What is client value and why is it important?

Uncover the financial value of clients while fostering trust, communication and shared values for long-term success in the financial advice industry.

Uncover the financial value of clients while fostering trust, communication and shared values for long-term success in the financial advice industry.

When talking about client value, there are two aspects to consider: firstly, the financial value that a client may bring to your firm over their lifetime as a client in the form of fees, and secondly, the value the client brings to your business from an advocacy and loyalty perspective. Both are necessary to bring about long-term success to your business, and both aspects should be nurtured in your relationships with your clients.

In this article, we will consider all aspects of client value, looking at the following:

Assessing the value of your clients: understanding which of your clients will be the most valuable and therefore lead to the most growth

The calculation of the lifetime value of a client (LTV)

What is customer loyalty value (CLV)?

How to measure client value

What factors can influence your clients’ value?

How to increase your clients’ value

Understanding the financial value of a client is important but building strong relationships with clients based on trust, communication and an understanding of values and goals is also vital to your long-term success in the financial advice industry.

Understanding which of your clients will be the most valuable to you and your business will enable you to nurture these important relationships and, at the same, time encourage you to recruit new clients who fit within this client type, ensuring you can provide maximum value and gain maximum benefit. As mentioned in the introduction, there are two aspects to client value and you should be aware of both of these when assessing who are your most valuable clients.

If you have not already undertaken the exercise to segment your clients, it is worthwhile reading our article “Effective client segmentation for financial professionals”. While it may be time-consuming, undertaking this activity is worth the investment as doing so may inform you as to which of your clients will provide you with the greatest value.

Market segmentation is the process of dividing your client base into smaller groups – or segments – that have similar characteristics, needs or values. Segmenting your clients means you can identify the most suitable products and strategies for each client base, enabling your clients to receive the most value from your services. You can also take the time to form strong relationships with the clients who are the most valuable to you.

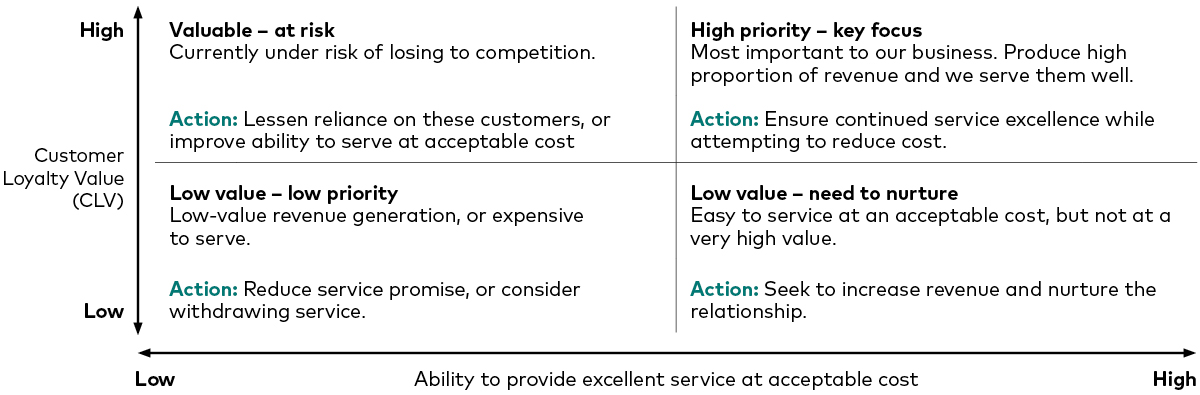

A customer value matrix, like the one below, will help you to plot and visualise which of your clients provide the most value and are therefore of principal importance to your business.

It is often the case that the smallest proportion of clients produce the largest proportion of revenue for the firm (this is known as the 80/20 rule), so being aware of which of your clients fall into this 20% group is of huge importance.

Conversely, whilst it may seem that investing timely in the low value – low-priority group may not be worthwhile, it is prudent to also consider ways in which you can serve this group in the most time and cost-effective manner. Clients’ situations do change – perhaps in time they will have additional funds to invest, intergenerational wealth planning could positively impact them, or they could speak highly of your service to a colleague who could fall in the high-value – high-priority group. Providing good service to all, but ensuring this service is in line with your time and cost returns, is a sensible approach.

Definition: “Lifetime value calculation is the process by which a business measures the value of a customer to the business through the company’s full lifespan. Customer lifetime value (LTV) is one of the metrics used to measure the growth of a company.”

Understanding the LTV of a client has clear benefits for a financial advisory business. Let’s consider these in more detail.

Calculating the LTV of a client can enable you to estimate the revenue that your client is likely to generate for your firm over the course of their lifetime as your client. This is not limited to fees that they pay today, but also the potential revenue that could result from purchasing additional services or products in the future.

Understanding each of your client’s LTV may allow you to make more informed decisions regarding allocating resources and prioritising client relationships. Whilst it may seem sensible to focus heavily on clients who have scored a high LTV, identifying those clients whose LTV could be improved is similarly important. Recognising the long-term potential of clients will encourage you to nurture those relationships, too.

Understanding your clients’ LTV will enable you to make sure your business’s customer retention strategy is effective and efficient. Maximise your efforts to provide outstanding service to retain clients with a high LTV and adopt more cost-effective, automated or off-the-shelf strategies like multi-asset funds or models, which require less human input for clients with a lower LTV. This will enable your business to utilise the LTV data, building a loyal and long-term client base.

The calculation used is:

LTV = the total of the net present value of anticipated future cash flows (revenue minus costs) of an individual client.

You can work out the LTV of your clients by following the below steps:

Calculate the revenue you have earned from your client. Include all revenue generated, i.e. fees and other charges.

Estimate your client’s lifespan – how long you expect them to stay with you as a client. This can be based on historical data or industry benchmarks.

Calculate the average revenue for the client per year by dividing the figure for the total revenue earned from the client by the number of years they have been a client.

Estimate the lifetime revenue by multiplying the average revenue per year by the estimated lifespan of the client. This is the total lifetime revenue.

Finally, subtract the cost of acquiring the client – this could be advertising costs or other fees.

This figure will then determine the LTV of the client.

In this example, we assume your client – let’s call them Jan – has produced £15,000 in revenue over the five years they have been your client. You estimate Jan will stay with you as a client for at least another 15 years.

Jan has produced an average revenue p.a. of £15,000 / five years = £3,000

Jan’s total anticipated life span as your client will be 15 years + the five years they have been a client already = 20 years.

Total lifetime revenue = £3,000 average annual revenue x 20 years = £60,000.

Cost of acquiring Jan as a client = (estimated) £2,500.

Therefore, Jan’s LTV = £60,000 - £2,500 = £57,500

It is good practice to regularly review and update your LTV calculations for your clients as client behaviour and markets change. These figures are important, so ensure they remain accurate and relevant.

Clients with a high LTV will enable the most growth for your business, providing a steady stream of revenue.

They are also more likely to refer new business to you, as these will be the clients who are most pleased with your service and therefore will speak highly of you.

As you will most likely look after these high revenue-yielding clients so well, these will be the clients who will be the most loyal and stay with you for the long term.

You can look to increase your offering to these clients with additional products, thereby increasing your revenue stream and generating more goodwill.

Calculating this metric anticipates that you will retain the client for the lifespan you estimate. But to really understand client value you will also need to consider customer loyalty. This introduces another metric that we will now consider in detail: Customer loyalty value (CTV).

At Vanguard, we calculate customer loyalty value as:

A client with a loyalty rate of 100% will never leave you, whereas you can assume a client with a 50% loyalty rate has a 50/50 chance of leaving you. The projection of loyalty is generally an estimate based on your relationship with the client and your understanding of them (be realistic with this). However, you can use client questionnaires to delve deeper into their future intentions or consider their purchasing history (i.e. considering if they have purchased additional services or products from you indicating a longer-term investment view) to derive a realistic percentage. See our article “Adding investment value using customer surveys” for an example client survey you can easily access and use.

Visionary, customer-focused leaders such as Amazon’s Jeff Bezos, Costco’s Jim Sinegal, and Vanguard’s Jack Brennan have long understood the importance of concentrating on customer value as an asset rather than pursuing short-term profits or quarterly earnings, and they’ve become enduring customer loyalty leaders in the process… When a company focuses on loyalty, it makes customers’ lives so much better that they keep coming back, and they bring their friends1.

John J. Brennan, also known as Jack Brennan, served as chairman of The Vanguard Group from 1996 to 2009, and was Vanguard CEO from 1996 until he was succeeded by William McNabb in 2008. Jack’s promotion of the benefits of a loyalty-based strategy was renowned, and asking the question, “is it in the best interest of the client?” became second nature to his staff. His principal goal was to keep clients for life.

Understanding CLV has many benefits for your business. Let’s look at these in detail.

CLV measures the robustness of your future revenue streams. Whilst knowing what your revenue stream looks like for the forthcoming year is vital, understanding what it looks like on a much longer term enables your business to have a “true value”, which, if you are considering selling your business at any point, will heavily influence the amount that the business is worth.

CLV helps you structure your business most effectively. Client surveys and feedback (see “Adding investment value using customer surveys”) may reveal your clients’ current levels of satisfaction regarding the services you offer, the interaction with your staff and the quality of delivery. What they don’t tell you is if they might be planning to leave you for a different adviser at any point in the future. Measuring CLV will shed light on these unknown aspects and enable you to plan and structure accordingly.

Segmenting customers by loyalty rate ensures you can target your efforts most efficiently and effectively. Carrying out the client segmentation exercise as outlined in “Effective client segmentation for financial professionals” will enable you to ensure that your products and time are targeted to those who will provide the most value to your business. This is not a short exercise to undertake, but the business benefits will make it well worth the investment of time and resources.

As we have seen, understanding client value is important to sustaining and growing your business long term, but how would you go about measuring this? What are the options available?

You can measure client value through the following routes:

By measuring your client’s lifetime value, you have, in figures, an economic value, that each client brings to your business over their lifetime. By assessing your clients using this calculation, you can then segment your client base to ensure you are prioritising those clients who are most profitable, focusing on them to maximise your business revenue. Conversely, you can work out ways to service, more efficiently, the clients who fall at the other end of the scale, enabling you to increase your profits from this client group, too.

This can help to identify which of your clients are most likely to generate new business streams for you and who are, therefore, of great importance.

You can measure this through client surveys and feedback forms. If you have not recently surveyed your client base, doing so will enable you to receive valuable feedback which you can use to ensure that you are providing a valued service to your clients, especially to those who will be of the highest value to you. Our article contains a step-by-step guide to writing and distributing a survey to your client base.

Measuring profitability can help you see which clients are the highest priority with the greatest value and on whom, therefore, you would be wise to focus on nurturing. This measure can also inform areas in which your business could become more cost-efficient and make savings.

This can be measured through client surveys or feedback. If undertaking a client survey, it is worthwhile spending some time deducing what information you want the survey to provide so you can word the questions accordingly. Use the survey to provide useful information as to the quality of your relationships with your clients and the potential that they will refer business to you and remain with you for the long term.

By measuring your clients’ value, you can ensure that you are focusing on clients who provide the most value to your business, along with recognising clients who are, perhaps, less valuable and deduce ways to service them effectively, but also cost-efficiently.

There are many factors that can influence the value of your clients, and in this section, we will look at these. Ultimately, however, taking a holistic view of your client relationship by considering the range of factors that may contribute to your client’s value will provide a more realistic approach than just focusing on one aspect of client value.

Clients who have been with you for a long period of time and with whom you have developed a relationship are clients who will, in turn, provide value to you. They will listen to you, take on board your advice and suggestions, and may be open to purchasing different services and products.

Clients with a larger investment portfolio will generate more revenue for your business through fees, and other services, which may make them more valuable. You may find that clients with a large investment portfolio are also open to suggestions of alternative investments and can therefore be cross sold to, increasing their value again. Furthermore, a client with a large investment portfolio may be well-connected and have an influence on the financial decisions of their peers, so by prioritising and providing a consistently excellent service, your business can potentially generate referrals and a respected reputation from these clients.

As investments become more intricate, they may require a greater degree of time and expertise from the adviser, which can then result in an increase in fees and charges. Providing complex advice will enable you to demonstrate your knowledge and may enhance your reputation in the financial advice field.

Clients who are likely to refer their friends and family are valuable not only for their business but for the potential to increase your client base by introducing new business to your firm. With a personal connection and investment in the success of your business, these are likely to be loyal and committed clients.

It is inevitable that you will expand your business through recruiting new clients, despite this sometimes being a time-consuming and therefore relatively expensive exercise to undertake. Maximising the potential value of your existing clients remains the most cost-effective way to grow your business and with this in mind, you could consider implementing some or all of the following methods to increase the value of your existing clients:

Clients are more likely to stay with you if you are actively engaged with them and meet their individual needs. They are more likely to be satisfied with the service they receive and may be open to the option of extra products which will increase revenue for your business whilst also strengthening your client relationship. Read our article on Creating the right content for investment clients to see how you can be more proactive.

Cross-selling to your clients can increase their confidence in you, building a stronger relationship whilst also generating additional revenue streams. It can benefit your client by saving them time and energy sourcing these other services for themselves, and also may stop them from looking to other companies to provide these services, meaning a loyal and long-term client.

Gaining referrals from your existing clients is the most cost-effective marketing strategy, and should have a higher conversion rate than a cold lead.

You can create positive, long-term relationships with your clients by consistently providing exceptional service and delivering on your promises. By doing this, you can increase your client’s satisfaction, enhance your reputation and attract new clients in a cost-effective way. Visit the section on client relationships to discover more ways to improve your service.

By doing this you can set your business apart from others in the industry, showcasing yourself as a provider of niche solutions for which you will be able to provide specialist advice and knowledge.

Understanding which of your clients are the most valuable to your business is key to enable you to structure and develop your business model to fulfil their requirements. Engaging with those clients proactively to develop a loyal, trusting relationship will provide your business with a multitude of benefits.

To establish this, undertaking an assessment of your client base to determine your most valuable clients is recommended. Calculating the LTV of your clients, along with the CLV, will allow you to see where your time, energy and resources will be most well spent.

Reviewing this data and reassessing it every six months to annually is sensible to ensure that it is always current, and to note any clients whose loyalty may be decreasing. You can use this valuable information to inform changes to your business structure or service offering.

Undertake the LTV calculation exercise for your client base. Whilst it may take time, the information gained from this initiative can be used to direct your business priorities for each client area so it is an important activity to undertake.

Using the LTV figures, calculate the CLV for your clients. Group your clients according to their CLV score to deduce which clients are the most loyal.

Plot your clients on the matrix in section 1. Who are your most valuable clients? Is the outcome surprising or is it as you expected? Does your client base fit the 80/20 rule, in which 20% of your clients produce the bulk of the revenue for your business?

Consider your client base and, looking through section 6, write down three ways you could increase your clients’ value. This could be implementing a new product, using cross-selling opportunities, encouraging referrals, or maybe something which you think would be effective but which was not on the list. At your next client meeting, use this list to inspire you to add value to your clients.

Read our article “Effective segmentation” if you haven’t already done so, for a detailed approach to client segmentation and an explanation of the benefits this exercise may bring to your business.

Download our client value survey

Leverage the insights gathered from this survey to evaluate how well your business performs in key aspects that matter most to your clients in terms of the value they receive.

Footnotes

1. Source: HBR.org

If you have completed all content in the module, you are ready to take the quiz and collect your CPD

Ready to test your knowledge?

Take the quizCPD content crafted to empower you to service your client’s needs effectively, build relationships, create loyalty and achieve new business growth.

CPD content structured to give you access to useful tools, guides and multimedia resources covering diverse topics from risk profiling to retirement planning.

CPD content formulated for you to explore in-depth insights on investment principles, portfolio construction and comprehensive product education to expand your technical knowledge.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Important information

This article is directed at professional investors and should not be distributed to, or relied upon by retail investors.

This article is designed for use by, and is directed only at persons resident in the UK.

The information contained in this article is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this article does not constitute legal, tax, or investment advice. You must not, therefore, rely on the content of this article when making any investment decisions.

The information contained in this article is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2024 Vanguard Asset Management, Limited. All rights reserved.