What is segmentation?

Market segmentation is the process of dividing your client base into smaller groups – or segments – which have similar characteristics, needs or value. The benefit of this is that understanding your clients means you can target them better to ensure you are providing the most value. It also helps ensure you are forming the best relationships with the clients who are the most valuable to you, whilst recognising where your other clients fall and how you can ensure their needs are met whilst maintaining profitability.

What approaches to this could your business take?

There are numerous approaches to profiling the segmentation of your client base. Many companies will assist a firm with understanding these client profiles, using a data-modelling approach. But before you dive into the data, consider first the question you are trying to answer from undertaking this exercise as this may help to inform the approach you take:

- Are you trying to achieve greater definition in your business?

- Are you looking to change the direction of your business to concentrate on a different advice and investment area?

- Are you looking to understand why your profitability is low despite a large client base and high volumes of business?

What is it you are looking to achieve? Understanding your starting point will enable you to end up where you want.

In this article, we will consider three approaches to undertaking client segmentation and then focus in detail on segmenting by customer loyalty value (CLV), which may be the most useful segmentation for your business. We will then detail the four steps you need to carry out to fulfil this exercise and subsequently for your business to benefit from the results.

The approaches to client segmentation.

There are three approaches we will consider for client segmentation. These are:

- Bottom-up

- Top-down

- Value-to-business assessment

Let’s have a look at these in more detail.

1. The bottom-up approach

This method enables the observer to see trends or themes in their existing client base by studying the more detailed variables present in the data. The analysis would involve identifying important data fields such as client age, assets under management, investment or product holdings, revenue per customer and servicing demand.

By building a list of common themes, the data may show groups of customers and may give clues as to which customer categories appear more aligned with the business or are, perhaps, more valuable.

2. The top-down approach

This method applies when you know the client segment you want to identify and focus on. For example, your business may want to focus on servicing more clients as they move into their retirement. With this characteristic in mind, you can then study your client base from the top down and identify those clients who match your desired profile. This may show that a high number of clients fit your model, or that your business has not attracted the right type of client in the past.

3. Value-to-business assessment

Studying your clients from the bottom up can create an insight into the clients you have accrued but may not allow you to draw any real conclusions.

Studying your clients from the top down to identify specific characteristics may yield a certain answer but you could easily miss other interesting insights.

One way to assess the whole of your client portfolio but keep the task manageable is to have a focal point. Given the significance of profit to the value of your business, one focal point could be the value that each client brings to the business. Ranking your clients by business value may help inform the importance of certain clients or client types and uncover some interesting insights into why these clients are more valuable.

With this in mind, segmenting by customer loyalty value could provide the most important insights into the value of your client base, so this is the area that we will consider in more detail.

Segmenting by customer loyalty value, a step-by-step guide

Segmenting by customer loyalty value (or CLV) will allow your firm to understand how value accrues (or even erodes) from certain clients or client types. By focusing on client revenue, you can use this metric to influence critical business decisions about which segment to focus on.

This approach not only allows an understanding of the value of certain clients but more importantly the attributes of that value – for better or for worse.

There are four steps to undertaking the segmentation process, and we will go through them in more detail in this article. They are:

- Gathering data

- Understanding segments

- Categorising findings

- Determining focus

Step one: gather data

You will need to collate the relevant data from your client records showing the advice and service delivered. Having this information available in a digital format will of course make this easier. Read our article Managing an effective client database for more information about updating the system you use to maintain your client records if you can't access this information easily on your current system.

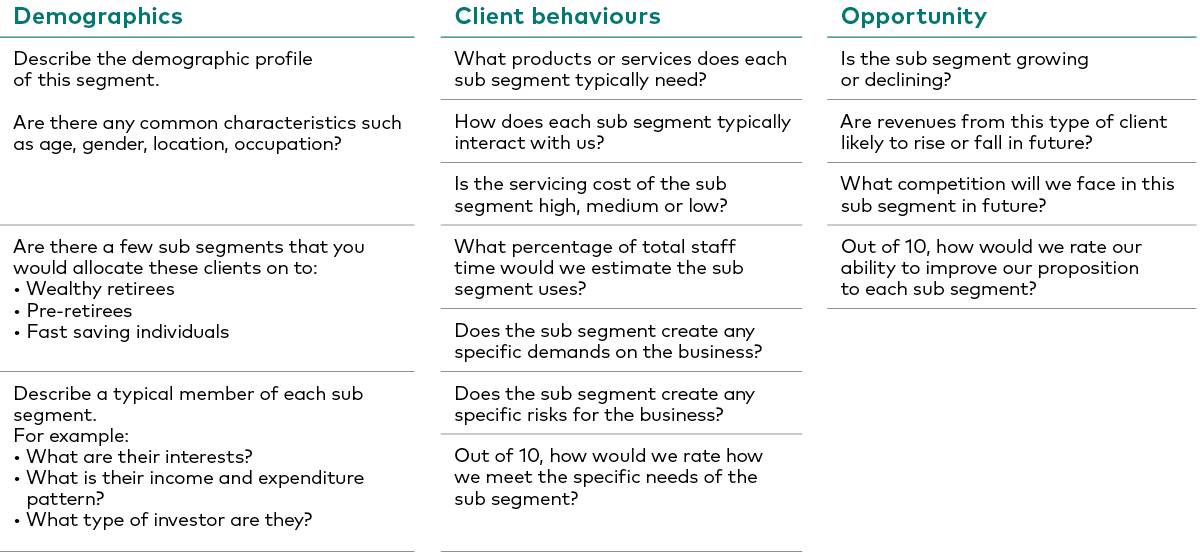

The chart below details the sort of information that you will need to collate.

As our focus at this time is client value; the key data you will need for each client is the revenue they produce for the firm. For example, how much does each client pay in ongoing fees, or what ongoing commission or asset-based revenues does each client generate? How loyal is each client?

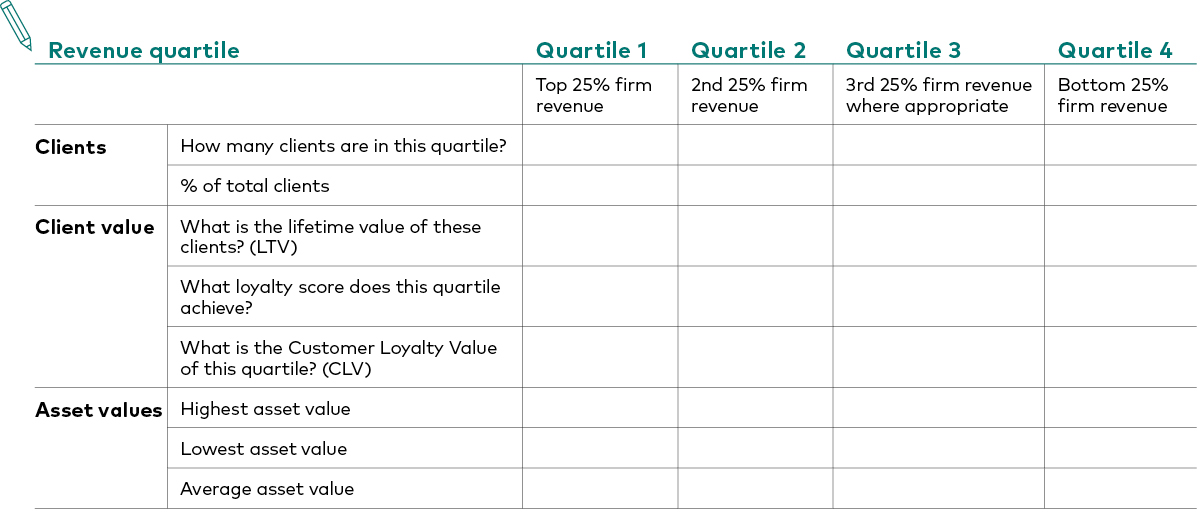

When this data has been collated, start to tabulate it into quartile or decile rankings, adding it to a table like the one below:

This analysis will show a high-level split of the revenue being earned by the firm and the proportional source of that revenue, together with the CLV for each segment. It is often the case that the smallest proportion of clients produce the largest proportion of revenue for the firm (this is known as the 80/20 rule). Likewise, you may also see a significant number of clients produce a similar or lesser proportion of revenue.

It is good practice to avoid depending on too few clients for revenue but at the same time find more efficient ways to service clients who provide little revenue and little value to your firm. At its extreme, this could mean turning unprofitable clients away but, more often than not, it is about finding a more efficient way to service them. Potentially substituting face to face contact with digital, or bespoke portfolios with an off the shelf solution for example . Don’t forget, a client may not be valuable today, but could be in the future.

Step two: understand the segments

“Without data you’re just another person with an opinion.”

Now you have an idea of the revenue in each segment, you will want to understand how the characteristics of the clients in each segment influence the profitability of that segment. What is the cost of delivering the promised service to those clients? It might be the case that segment-two clients will become more profitable if it costs proportionally less to service them compared with your best revenue-generating clients. What does your data tell you?

Gaining a deeper understanding of the various sub-segments makes it possible for your business to understand each segment’s contribution. It may also become evident that the business is over-serving or under-serving some clients, based on their value to the business. This is the point at which you need to capture and summarise your findings.

Use professional firms to help provide value to your data

You may have found the segmentation exercise easy so far, or it could have been less straightforward, leaving you with more questions than answers. If you have been left feeling unsure about the segments in your client list, engaging with a professional marketing firm can help to dig deeper into the data and suggest some appropriate strategies. Consider engaging with a data provider like Kantar or Nielsen who may provide deeper insight.

Step three: categorise your findings

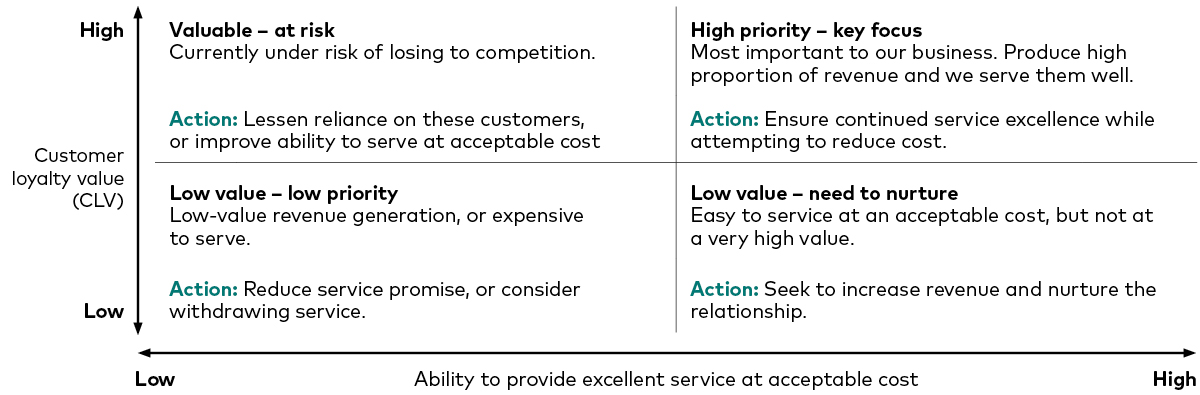

To inform your ongoing priorities and discussions, categorise your clients using a customer-segmentation matrix like the one below:

Once you have positioned your clients on the matrix, consider where they fall and the service offering most applicable to them.

High service at an acceptable cost / high value = key focus: these are your most valuable and loyal clients who require high-quality service but are willing to pay for it. They should be your highest priority and receive the highest level of personalised service.

Low service at an acceptable cost / high value = need to nurture: these clients are also valuable, but they may not wish to pay for the highest level of service. Look for ways to provide cost-effective solutions that will still meet their needs.

High service at an acceptable cost / low value = at risk: these clients demand high-quality service, so if you wish to retain them you may need to look for ways to serve them at a lesser cost.

Low service at an acceptable cost / low value = low priority: look for ways to automate or streamline services to this group to enable low-cost service, or alternatively consider removing the service altogether.

The customer segmentation matrix makes it clear to see the needs and value of each segment, enabling the best decisions for your business to be taken for each client.

Step four: determine your focus

Understanding your client segments can help to guide decision-making regarding your business focus. The future success of your business may rest on your ability to attract and retain the right type of client, as identified through step two’s analysis of the data.

To inform these business decisions, consider asking key questions about each category of clients. You can separate them into four groups: high-priority focus, valuable but at-risk, clients you should nurture and low value/low priority.

Key questions:

High-priority focus clients

- How do I make sure everyone in my business understands the value of these clients?

- How do I ensure that these clients continue to fully appreciate the service they receive?

- How can I make sure that these clients are aware of the full spectrum of services the business offers?

- How can I make sure these clients feel special?

- How can I reduce the cost of servicing these clients without impacting on the service experience?

- How can I attract more of this type of client?

- How can I turn these customers into advocates?

Valuable but at-risk clients

- What makes it difficult to service these clients?

- What do these customers think about our service?

- What do these customers say about my business?

- Should we or could we provide a better service for the fee that they pay?

- How can this client be served more easily without increasing costs?

- What would the impact of losing this client to a competitor be?

- Is there a way to reset the client’s expectation of the service they receive for their fee?

Clients that should be nurtured

- How can more value be obtained from these clients?

- Are there any other services that could be offered to them?

- Are these clients useful as advocates?

- How can increasing costs be avoided as services to these clients are increased?

- Can the current service be offered at a lower cost?

Low value / low priority

- How can I be sure these clients add little value to the business?

- Are there any time-related service contracts in place with this client?

- Would the client be willing to pay a minimum fee for the service?

- Is the minimum service requirement set by regulations obtainable?

- Does the client add value in any other way, such as lead generation or advocacy?

- What would the impact of withdrawing services for this client be?

When you have asked these questions for your client base, use the answers to inform your decisions going forwards. Ensure that you have established the value of your clients and answered these questions before making any strong decisions.

If you are thinking of severing ties with any clients, make sure that this is handled with tact and care.

Conclusion

Customer segmentation is a useful tool for advisers to identify and prioritise their clients based on their needs and value. In undertaking this exercise, you can focus resources and time on providing personalised solutions that meet the needs of each customer segment, which may lead to improved client satisfaction and increased client retention.

Advisers who can effectively leverage the information gained from this strategy will be well-positioned to grow their business, focusing on developing relevant services for the clients who provide the most value.

Next steps

Carrying out the complete segmentation exercise may be time-consuming, so consider when a good time to carry it out might be. Do you have a lull over August, perhaps? Or would December be a quieter time when you could undertake this?

Work out who in your firm is best suited to lead this project. Are you keen to run it and oversee the process? Do you have the capacity to undertake it? Should you put a team together?

In order to access the data most efficiently, ensure that your client database is complete and accurate. Carry out an audit if necessary to ensure that everyone in your firm is using it consistently and that the data you are collecting is relevant and complete.

For information on the areas of your business you should consider streamlining or automating, read our article Quantifying the investor’s view on human and robo-advice: the value, benefits and opportunities.

If you have completed all content in the module, you are ready to take the quiz and collect your CPD

Ready to test your knowledge?

Take the quizOther Vanguard 365 pillars

Practice management

Tailored content to help you build your practice, market your services effectively and cultivate a thriving professional network.

Financial planning

CPD content structured to give you access to useful tools, guides and multimedia resources covering diverse topics from risk profiling to retirement planning.

Investment knowledge

CPD content formulated for you to explore in-depth insights on investment principles, portfolio construction and comprehensive product education to expand your technical knowledge.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Important information

This article is designed for use by, and is directed only at persons resident in the UK.

The information contained in this article is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this document does not constitute legal, tax, or investment advice. You must not, therefore, rely on the content of this article when making any investment decisions.

The information contained in this article is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

© 2025 Vanguard Asset Management, Limited. All rights reserved.

Vanguard Asset Management, Limited is authorised and regulated in the UK by the Financial Conduct Authority.