (Ireland) Limited. All rights reserved.

© 2025 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2025 Vanguard Asset Management, Limited. All rights reserved.

4253085