Table of contents

Key takeaways

Market overview: Amid a strong rise in US equities, and tech companies in particular, European-domiciled ETF flows surged in Q4 2024. For the year, European ETFs captured net inflows of $278 billion, easily outpacing the previous record of $191 billion, set in 2021.

Equity spotlight: As US stocks rose in 2024, so too did the concentration of the largest holdings in key benchmarks such as the S&P 500. In response, many investors have explored ways to mitigate the impact of concentration risk, looking at equal-weighted indices and small-caps in particular.

Fixed income spotlight: Developed market bond yields pushed higher in Q4 2024, as markets repriced expectations of future rate cuts. In this environment, corporate bond ETFs saw investor demand in Q4 and during much of 2024.

Capital markets spotlight: With the US move from T+2 to T+1 trade settlement in 2024, there have been knock-on effects for investors in UCITS ETFs. While many UCITS ETFs trade T+2, creating a settlement misalignment, ETF issuers have been able to minimise additional costs.

Market overview

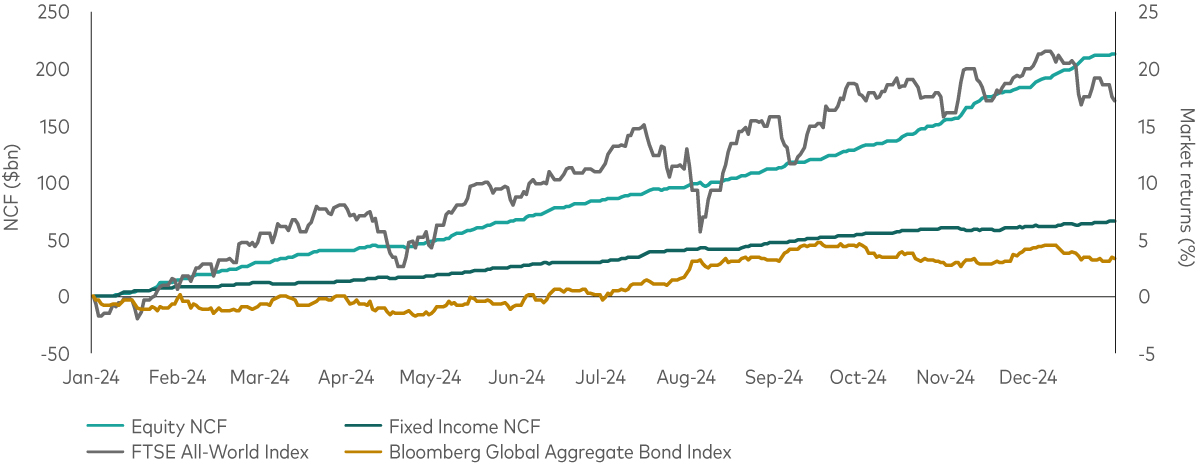

European-domiciled ETFs capped a year of record-breaking inflows with further strong flows in Q4 2024. Core equity exposures, such as the S&P 500 and FTSE All-World, dominated the flows picture – driven in large part by the performance of the technology sector. For the year, equity ETFs saw net inflows of $213 billion, with $83 billion of that total coming in Q4 alone. Global equities finished Q4 down -1.2%1, while the S&P 500 reached record highs amid the backdrop of a stronger US dollar.

The broader story underlying strong returns for the tech sector stems from growing expectations around artificial intelligence (AI), as companies with the potential to be at the forefront of this set of technologies enjoyed strong returns. However, we saw rising investor concern relating to concentration risk, namely with respect to the higher weighting of the so-called Magnificent 7 (Mag 7)2 companies in the S&P 500 and other developed market indices.

Fixed income ETFs brought in nearly $12 billion of net inflows in Q4 2024 (and $66 billion for the full year), with the bulk of the flows going into euro area government bond and corporate bond exposures. With corporate fundamentals remaining strong, and corporate bonds offering a yield pick-up versus risk-free alternatives, we could see further demand for investment grade credit exposures in the coming months.

ETF industry net cash flow (NCF) vs. market returns by asset class

Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Source: ETFBook, Bloomberg and Vanguard. Data from 1 January 2024 to 31 December 2024. Performance calculated in USD with gross income reinvested.

Equity spotlight

Concentration risk becomes the talk of the town

Over the past decade, concentration in the Mag 7 has risen to more than 33% of the S&P 500 index3. As a result, this group of stocks has provided one of the main drivers of returns. In a reaction to that growing concentration, we saw assets move into equal-weighted S&P 500 exposures last year, in particular as investors grappled with uncertainty around the US election (which took place on 5 November 2024). This move came despite recent underperformance of the equal-weighted index relative to the market cap-weighted equivalent.

In Q4 2024, equal-weighted exposure to the S&P 500 drove $9 billion of net ETF cash flows, or about 10% of all ETF flows during the quarter. Indeed, investor flows into equal-weighted ETFs accelerated following the US election. Nevertheless, the elevated equity concentrations did little to dent investor appetite for core beta ETF exposures, such as the S&P 500 and the MSCI World, which collected roughly $53 billion of net inflows, or 55% of all net flows in Q4.

Concentration risk isn't new to markets. We expect some investors will continue looking for ways to counteract the concentration we see in developed market equity indices. When considering a cap-weighted versus an equal-weighted index approach, investors should ensure they understand what each means in terms of the costs, risks and ultimately the investment exposure. In our view, the equal-weighted approach changes the risks (it doesn’t remove them) and the market cap-weighted approach could be the better option for many investors seeking broad, diversified exposure to US equities.

The season of small-caps

Small-capitalisation equity ETFs also attracted considerable flows in 2024, and some investors may view these exposures as another way to diversify away from the mega-cap stocks that dominate equity benchmarks. And from a return perspective, in the second half of 2024, the US small-cap benchmark Russell 2000 (+9.73%) outperformed the likes of the S&P 500 (+8.32%) and the MSCI World (+6.20%)4.

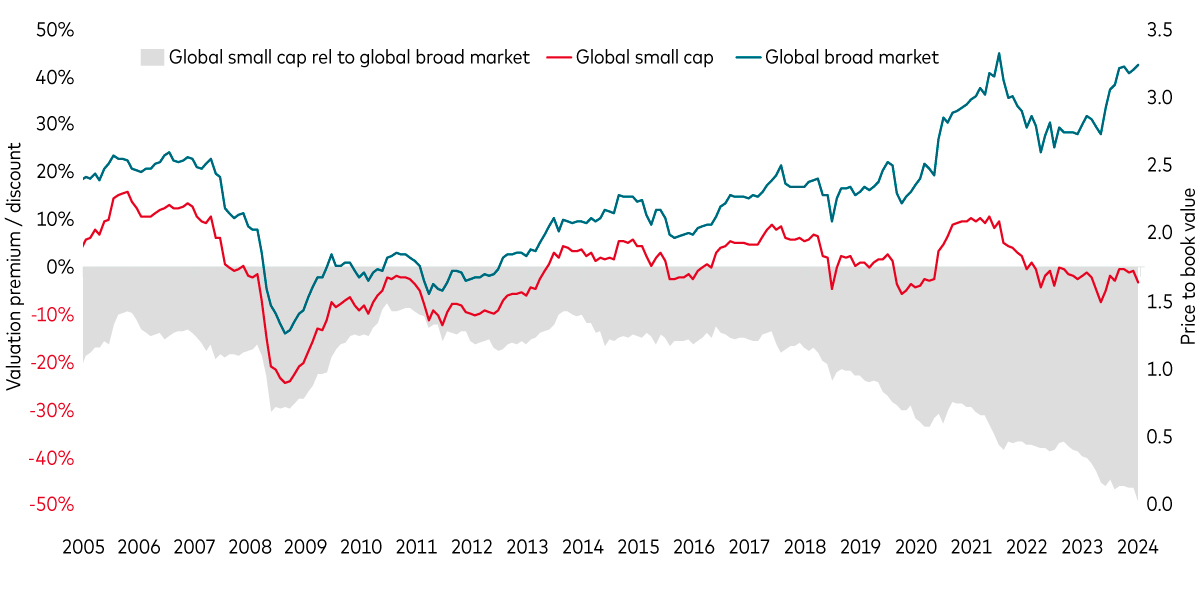

Small-cap equities have consistently traded at a discount (as measured by price/book value) to the broader equity market, going back decades. From 2018 onwards, however, the valuation gap has been expanding. Currently, the valuation discount for global small-caps has reached a level not seen in the past 20 years.

Global small-cap equity valuations at two-decade low

Source: FactSet. Data from 31 July 2005 to 31 December 2024.

Including global small-caps in an investment portfolio can help to enhance diversification, as small-cap exposures tend to be less concentrated than large-caps. By more evenly distributing investments across a variety of companies spanning different sectors and countries, adding small-caps to a diversified equity portfolio containing larger-capitalisation stocks can mitigate the impact of volatility in any single market or sector, reducing lopsided valuation risk.

If we compare the MSCI World Index with the MSCI World Small-Cap Index, we can see the high level of diversification small-caps offer, both in terms of reduced top-level concentration and a greater number of index holdings. Consider how the top 10 holdings represent 26% of the MSCI World Index, despite the index holding a total of 1,395 constituents5. In the MSCI World Small-Cap Index, however, the top 10 holdings account for only 2% of an index with 3,979 constituents in total.

Fixed income spotlight

Demand for corporate bonds leads to tightening spreads

Developed market fixed income yields broadly pushed higher in Q4 2024, as markets repriced expectations of future rate cuts. The rise in yields came despite interest rate cuts by the US Federal Reserve (Fed), Bank of England and European Central Bank (ECB) during the quarter.

Against this backdrop, corporate bond ETFs saw strong flows in both Q4 and for full-year 2024. Credit markets in particular saw strong investor demand, driven by attractive yields, sound fundamentals and steeper yield curves. Given the volatility in government bonds, corporate bond ETFs have acted as an effective hedge within fixed income portfolios. For example, the Vanguard EUR Corporate Bond UCITS ETF and the Vanguard USD Corporate Bond UCITS ETF proved popular among investors in the final quarter of 2024, as these exposures benefited from their yield uplift relative to government bonds while maintaining their high-quality, defensive nature.

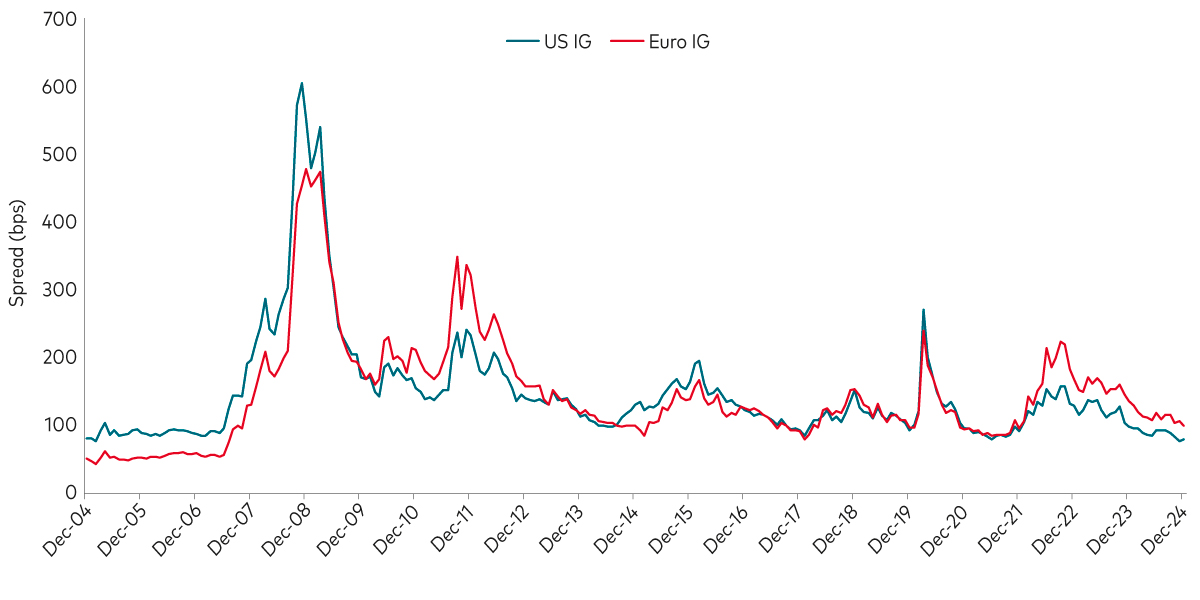

However, as a result of the strong demand, credit spreads have been grinding tighter and are now at historically tight levels, with US investment-grade (IG) spreads in the 10th percentile of their historical averages over the past 20 years. Conversely, European spreads are approaching their 10-year averages and are structurally more attractive compared with US IG.

US and European investment grade credit spreads tightened in Q4 2024

Source: Bloomberg, data from 31 December 2004 to 31 December 2024. The chart shows the average option-adjusted spread (OAS) for the Bloomberg US Aggregate Corporate Bond Index and the Bloomberg Euro Aggregate Corporate Bond Index.

Investment grade endures

There is still a place for IG credit in investor portfolios. Corporate bonds offer a higher yield compared with their risk-free counterparts and have historically delivered higher cumulative returns over the long term. Corporate bonds can also offer diversification to government bonds – which is important, as an environment of strong growth and high inflation tends to be negative for government bond yields but positive for credit spreads. Although this relationship broke down in 2022, we have started to see the negative correlation return over the last couple of years.

It is important for bond investors to consider quality, especially given the current macroeconomic backdrop in Europe. We have already started to see European growth struggle, driven by challenges in Germany and France. If conditions worsen, lower-quality names are likely to be the most affected and investors could experience significant volatility.

Looking to the year ahead, the technical and fundamental backdrop for investment grade credit continues to look positive. We expect net supply to be largely flat or slightly lower in 2025 compared with last year, as higher gross issuance is likely to be met with a wave of maturities. Also, further rate cuts by the ECB could aid consumer confidence and stimulate economic activity, which may benefit company earnings and revenues. These factors, coupled with the deleveraging we have seen among IG companies in recent years, puts the fundamental outlook for IG credit on a firm footing.

Capital markets spotlight

Recent changes in T+1 settlement costs and impacts explained

With the US move from T+2 to T+1 trade settlement in May 2024, there have been knock-on effects for investors in UCITS ETFs. While many UCITS ETFs trade T+2, creating a settlement misalignment, ETF issuers have been able to minimise additional costs.

Despite the move in the US to T+1 settlement last year, with most of Asia and Europe remaining T+2, the majority of UCITS ETF trading continues with a two-day settlement cycle. Although impacts appear minimal, UCITS ETF investors should be mindful of how a change in the US settlement cycle can impact an ETF’s total cost of ownership (TCO).

For investors, an ETF’s TCO represents how much of their investment is spent through buying, holding and selling an ETF. Understanding trading costs and how to avoid unnecessary charges can help to reduce an ETF investor’s TCO, delivering greater value.

How ETF trading and settlement costs work

When buying (or selling) activity is high, UCITS ETF shares are created (redeemed) by authorised participants with the issuer. The issuer then buys (sells) underlying securities in the ETF. Securities domiciled in a T+1 location that are held in an ETF will conform with the T+1 settlement regime, while T+2 securities and the majority of UCITS ETF trading will remain T+2.

ETF issuers need to balance ETF requirements (such as UCITS cash rules and funding costs) with flexibility for authorised participants, whose use of their own capital, borrowing from prime brokers and regulatory settlement penalties leave them financially exposed until a trade settles.

A closer look at US UCITS ETFs

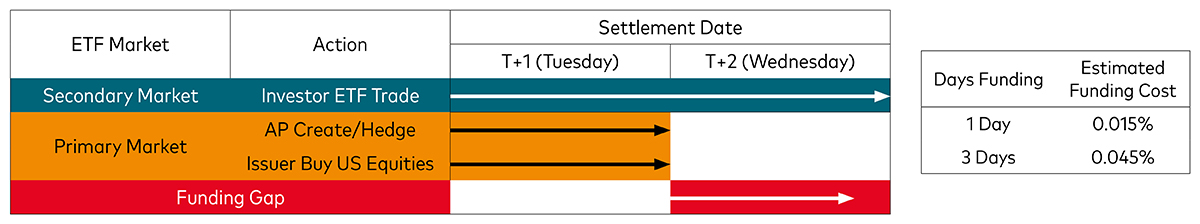

For UCITS ETFs with 100% underlying US exposure, authorised participants receive cash on T+2 from investors, while the issuer requires cash (shares) to facilitate the buying (selling) of underlying securities at T+1. This results in a funding gap.

US UCITS ETF: Buy funding example

Source: Vanguard. The diagram is provided for illustrative purposes only.

One-day funding costs roughly equal the Fed’s interest rate, divided by the number of days in the calendar year. On the penultimate day of the trading week (generally a Thursday), the funding cost for facilitating a trade with settlement exposure over a weekend is multiplied by three.

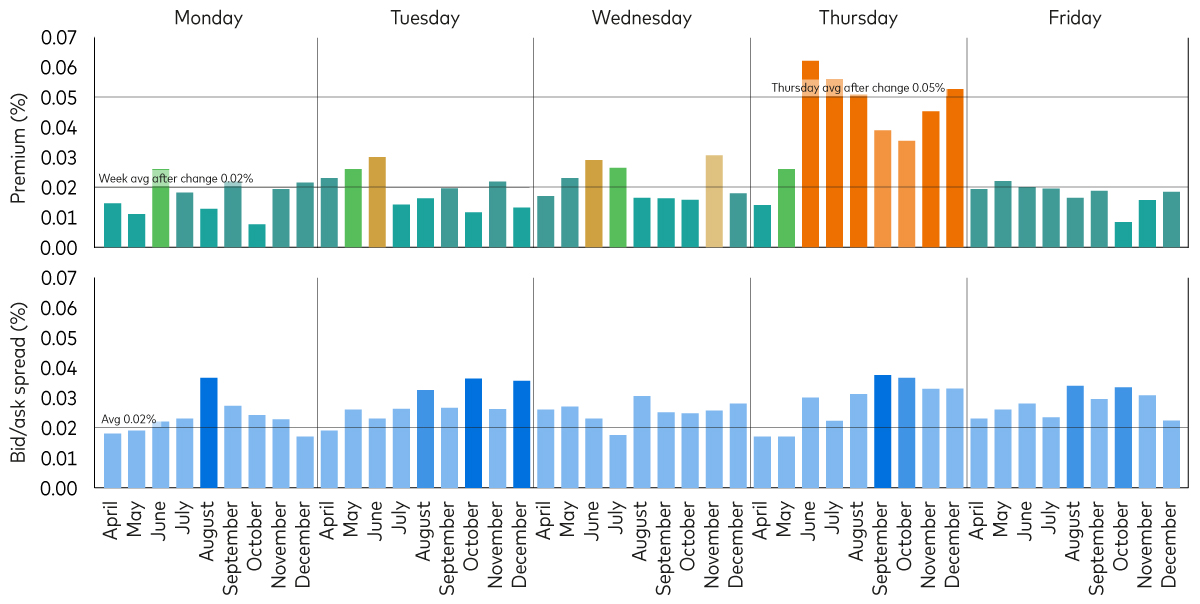

By analysing intraday on-exchange trading data, we have observed increased funding costs on a Thursday being passed to investors through a higher premium (see chart below), with a slight increase in the quoted bid/ask spread. This has led to ETF trading activity on Thursdays falling by 19%.

On other days, the risk of a one-day funding gap appears not to materially affect either average bid/ask spreads or the premium/discount.

US UCITS ETF trading costs changes

Average VUSD premium/discount & ETF bid/ask Spread - 3PM to 4PM

Source: Vanguard, as of 23 July 2024.

UCITS ETFs with global exposures have underlying securities from countries with both T+1 and T+2 regimes. While funding is still a consideration, the impact is reduced by the percentage of the underlying securities in the T+1 cycle. Therefore, impacts on trading costs for these ETFs appear not to be material.

Takeaways from the change and misalignment of settlement

The majority of UCITS ETF trading will continue on a T+2 cycle. Impacts appear small but premium/discount volatility can increase for certain trades and trading days.

For ETF investors making larger ETF investments, it can be beneficial to align settlement cycles with the market of the majority of the underlying securities in the ETF. Non-standard settlement on UCITS ETFs can be conducted off-exchange where trading isn’t bound by local settlement requirements.

For smaller-sized trading on-exchange, investors should be mindful of potentially increased trading costs on Thursdays due to the increased funding requirements over the weekend.

While small cost increases are inevitable without global settlement alignment, ETF issuers and other ETF stakeholders should utilise technology and operational flexibility to limit the impacts for ETF investors.

Further settlement changes ahead

Attention now shifts to governing bodies across Europe and the UK, which will decide on T+1 implementation for the next chapter of the global settlement story. Given the global trading of UCITS ETFs, we would recommend that Europe and the UK change in tandem, collaborating with each other and ETF stakeholders.

The Vanguard ETF Capital Markets Desk is available to help you with any questions you may have via email.

1 As measured by the FTSE All-World Index in US dollar terms.

2 In this context, the Magnificent 7 refers to the companies Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia and Tesla.

3 Source: S&P, as at 31 December 2024.

4 Source: Bloomberg, as at 31 December 2024. Returns are net in US dollars.

5 Source: FactSet, as at 31 December 2024.

Related ETFs

Important risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Performance figures shown may be calculated in a currency that differs from the currency of the share class that you are invested in. As a result, returns may decrease or increase due to currency fluctuations.

ETF shares can be bought or sold only through a broker. Investing in ETFs entails stockbroker commission and a bid- offer spread which should be considered fully before investing.

Funds investing in fixed interest securities carry the risk of default on repayment and erosion of the capital value of your investment and the level of income may fluctuate. Movements in interest rates are likely to affect the capital value of fixed interest securities. Corporate bonds may provide higher yields but as such may carry greater credit risk increasing the risk of default on repayment and erosion of the capital value of your investment. The level of income may fluctuate and movements in interest rates are likely to affect the capital value of bonds.

The Funds may use derivatives in order to reduce risk or cost and/or generate extra income or growth. The use of derivatives could increase or reduce exposure to underlying assets and result in greater fluctuations of the Fund's net asset value. A derivative is a financial contract whose value is based on the value of a financial asset (such as a share, bond, or currency) or a market index.

Some funds invest in securities which are denominated in different currencies. Movements in currency exchange rates can affect the return of investments.

For further information on risks please see the “Risk Factors” section of the prospectus on our website.

Important information

This is a marketing communication.

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information is general in nature and does not constitute legal, tax, or investment advice. Potential investors are urged to consult their professional advisers on the implications of making an investment in, holding or disposing of shares and /or units of, and the receipt of distribution from any investment.

For Swiss professional investors: Potential investors will not benefit from the protection of the FinSA on assessing appropriateness and suitability.

Vanguard Funds plc has been authorised by the Central Bank of Ireland as a UCITS and has been registered for public distribution in certain EEA countries and the UK. Prospective investors are referred to the Funds' prospectus for further information. Prospective investors are also urged to consult their own professional advisers on the implications of making an investment in, and holding or disposing shares of the Funds and the receipt of distributions with respect to such shares under the law of the countries in which they are liable to taxation.

The Manager of Vanguard Funds plc is Vanguard Group (Ireland) Limited. Vanguard Asset Management, Limited is a distributor for Vanguard Funds plc.

For Swiss professional investors: The Manager of Vanguard Funds plc is Vanguard Group (Ireland) Limited. Vanguard Investments Switzerland GmbH is a financial services provider, providing services in the form of purchase and sales according to Art. 3 (c)(1) FinSA . Vanguard Investments Switzerland GmbH will not perform any appropriateness or suitability assessment. Furthermore, Vanguard Investments Switzerland GmbH does not provide any services in the form of advice. Vanguard Funds Series plc has been authorised by the Central Bank of Ireland as a UCITS. Prospective investors are referred to the Funds' prospectus for further information. Prospective investors are also urged to consult their own professional advisors on the implications of making an investment in, and holding or disposing shares of the Funds and the receipt of distributions with respect to such shares under the law of the countries in which they are liable to taxation.

For Swiss professional investors: Vanguard Funds plc has been approved for offer in Switzerland by the Swiss Financial Market Supervisory Authority. The information provided herein does not constitute an offer of Vanguard Funds plc in Switzerland pursuant to FinSA and its implementing ordinance. This is solely an advertisement pursuant to FinSA and its implementing ordinance for Vanguard Funds plc. The Representative and the Paying Agent in Switzerland is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich. Copies of the Articles of Incorporation, KID, Prospectus, Declaration of Trust, By-Laws, Annual Report and Semiannual Report for these funds can be obtained free of charge from the Swiss Representative or from Vanguard Investments Switzerland GmbH via our website.

The Manager of the Ireland domiciled funds may determine to terminate any arrangements made for marketing the shares in one or more jurisdictions in accordance with the UCITS Directive, as may be amended from time-to-time.

The Indicative Net Asset Value (“iNAV”) for Vanguard’s ETFs is published on Bloomberg or Reuters. Refer to the Portfolio Holdings Policy at https://fund-docs.vanguard.com/portfolio-holdings-disclosure-policy.pdf

For investors in Ireland domiciled funds, a summary of investor rights is available in English, German, French, Spanish, Dutch and Italian.

For Dutch investors only: The fund(s) referred to herein are listed in the AFM register as defined in section 1:107 Dutch Financial Supervision Act (Wet op het financieel toezicht).For details of the Risk indicator for each fund listed, please see the fact sheet(s) which are available from Vanguard via our website.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Group (Ireland) Limited. All rights reserved.

© 2025 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2025 Vanguard Asset Management, Limited. All rights reserved.

4194011