Key points

- A softer inflation outlook in the United States increases the chance of rate cuts later this year.

- In the euro area, the European Central Bank kept interest rates on hold in July, after cutting in June.

- In the UK, a better-than-expected increase in economic activity has led us to raise our full-year growth expectations.

Slowing economic activity in the US and modest growth in the UK and euro area suggest a moderate outlook for the world economy in the second half of the year. But with inflation still sticky, central banks face a tricky balancing act in cutting rates.

United States

US economic activity appears to be moderating as the gains in productivity and labour supply that drove GDP growth in 2023 show signs of subsiding.

Whereas preliminary figures from the US Federal Reserve (Fed) Bank of Atlanta suggest the US economy grew by 2.5% in the second quarter, proprietary Vanguard models foresee lower growth. We continue to anticipate full-year GDP growth at around 2%.

A second straight benign Consumer Price Index (CPI) reading, a key measure of inflation, cheered markets, which now anticipate a quarter-point interest rate cut by the Fed in September. Consumer prices fell by 0.1% month-over-month in June, and rose by 3% compared with the second quarter last year.

Core inflation, which excludes volatile energy and food prices, increased by just 0.1%, while headline inflation fell by a basis point.

The Fed left its target for the federal funds rate unchanged in a range of 5.25%–5.5% at its June meeting. It faces a tricky balance between cutting rates too soon and risking resurgent inflation, and cutting too late to the economy’s detriment.

Vanguard believes that the Fed will need to see continued supportive inflation data or a sharp slowdown in the labour market before it cuts interest rates. Should the Fed decide it is able to cut interest rates in 2024, we don’t foresee more than a single quarter-point cut.

The labour market sent mixed signals in June, with 206,000 jobs created. At the same time, the unemployment rate rose to a 30-month high of 4.1%, from 4.0%. Vanguard expects monthly unemployment rates to fluctuate between 3.8% and 4.2% for the rest of the year, settling at around 4% at year-end.

Euro area

The euro area is growing again, with real GDP having increased by 0.3% in the first quarter of 2024 compared with the fourth quarter of 2023, leaving behind five quarters of stagnation. We expect modest growth for the rest of the year, supported by rising real incomes and lower inflation-adjusted borrowing costs. We foresee full-year GDP growth of 0.8%.

The pace of headline inflation slowed to 2.5% for the 12 months to June, compared with 2.6% in May, while core inflation held steady at 2.9%. Yet higher-than-expected services inflation has led us to raise our year-end forecasts from 2.0% to 2.2% for headline inflation, and 2.2% to 2.6% for core inflation.

The European Central Bank (ECB) left its deposit facility rate unchanged at 3.75% on July 18. Its 25-basis-point cut on June 6 ended a 450 bps hiking cycle that began in July 2022. We expect the next rate cut to take place at the ECB’s September meeting and expect future quarter-point cuts quarterly thereafter, which would leave the policy rate at 3.25% at year-end 2024 and 2.25% at year-end 2025. However, risks skew toward less easing given increased upward momentum in services inflation.

The unemployment rate held steady at a record low of 6.4% on a seasonally-adjusted basis in May. We foresee the unemployment rate ending 2024 around current levels. However, lower corporate profit margins in 2024 would skew risks to the upside.

United Kingdom

Increased activity in the services sector drove a greater-than-expected gain in monthly GDP, which grew by 0.4% in May, according to the Office for National Statistics. Services output, the largest contributor to the monthly gain, increased by 0.3% for the second straight month.

Based on the stronger growth, Vanguard has raised its forecast for second-quarter and full-year GDP growth. We foresee growth of 0.7% in the second quarter compared with the first, leading us to increase our forecast for full-year growth from 0.7% to 1.2%. We anticipate only a marginal impact on growth from the new Labour government, as it will be constrained by the same fiscal rules as the previous Conservative government.

The robust services activity underscores the potential for wages and inflation to remain sticky. Headline inflation remained at the Bank of England’s (BOE’s) 2.0% compared with the second quarter last year, the same level as in May. However, the pace of services inflation remained elevated, at 5.7%, over the same time period. Private-sector wage growth, excluding bonuses, moderated but remains high, at 5.6% in the March–May period. The last time it was lower was in the April–June 2022 period.

The unemployment rate remained at 4.4% in the March–May period. The labor market continues to soften, with employment and job vacancies continuing a downward trend. We foresee a year-end 2024 unemployment rate in a range of 4%–4.5%. Risks skew to the upside given recent upward momentum in the unemployment rate.

The BOE held the bank rate steady at 5.25% at its June meeting, yet minutes from the meeting suggest most pieces are in place for a rate cut at the central bank’s next meeting, results of which are scheduled to be released on Thursday 1 August. We anticipate a quarterly cadence of quarter-point rate cuts beginning in August, which would leave the bank rate at 4.75% to end 2024 and at 3.75% to end 2025.

However, the recent increase in economic activity represents a risk to an August rate cut by the BOE, and to the number of cuts the central bank might make this year. The BOE may also be constrained by the Fed, which we believe may find that it’s not in a position to cut rates in 2024.

China

As its leadership convened for a twice-a-decade economic policy meeting known as the 3rd Plenum, China released data on 15 July showing the economy hit a soft patch in the second quarter.

GDP grew by 0.7% compared with the first quarter and by 4.7% compared with the second quarter last year. The growth data were in line with our non-consensus view. China has set a goal for full-year 2024 growth “around 5%”. We continue to foresee China growing by 5.1% for the full year, though supply and demand that remain out of balance could challenge that growth’s sustainability.

The pace of inflation as measured by consumer prices rose by 0.2% compared with the second quarter last year, less than the 0.3% pace in both May and April. We foresee full-year core and headline inflation of around 1.0% and 0.8%, respectively, which would be well below the 3% inflation target set by the People’s Bank of China (PBOC).

The unemployment rate was flat in June at 5.0%. Vanguard believes that structural mismatches in labour demand and supply, particularly among the youngest workers, may not be easily addressed in the near term and may require additional policy support.

The focus of the 3rd Plenum will be structural economic changes. Although past convocations have occasionally produced historically important announcements, we expect this year’s to consolidate existing policy thinking. Still, it has the potential to send signals on how China will cultivate long-term-growth drivers and confront challenges.

The points above represent the house view of the Vanguard Investment Strategy Group’s (ISG’s) global economics and markets team as at 17 July 2024.

Asset-class return outlook

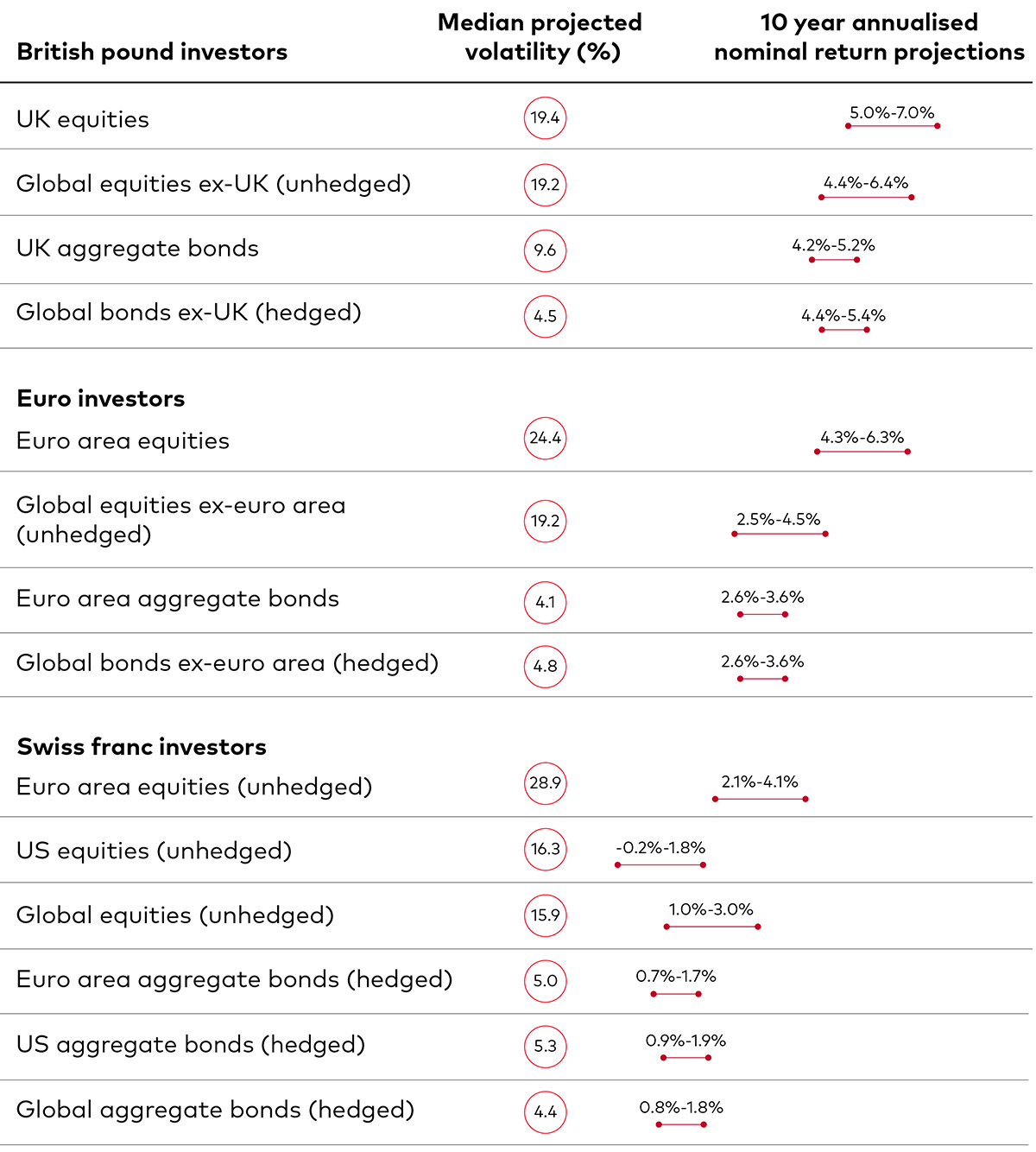

Vanguard has updated its 10-year annualised outlooks for broad asset class returns through the most recent running of the Vanguard Capital Markets Model® (VCMM), based on data as at 31 May 2024.

Our 10-year annualised nominal return projections, expressed for local investors in local currencies, are as follows1.

1 The figures are based on a 2-point range around the 50th percentile of the distribution of return outcomes for equities and a 1-point range around the 50th percentile for fixed income. Numbers in parentheses reflect median volatility.

IMPORTANT: The projections or other information generated by the Vanguard Capital Markets Model® regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time. The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The Vanguard Capital Markets Model® is a proprietary financial simulation tool developed and maintained by Vanguard’s primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include US and international equity markets, several maturities of the U.S. Treasury and corporate fixed income markets, international fixed income markets, US money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Past performance is not a reliable indicator of future results.

Any projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

Important information

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained in this document is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this document does not constitute legal, tax, or investment advice. You must not, therefore, rely on the content of this document when making any investment decisions.

The information contained in this document is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

Issued in Germany by the Vanguard Group Europe GmbH.

© 2024 Vanguard Group (Ireland) Limited. All rights reserved.

© 2024 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2024 Vanguard Asset Management, Limited. All rights reserved.

© 2024 Vanguard Group Europe GmbH. All rights reserved.