Key points

- US economic growth is expected to cool with the US Federal Reserve (Fed) expected to cut interest rates in September.

- In the euro area, a gradual interest rate easing cycle is now underway with economic growth expected to moderate.

- In the UK, a more balanced outlook for the economy has led us to anticipate that further interest rate cuts will occur only gradually.

Improved economic activity in the US, euro area and the UK point to a continued uplift in the global economy for the rest of the year. However, this won’t be without its challenges and a slowdown in the pace of growth is anticipated over the coming months.

While the euro area and the UK have already started to cut interest rates, the expectation is that the US Federal Reserve (Fed) will begin to cut interest rates in September.

United States

Recent data suggest that the labour market is softening and the Fed appears to be taking notice. A weaker-than-expected July labour market report appeared to support the case for a September interest rate cut.

The US economy created 114,000 jobs in July, and the unemployment rate rose to 4.3%. The unemployment rate increase is attributable to labour force growth exceeding job growth rather than an increase in job losses.

US economic activity continued to be resilient in the second quarter, with real GDP increasing by an annualised 2.8%, driven by increases in consumer spending, non-residential fixed investment and government spending.

GDP growth is tracking largely in line with Vanguard’s 2% outlook for 2024. We believe that growth is likely to cool but remain at a near-trend pace by year-end. The Fed gave a strong signal that it was prepared to cut the rate target by 25 basis points at its September meeting (a basis point is one-hundredth of a percentage point). Vanguard also expects a second 25-basis-point cut this year.

For 2025, amid anticipated below-trend growth, core inflation falling to near the Fed’s 2% target and an unemployment rate rising moderately above current levels, we expect the Fed’s rate target to end the year in a range of 3.25%–3.5%.

Broad consumer prices rose in the year to July at the slowest pace since early 2021. The Consumer Price Index (CPI), a key measure of inflation, rose by 2.9% in July compared with July 2023. Core CPI, which excludes volatile food and energy prices, rose by 3.2% in the year to July.

Euro area

The euro area’s economy grew again in the second quarter, with real GDP having increased by 0.3% compared with the first quarter. This was despite an unexpected drag from Germany, where a manufacturing sector rebound remains elusive.

The pace of headline inflation increased in July, in line with our view that the path towards a 2% inflation target will be bumpy. Headline inflation rose to 2.6% in the year to July compared with 2.5% in the year to June.

While energy, food and core goods inflation are tracking at levels consistent with the 2% target set by the European Central Bank (ECB), services inflation momentum has reaccelerated in recent months.

Core inflation, which excludes volatile food, energy, alcohol and tobacco prices, remained at 2.9% on an annualised basis for a third straight month. Vanguard expects headline inflation to fall to around 2.2% for the 12 months to December and core inflation to fall to around 2.6%, reaching the ECB’s target in 2025.

The ECB noted that monetary policy remains restrictive but that domestic price pressures remain high. We expect the ECB to cut its rate by a further quarter-point in September. We anticipate quarter-point cuts quarterly thereafter, which would leave the policy rate at 3.25% at year-end 2024 and 2.25% at year-end 2025.

The unemployment rate rose to 6.5% on a seasonally adjusted basis in June from a record low of 6.4% in May. Its current level is the same as it was a year earlier. We expect to see little change to the unemployment rate by the end of the year.

United Kingdom

The most recent growth and inflation data suggest the UK economy is becoming more balanced.

Inflation was softer than expected in July and second-quarter growth was only minimally less than that of the first quarter, when the UK exited a brief recession.

GDP growth increased by 0.6% in the second quarter compared with the first, and overall, Vanguard expects the economy to grow by 1.2% in 2024.

While headline inflation increased in the year to July, rising to 2.2% from 2.0% in the year to June, it was largely attributable to energy prices having fallen by less than they did a year earlier.

Meanwhile, core CPI, which excludes volatile food, energy, alcohol and tobacco prices, slowed to 3.3% in the year to July, from 3.5% in the year to June. Vanguard expects core inflation to end the year 2024 at around 2.8% and to hit the Bank of England’s (BOE) 2% target by the second half of 2025.

The BOE cut its policy rate on 1 August (for the first time in the current cycle) by 25 basis points to 5%. We expect that further rate cuts will occur only gradually, as services inflation remains high despite recent downward progress.

The unemployment rate fell unexpectedly to 4.2% in the April–June period, from 4.4% in the March–May period. While job vacancies continued on a downward trend, employment increased, with 24,000 jobs created. Vanguard expects the unemployment rate ending 2024 in a range of 4%–4.5%.

China

Broad economic data pointed to a tepid start to the third quarter after a second quarter of below-potential growth and a continued imbalance in supply and demand.

GDP grew by just 0.7% in the second quarter compared with the first and by 4.7% compared with the second quarter last year. Consumption lost momentum in the quarter, reflecting recent data showing weak domestic demand, sluggish imports and subdued inflation.

At a late-July Politburo meeting that echoed sentiments from the twice-a-decade economic policy meeting known as the 3rd Plenum earlier in the month, policymakers pledged support on both fiscal and monetary fronts to an economy weighed down by lagging consumer demand and a housing glut.

Implementation will be essential as to whether China reaches its 2024 target for growth of “around 5%.” In the second half of 2024, we expect the economy to regain some ground and stabilise towards trend growth, with export and manufacturing investment as a tailwind.

Vanguard continues to expect China to grow by 5.1% for the full year, though continued imbalances in the country’s economy could challenge the growth outlook.

The pace of inflation as measured by consumer prices rose by 0.5% in the year to July, above expectations but well below the 3% inflation target set by the People’s Bank of China.

We expect reflation in 2024 to be mild, with headline inflation of 0.8% and core inflation, which excludes volatile food and energy prices, of just 1.0%.

The points above represent the house view of the Vanguard Investment Strategy Group’s (ISG’s) global economics and markets team as at 16 August 2024.

Asset-class return outlook

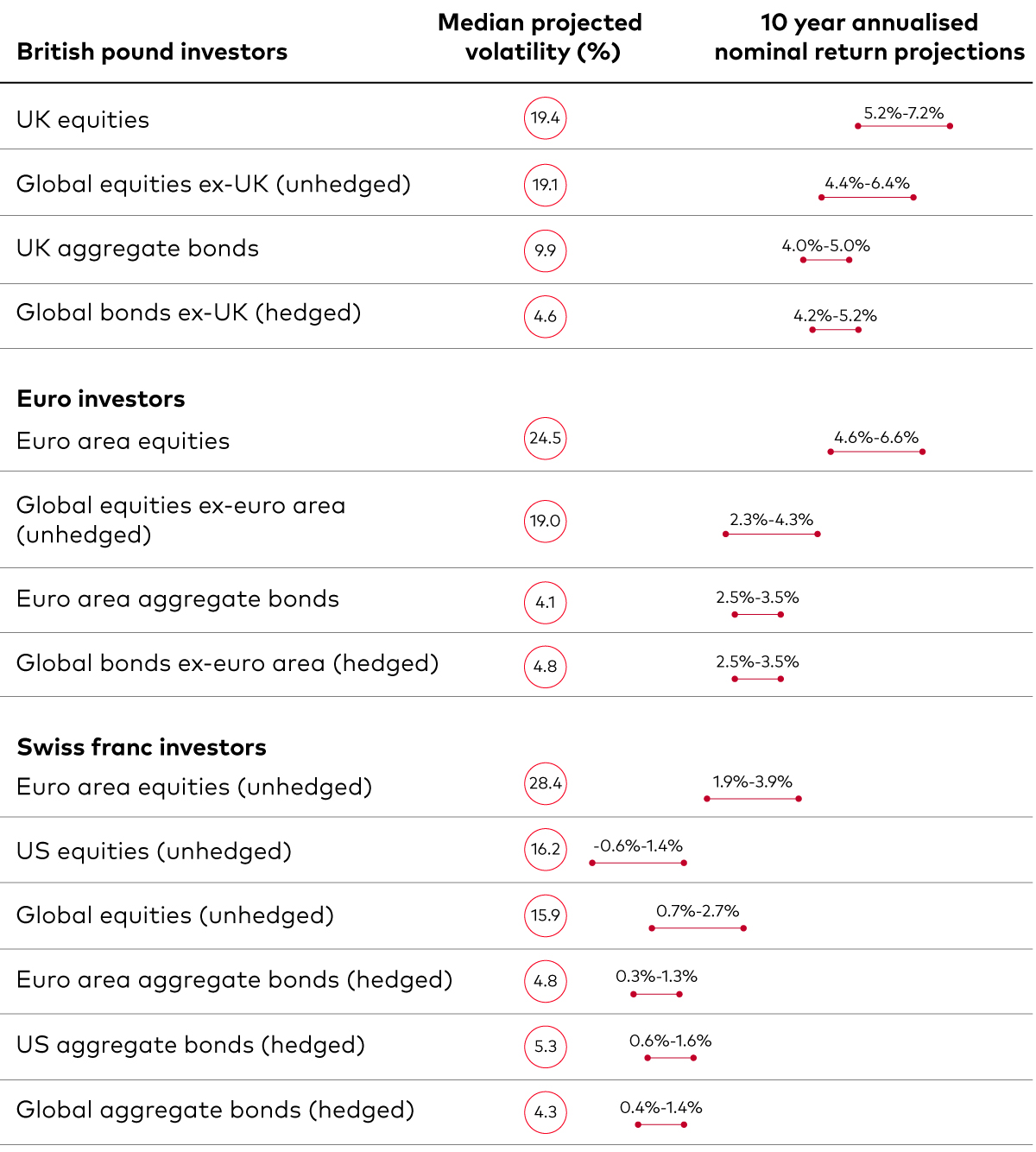

Vanguard has updated its 10-year annualised outlooks for broad asset class returns through the most recent running of the Vanguard Capital Markets Model® (VCMM), based on data as at 30 June 2024.

Our 10-year annualised nominal return projections, expressed for local investors in local currencies, are as follows1.

1 The figures are based on a 2-point range around the 50th percentile of the distribution of return outcomes for equities and a 1-point range around the 50th percentile for fixed income. Numbers in parentheses reflect median volatility.

IMPORTANT: The projections or other information generated by the Vanguard Capital Markets Model® regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time. The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The Vanguard Capital Markets Model® is a proprietary financial simulation tool developed and maintained by Vanguard’s primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include US and international equity markets, several maturities of the US Treasury and corporate fixed income markets, international fixed income markets, US money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.

The primary value of the VCMM is in its application to analysing potential client portfolios. VCMM asset-class forecasts—comprising distributions of expected returns, volatilities, and correlations—are key to the evaluation of potential downside risks, various risk–return trade-offs, and the diversification benefits of various asset classes. Although central tendencies are generated in any return distribution, Vanguard stresses that focusing on the full range of potential outcomes for the assets considered, such as the data presented in this paper, is the most effective way to use VCMM output.

The VCMM seeks to represent the uncertainty in the forecast by generating a wide range of potential outcomes. It is important to recognise that the VCMM does not impose “normality” on the return distributions, but rather is influenced by the so-called fat tails and skewness in the empirical distribution of modeled asset-class returns. Within the range of outcomes, individual experiences can be quite different, underscoring the varied nature of potential future paths. Indeed, this is a key reason why we approach asset-return outlooks in a distributional framework.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Past performance is not a reliable indicator of future results.

Any projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

Important information

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained in this document is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this document does not constitute legal, tax, or investment advice. You must not, therefore, rely on the content of this document when making any investment decisions.

The information contained in this document is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

Issued in EEA by Vanguard Group Europe Gmbh, which is regulated in Germany by BaFin.

© 2024 Vanguard Group (Ireland) Limited. All rights reserved.

© 2024 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2024 Vanguard Asset Management, Limited. All rights reserved.

© 2024 Vanguard Group Europe Gmbh. All rights reserved.