Voices from various news clips: Inflation is high. It hasn't broken. The pound in your pocket is buying less and less. … transitory, now it's terrible. Interest rates are set to rise further. Question is how far should they go?

Narrator: The high inflation and interest rates of the last two years may seem unusual … but we've been here before.

Voice from archival clips: Prices began to rise. You had to pay more for food and clothing.

Narrator: High inflation followed by high interest rates … several times.

Joe Davis: I remember being in the back of my parents’ station wagon. It was the mid-1970s. I remember my mum waiting in line for a long time. Turns out we were waiting in the gas lines. Fuel was being rationed. I was a child, didn't know what inflation was, but I do know I had to wait a long period of time and my parents struggled during that period.

Narrator: Since the 2008 global financial crisis and through the Covid-19 pandemic, low interest rates drove equity valuations to unsustainable highs and bond yields to unfathomable lows.

Joe Davis: When you have a low interest-rate environment, that is code word for saying long expected future returns are going to be low because you don't have the power of compounding that a higher interest rate would give you that would be a tailwind for your portfolio.

Narrator: Supply and demand disruptions, particularly in goods and labour markets, sparked generationally high inflation as economies recovered from pandemic shocks.

To fight that inflation, developed markets’ central banks have been raising short-term interest rates. The inflation fight isn't over, but we're confident it will be won.

As inflation falls to central bank targets, we expect to see cyclical interest rates moderate from recent peaks, though not to the lows we’ve recently become accustomed to.

Joe Davis: We've not only been here before, we've been in this sort of environment more times than not over the past three centuries of market history. And so, I think history will show, and our view has been, that the past 10 years were the exception, not the norm.

Narrator: Vanguard believes that structural interest rates will stay elevated for years to come. We estimate neutral rates are higher than they’ve been recently. The neutral rate is a theoretical equilibrium policy rate that would neither stimulate nor restrict an economy.

By our estimate, the real neutral rate, which is adjusted for inflation, has settled roughly a percentage point higher than what it was in the years after the global financial crisis. A higher rate environment has far-reaching implications for the economy and markets.

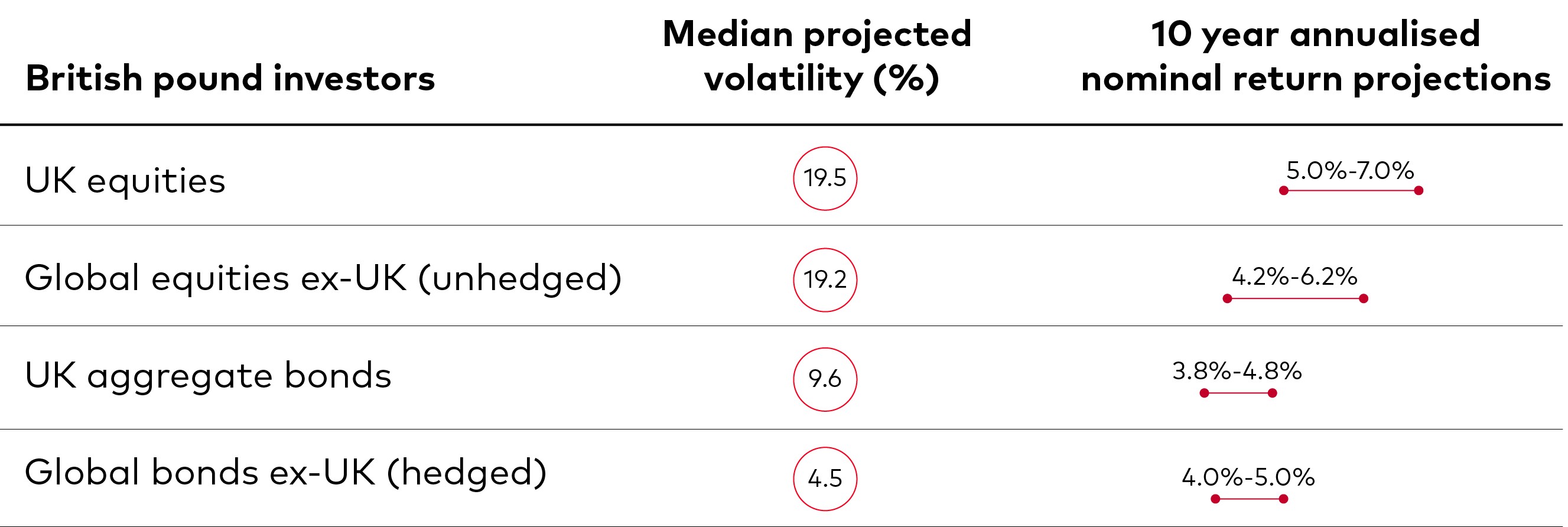

Joe Davis: Emphatically, bonds are back. A fixed income portfolio has a high probability of outperforming the rate of inflation, whatever that should be over the next decade.

Implications for equities, it's a mixed assessment. Longer term, like any investment, it's positive because you have higher expected returns, because you're compounding that higher interest rate right in your portfolio.

The one caveat is when you have a higher interest rate environment, it means that stock markets, all else equal, are a little bit more expensive today than they otherwise would be. So, in other words, it's saying there's no pain, no gain.

Narrator: Higher interest rates may be bad news for borrowers, but they’re good news for savers and diversified investors. It's the return of sound money.

Joe Davis: Sound money is when we have interest rates that are above the rate of inflation. That's been the average historically, hasn't been the case for the past 15 years … which is why the return to sound money is, I would argue, the single best financial market development over the past two decades.